Exam 8: Share-Based Payments

Exam 1: The Conceptual Framework of the Iasb30 Questions

Exam 3: Fair Value Measurement30 Questions

Exam 4: Revenue30 Questions

Exam 5: Provisions, Contingent Liabilities and Contingent Assets30 Questions

Exam 6: Income Taxes28 Questions

Exam 7: Financial Instruments30 Questions

Exam 9: Inventories29 Questions

Exam 10: Employee Benefits29 Questions

Exam 11: Property, Plant and Equipment28 Questions

Exam 12: Leases27 Questions

Exam 13: Intangible Assets28 Questions

Exam 14: Business Combinations30 Questions

Exam 15: Impairment of Assets28 Questions

Exam 16: Accounting for Mineral Resources26 Questions

Exam 17: Agriculture26 Questions

Exam 18: Financial Statement Presentation29 Questions

Exam 19: Statement of Cash Flows28 Questions

Exam 21: Operating Segments30 Questions

Exam 22: Operating Segments29 Questions

Exam 23: Consolidation: Controlled Entities29 Questions

Exam 24: Consolidation: Wholly Owned Subsidiaries26 Questions

Exam 25: Consolidation: Intragroup Transactions27 Questions

Exam 26: Consolidation: Non-Controlling Interest25 Questions

Exam 27: Consolidation: Other Issues29 Questions

Exam 28: Translation of the Financial Statements of Foreign Entities28 Questions

Exam 29: Associates and Joint Ventures26 Questions

Exam 30: Joint Arrangements26 Questions

Select questions type

On 1 July 2013 Pepper Limited granted 500 share options to each of its 100 employees. Each grant is conditional on the employee working for the company for the next two years. The fair value of each option is estimated to be $3.00. Pepper estimates that 8% of its employees will leave during the two year period and therefore forfeit their rights to the share options.

During the year ended 30 June 2014 five employees left. At this time the company revised its estimate of total employee departures over the full two-year period to 10%.

During the year ended 30 June 2015 a further 4 employees left.

The amount to be recognised as an expense by Pepper for the year ended 30 June 2014 is:

Free

(Multiple Choice)

4.9/5  (38)

(38)

Correct Answer:

A

A share -based payment transaction in which the entity acquires goods or services by incurring liabilities to the supplier for amounts that are based on the value of the entity's shares or other equity instruments of the entity is classified in IFRS 2 Share-based Payment as

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

B

In situations where an option-pricing model is required to be used to determine the fair value of equity instruments granted IFRS 2 Share-based Payment:

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

B

Which of the following statements in relation to disclosures required under IFRS 2 Share-based Payment is not correct?

(Multiple Choice)

4.9/5  (26)

(26)

Which of the following statements in relation to disclosures required under IFRS 2 Share-based Payment is NOT correct?

(Multiple Choice)

5.0/5  (34)

(34)

On 1 July 2013, Nelson Pty Ltd granted 250 options to each of its 50 employees. The options are conditional on the employees remaining with the company for the 3 year vesting period. The options have a fair value of $7.50 at vesting date. In addition, the shares will vest as follows:

On 30 June 2014 if the company's earnings have increased by more than 12%

On 30 June 2015 if the company's earnings have increased by more than 10% averaged across the 2 year period

On 30 June 2016 if the company's earnings have increased by more than 8% averaged across the 3 year period

At 30 June 2014 Nelson's earnings have increased by 11% and 3 employees have left.

The company expects that earnings will continue to increase at a similar rate during the year to 30 June 2015 and that the shares will vest at that time. It also expects that a further 4 employees will leave during the year.

The remuneration expense for the year ended 30 June 2014 for Nelson is:

(Multiple Choice)

4.8/5  (33)

(33)

THE FOLLOWING INFORMATION RELATES TO QUESTIONS 12 - 14

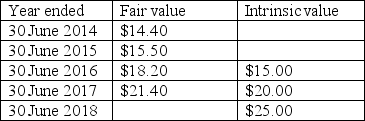

On 1 July 2013 Watson Pty Ltd granted 100 share appreciation rights (SARS) to each of its 50 employees, conditional on the employee not leaving the company in the next three years. The company estimates the fair value of the SARS at the end of each year in which a liability exists as shown in the table below. The intrinsic values of the SARS at the date of exercise at 30 June 2016, 2017 and 2018 are also shown. All SARS held by employees at 30 June 2016 vest.

By 30 June 2016 nine employees have left and 15 employees have exercised their SARS.

-The liability recorded at 30 June 2015 is:

By 30 June 2016 nine employees have left and 15 employees have exercised their SARS.

-The liability recorded at 30 June 2015 is:

(Multiple Choice)

4.9/5  (46)

(46)

THE FOLLOWING INFORMATION RELATES TO QUESTIONS

Viola Ltd has granted each of its 10 senior executives a choice between receiving a cash payment equivalent to 1000 shares or receiving 1200 share. The grant is conditional on the completion of three years' service with the company. If the share alternative is chosen, the shares must be held for two years after vesting date. At grant date the company's share price is $25 per share. At the end of years 1, 2 and 3 the share price is $27, $28 and $30 respectively. The company does not expect to pay dividends in the next three years. After taking into account the effect of post-vesting transfer restrictions the company estimates the grant-date fair value of the share alternative is $24 per share.

-What is the fair value of the cash alternative?

