Exam 19: Decision Analysis

Exam 1: Introduction to Statistics86 Questions

Exam 2: Charts and Graphs55 Questions

Exam 3: Descriptive Statistics59 Questions

Exam 4: Probability76 Questions

Exam 5: Discrete Distributions81 Questions

Exam 6: Continuous Distributions83 Questions

Exam 7: Sampling and Sampling Distributions87 Questions

Exam 8: Statistical Inference: Estimation for Single Populations82 Questions

Exam 9: Statistical Inference: Hypothesis Testing for Single Populations85 Questions

Exam 10: Statistical Inferences About Two Populations81 Questions

Exam 11: Analysis of Variance and Design of Experiments90 Questions

Exam 12: Simple Regression Analysis and Correlation98 Questions

Exam 13: Multiple Regression Analysis85 Questions

Exam 14: Building Multiple Regression Models78 Questions

Exam 15: Time-Series Forecasting and Index Numbers75 Questions

Exam 16: Analysis of Categorical Data77 Questions

Exam 17: Nonparametric Statistics76 Questions

Exam 18: Statistical Quality Control68 Questions

Exam 19: Decision Analysis79 Questions

Select questions type

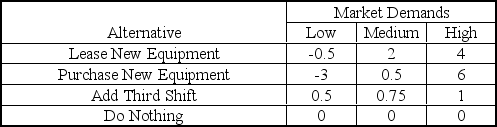

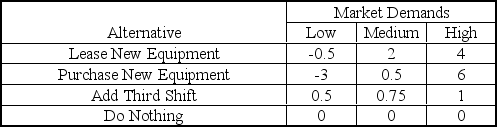

Trey Leeman,Operations Manager at National Consumers,Inc.(NCI),is evaluating alternatives for increasing capacity at NCI's Fountain Hill plant.He has identified four alternatives,and has constructed the following payoff table which shows payoffs (in $1,000,000's)for the three possible levels of market demand.  If Trey uses the Hurwicz criterion with alpha = 0.4,the appropriate alternative would be: _____________.

If Trey uses the Hurwicz criterion with alpha = 0.4,the appropriate alternative would be: _____________.

(Multiple Choice)

4.8/5  (38)

(38)

Frank Forgione has the right to enter a contest where he has a 50% chance of winning $50,000 and a 50% chance of losing $0.It costs Frank nothing to enter the contest.If he is willing to give up his right to enter the contest for a sure payment of $10,000,he is ___.

(Multiple Choice)

4.9/5  (34)

(34)

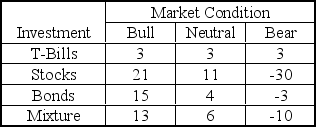

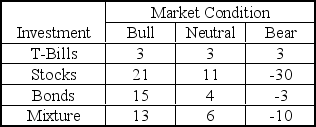

Ray Crofford is evaluating investment alternatives to invest $100,000 which he inherited from his grandfather.His investment advisor has identified four alternatives and constructed the following payoff table which shows expected profits (in $10,000's)for various market conditions.  For the 'T-Bills' and 'Bonds' choices,the indifference value of Hurwicz's alpha is _____.

For the 'T-Bills' and 'Bonds' choices,the indifference value of Hurwicz's alpha is _____.

(Multiple Choice)

4.9/5  (41)

(41)

In decision-making under uncertainty,the approach that considers only the best and the worst payoffs for each decision alternative is the __________.

(Multiple Choice)

4.8/5  (41)

(41)

A risk-taker decision maker will bail out of risky scenario only if the compensation to bail out is more than the expected monetary payoff from the risky scenario.

(True/False)

4.9/5  (36)

(36)

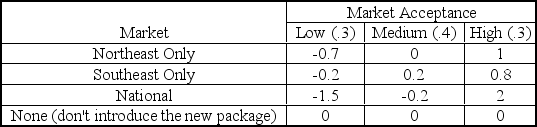

Melissa Rossi,Product Manager at National Consumers,Inc.(NCI),is evaluating alternatives for introducing a new package for toothpaste.She has identified four alternative markets,and has constructed the following table which shows NCI's rewards (in $1,000,000's)for various levels of acceptance by the markets and their probabilities.  The expected value of perfect information is ________.

The expected value of perfect information is ________.

