Exam 24: Investments in Joint Arrangements

Exam 1: Nature and Regulation of Companies50 Questions

Exam 2: Financing Company Operations48 Questions

Exam 3: Company Operations49 Questions

Exam 4: Fundamental Concepts of Corporate Governance50 Questions

Exam 5: Fair Value Measurement50 Questions

Exam 6: Accounting for Company Income Tax18 Questions

Exam 7: Financial Instruments20 Questions

Exam 8: Foreign Currency Transactions and Forward Exchange Contracts20 Questions

Exam 9: Property, Plant and Equipment47 Questions

Exam 10: Leases18 Questions

Exam 11: Intangible Assets50 Questions

Exam 12: Business Combinations49 Questions

Exam 13: Impairment of Assets49 Questions

Exam 14: Disclosure: Legal Requirements and Accounting Polices50 Questions

Exam 15: Disclosure: Presentation of Financial Statements50 Questions

Exam 16: Disclosure: Statement of Cash Flows18 Questions

Exam 17: Disclosure: Translation of Financial Statements Into a Presentation Currency29 Questions

Exam 18: Consolidation: Controlled Entities49 Questions

Exam 19: Consolidation: Wholly Owned Subsidiaries47 Questions

Exam 20: Consolidation: Intragroup Transactions47 Questions

Exam 21: Consolidation: Non-Controlling Interest50 Questions

Exam 22: Consolidation: Other Issues48 Questions

Exam 23: Associates and Joint Ventures48 Questions

Exam 24: Investments in Joint Arrangements23 Questions

Exam 25: Insolvency and Liquidation46 Questions

Select questions type

Each joint operator must recognise in its own accounts:

Free

(Multiple Choice)

4.8/5  (45)

(45)

Correct Answer:

D

The particular relationship between parties that signifies the existence of a joint arrangement is:

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

D

Ally Ltd and Cat Ltd have established the Ally Cat Joint Operation.Ally Ltd has a 60% interest in the joint operation and Cat Ltd has a 40% interest.

Ally Ltd contributed an asset with a carrying amount of $180 000 and a fair value of $240 000 and Cat Ltd agreed to provide technical services to the joint operation over the first two years of operations.The fair value of the technical services was agreed to be $160 000 and the cost to provide the services was estimated at $130 000 at the inception of the joint operation.

As part of its initial contribution entry Ally Ltd will record a:

Free

(Multiple Choice)

5.0/5  (30)

(30)

Correct Answer:

B

The assessment of the rights and obligations in an arrangement requires the analysis of which of the following factors?

I II III IV

Legal form of the arrangement Yes Yes Yes Yes

Other relevant factors and circumstances Yes Yes Yes No

Structure of the arrangement No Yes Yes Yes

Terms agreed to by the parties in the contract No No Yes No

(Multiple Choice)

4.9/5  (38)

(38)

Crazy Limited and Frog Limited formed a joint operation and share in the output of the joint operation 60:40.The joint operation paid a management fee of $40 000 to Crazy Limited during the current period.The cost to Crazy Limited of supplying the management service was $28 000.The amount of profit that Crazy Limited will recognise in relation to the provision of the management fee to the joint operation is:

(Multiple Choice)

4.8/5  (35)

(35)

If the joint arrangement is not structured through a separate vehicle,the arrangement is classified as a:

(Multiple Choice)

4.9/5  (37)

(37)

Three joint operators are involved in a joint operation that manufactures mining equipment.At the beginning of the year the joint operation held $100 000 in cash.During the year,the joint operation paid wages of $40 000.Additionally,creditors amounting to $80 000 were paid and the joint operators contributed $30 000 cash each to the joint operation.The balance of cash held by the joint operation at the end of the year is:

(Multiple Choice)

4.9/5  (39)

(39)

On 1 July 2010,Sunday Ltd entered into a 50:50 joint operation with Night Ltd to develop an open cut coal mine in central Queensland.Each operator's initial contribution was $4 million.Sunday contributed $2 million cash and equipment with a fair value of $2 million and a book value of $1 000 000.Night contributed $4 million cash.

Additional information

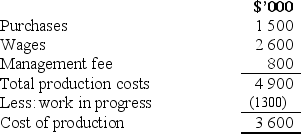

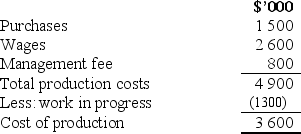

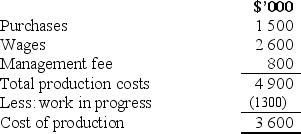

Production costs for the JO for the year ended 30 June 2011 were as follows.

The remaining useful life of the equipment contributed by Sunday is 5 years.

Night is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue.The costs of providing these management services to JO was $450 000.