(Multiple Choice)

4.8/5  (32)

(32)

THE FOLLOWING INFORMATION RELATES TO QUESTIONS

Viola Ltd has granted each of its 10 senior executives a choice between receiving a cash payment equivalent to 1000 shares or receiving 1200 share. The grant is conditional on the completion of three years' service with the company. If the share alternative is chosen, the shares must be held for two years after vesting date. At grant date the company's share price is $25 per share. At the end of years 1, 2 and 3 the share price is $27, $28 and $30 respectively. The company does not expect to pay dividends in the next three years. After taking into account the effect of post-vesting transfer restrictions the company estimates the grant-date fair value of the share alternative is $24 per share.

-What is the fair value of the equity alternative?

(Multiple Choice)

4.8/5  (37)

(37)

In a share based payment transaction where the entity has settlement choice:

(Multiple Choice)

4.9/5  (43)

(43)

THE FOLLOWING INFORMATION RELATES TO QUESTIONS 9 and 10

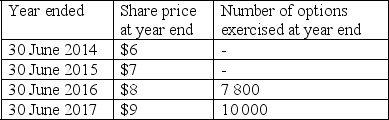

On 1 July 2013 Fantasy Ltd granted 200 options to each of its 100 employees. The share options will vest on 30 June 2015 if the employees remain employed with the company on that date. The share options have a life of four years. The exercise price is $5, which is also Fantasy's share price at the grant date. Fantasy is unable to reliably estimate the fair value of the share options at the grant date.

Fantasy's share price and the number of options exercised are set out below. Share options may only be exercised at year end.

-The formula to calculate the remuneration expense for the year ended 30 June 2016 is:

-The formula to calculate the remuneration expense for the year ended 30 June 2016 is:

(Multiple Choice)

4.9/5  (43)

(43)

THE FOLLOWING INFORMATION RELATES TO QUESTIONS 9 and 10

On 1 July 2013 Fantasy Ltd granted 200 options to each of its 100 employees. The share options will vest on 30 June 2015 if the employees remain employed with the company on that date. The share options have a life of four years. The exercise price is $5, which is also Fantasy's share price at the grant date. Fantasy is unable to reliably estimate the fair value of the share options at the grant date.

Fantasy's share price and the number of options exercised are set out below. Share options may only be exercised at year end.

-The cumulative remuneration expense to be recognised by Fantasy as at 30 June 2015 is:

-The cumulative remuneration expense to be recognised by Fantasy as at 30 June 2015 is:

(Multiple Choice)

4.9/5  (36)

(36)

On 1 July 2013 Pearl Pty Ltd granted 800 share options with an exercise price of $35 to the CFO, conditional on the CFO remaining in employment with the company until 30 June 2016. The fair value of Pearl's shares at that time were assessed to be $40. The exercise price will drop to $30 if Pearl's earnings increase by an average of 8% per year over the three year period. On 1 July 2013 the estimated fair value of the share options with an exercise price of $35 is $10 per option, and if the exercise price is $30, the estimated fair value of the options is $12 per option.

During the year ended 30 June 2014 Pearl's earnings increased by 10% and they are expected to continue to increase at this rate over the next two years.

During the year ended 30 June 2015 Pearl's earnings increased by 9% and Pearl management continued to expect that the earnings target would be achieved.

During the year ended 30 June 2016 Pearl's earnings increased by only 2%. At 30 June 2016 the share price is $23.

The remuneration expense to be recognised for the year ended 30 June 2014 is:

(Multiple Choice)

4.8/5  (32)

(32)

THE FOLLOWING INFORMATION RELATES TO QUESTIONS

Viola Ltd has granted each of its 10 senior executives a choice between receiving a cash payment equivalent to 1000 shares or receiving 1200 share. The grant is conditional on the completion of three years' service with the company. If the share alternative is chosen, the shares must be held for two years after vesting date. At grant date the company's share price is $25 per share. At the end of years 1, 2 and 3 the share price is $27, $28 and $30 respectively. The company does not expect to pay dividends in the next three years. After taking into account the effect of post-vesting transfer restrictions the company estimates the grant-date fair value of the share alternative is $24 per share.

-What is the liability component at the end of year 1?

(Multiple Choice)

4.9/5  (35)

(35)

On 1 July 2014 Luca Ltd grants 200 options to each of its 75 employees conditional on the employee remaining in service over the next two years. The fair value of each option is estimated to be $7. Luca estimates that 8 employees will leave over the two year vesting period.

By 30 June 2015 four employees have left and the entity estimates that a further five employees will leave over the next year.

On 30 June 2015 Luca decided to reprice its share options, due to a fall in its share price over the last 12 months. The repriced share options will vest on 30 June 2016. At the date of repricing Luca estimates that the fair value of each original option is $1.50 and the fair value of each repriced option is $3.

During the year ended 30 June 2016 four employees left.

The remuneration expense for the year ended 30 June 2015 is:

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following statements in relation to modifications to the terms and conditions on which equity instruments were granted as part of an employee share scheme is correct?

(Multiple Choice)

4.7/5  (37)

(37)

Pepper Limited grants 500 share options to each of its 30 employees. Each grant is conditional on the employee working for the company for the next three years. The fair value of each option is estimated to be $5.00 at grant date and $7.50 at vesting date.

The amount to be recognised as an expense by Pepper in year 2 is:

(Multiple Choice)

4.9/5  (38)

(38)

A share-based payment transaction in which the entity receives goods or services as consideration for equity instruments of the entity is classified in IFRS 2 Share-based Payment as

(Multiple Choice)

4.9/5  (38)

(38)

Showing 1 - 20 of 28

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)