(Multiple Choice)

4.9/5  (33)

(33)

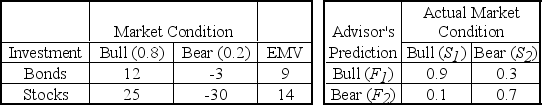

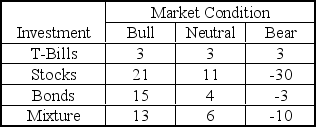

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather.His investment advisor has identified two alternatives and constructed the following tables which show (1)expected profits (in $10,000's)for various market conditions and their probabilities,and (2)the advisor's track record on predicting Bull and Bear markets.  The EMV of this investment opportunity with the advisor's prediction is ________.

The EMV of this investment opportunity with the advisor's prediction is ________.

(Multiple Choice)

4.8/5  (41)

(41)

Trey Leeman,Operations Manager at National Consumers,Inc.(NCI),is evaluating alternatives for increasing capacity at NCI's Fountain Hill plant.He has identified four alternatives,and has constructed the following payoff table which shows payoffs (in $1,000,000's)for the three possible levels of market demand.  The opportunity loss for the combination "Purchase New Equipment" and "High" is ___.

The opportunity loss for the combination "Purchase New Equipment" and "High" is ___.

(Multiple Choice)

5.0/5  (43)

(43)

In a decision-making scenario,if it is not known which of the states of nature will occur and further if the probabilities of occurrence of the states are also unknown the scenario is called decision-making under double risk.

(True/False)

4.8/5  (36)

(36)

In a decision-making under risk scenario,the expected monetary value of a decision alternative is the weighted average (using the probability of each state of nature as the weight)of the payoffs to the decision alternative in each state of the nature.

(True/False)

4.9/5  (34)

(34)

Ray Crofford is evaluating investment alternatives to invest $100,000 which he inherited from his grandfather.His investment advisor has identified four alternatives and constructed the following payoff table which shows expected profits (in $10,000's)for various market conditions.  For the combination of 'Bear' and 'Mixture',the opportunity loss is ______.

For the combination of 'Bear' and 'Mixture',the opportunity loss is ______.

(Multiple Choice)

4.7/5  (36)

(36)

Dan Hein owns the mineral and drilling rights to a 1,000 acre tract of land.If he drills a well and does not strike oil his net loss will be $50,000,but if he drills a well and strikes oil his net gain will be $100,000.If he does not drill,his loss is the cost of the mineral and drilling rights,which amount to $1000.The probability of the state of nature "oil in the tract" is unknown.If Dan is an optimist,he would choose the _____________.

(Multiple Choice)

4.9/5  (34)

(34)

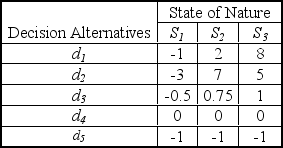

Consider the following decision table with rewards in $ millions.  Using the Hurwicz criterion with alpha = 0.1,the appropriate choice would be ________.

Using the Hurwicz criterion with alpha = 0.1,the appropriate choice would be ________.

(Multiple Choice)

4.9/5  (36)

(36)

In decision-making under uncertainty,a pessimistic approach is the __________.

(Multiple Choice)

4.9/5  (36)

(36)

In a decision analysis problem,variables (such as investing in common stocks or corporate bonds)which are under the decision maker's control are called decision alternatives.

(True/False)

4.9/5  (32)

(32)

The value of sample information is the ratio of the expected monetary value with information to the expected monetary value without information.

(True/False)

4.7/5  (47)

(47)

A particular electronic component is produced at two plants for an electronics manufacturer.Plant A produces 70% of the components used and the remainder are produced by plant B.The probability that a component is defective is 0.02 if it is produced at plant A and 0.01 if it is produced at plant B.The probability that the component is defective is ______

(Multiple Choice)

4.9/5  (38)

(38)

The expected monetary value without information is $60,and the expected monetary payoff with perfect information is $120.The expected value of perfect information is __.

(Multiple Choice)

4.8/5  (47)

(47)

Ray Crofford is evaluating investment alternatives to invest $100,000 which he inherited from his grandfather.His investment advisor has identified four alternatives and constructed the following payoff table which shows expected profits (in $10,000's)for various market conditions.  If Ray uses the maximin criterion,the appropriate choice would be ________.

If Ray uses the maximin criterion,the appropriate choice would be ________.

(Multiple Choice)

4.9/5  (37)

(37)

In a decision-making under risk scenario,the expected monetary value of a decision alternative is the arithmetic average of the payoffs to the decision alternative in each state of the nature.

(True/False)

4.8/5  (38)

(38)

Showing 21 - 40 of 79

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)