Night has sold all of the coal distributed to it and Sunday has sold 50% of the coal distributed to it by 30 June 2011.

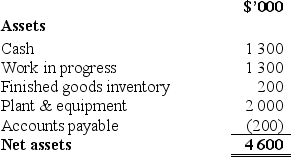

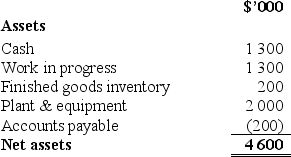

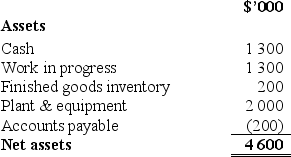

An extract of JO's balance sheet at 30 June 2011 shows:

The remaining useful life of the equipment contributed by Sunday is 5 years.

Night is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue.The costs of providing these management services to JO was $450 000.

Night has sold all of the coal distributed to it and Sunday has sold 50% of the coal distributed to it by 30 June 2011.

An extract of JO's balance sheet at 30 June 2011 shows:

Which of the following will not form part of Sunday Ltd's initial contribution entry?

Which of the following will not form part of Sunday Ltd's initial contribution entry?

(Multiple Choice)

4.8/5  (32)

(32)

On 1 July 2010,Sunday Ltd entered into a 50:50 joint operation with Night Ltd to develop an open cut coal mine in central Queensland.Each operator's initial contribution was $4 million.Sunday contributed $2 million cash and equipment with a fair value of $2 million and a book value of $1 000 000.Night contributed $4 million cash.

Additional information

Production costs for the JO for the year ended 30 June 2011 were as follows.

The remaining useful life of the equipment contributed by Sunday is 5 years.

Night is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue.The costs of providing these management services to JO was $450 000.

Night has sold all of the coal distributed to it and Sunday has sold 50% of the coal distributed to it by 30 June 2011.

An extract of JO's balance sheet at 30 June 2011 shows:

The remaining useful life of the equipment contributed by Sunday is 5 years.

Night is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue.The costs of providing these management services to JO was $450 000.

Night has sold all of the coal distributed to it and Sunday has sold 50% of the coal distributed to it by 30 June 2011.

An extract of JO's balance sheet at 30 June 2011 shows:

Night Ltd's initial contribution entry will include a debit to the Cash in JO account of:

Night Ltd's initial contribution entry will include a debit to the Cash in JO account of:

(Multiple Choice)

4.9/5  (26)

(26)

A joint operation holds equipment with a carrying amount of $1 200 000.The two joint operators participating in this arrangement share control equally.They also depreciate equipment using the straight-line method.The equipment has a useful life of 5 years.At reporting date,each joint operator must recognise which of the following entries in its records in relation to depreciation?

(Multiple Choice)

4.7/5  (38)

(38)

On 1 July 2010,Sunday Ltd entered into a 50:50 joint operation with Night Ltd to develop an open cut coal mine in central Queensland.Each operator's initial contribution was $4 million.Sunday contributed $2 million cash and equipment with a fair value of $2 million and a book value of $1 000 000.Night contributed $4 million cash.

Additional information

Production costs for the JO for the year ended 30 June 2011 were as follows.

The remaining useful life of the equipment contributed by Sunday is 5 years.

Night is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue.The costs of providing these management services to JO was $450 000.

Night has sold all of the coal distributed to it and Sunday has sold 50% of the coal distributed to it by 30 June 2011.

An extract of JO's balance sheet at 30 June 2011 shows:

The remaining useful life of the equipment contributed by Sunday is 5 years.

Night is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue.The costs of providing these management services to JO was $450 000.

Night has sold all of the coal distributed to it and Sunday has sold 50% of the coal distributed to it by 30 June 2011.

An extract of JO's balance sheet at 30 June 2011 shows:

The value of inventory distributed to Sunday Ltd by the joint venture and subsequently sold by 30 June 2011 is:

The value of inventory distributed to Sunday Ltd by the joint venture and subsequently sold by 30 June 2011 is:

(Multiple Choice)

4.8/5  (39)

(39)

According to AASB 11 Joint Arrangements,joint control exists where:

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following statements is not correct in relation to joint control?

(Multiple Choice)

4.8/5  (26)

(26)

On 1 July 2010,the Ears & Eyes Joint Operation was established.The two joint operators participating in this arrangement,Ears Ltd and Eyes Ltd,share control equally.Both joint operators contributed cash to establish the joint operation.The joint operation holds equipment with a carrying amount of $1 200 000.Both joint operators depreciate equipment using the straight-line method and the depreciation is regarded a cost of production.The equipment has a useful life of 5 years.At 30 June 2011,Ears Ltd had sold all of the inventory distributed to it and Eyes Ltd had sold 50% of the inventory distributed to it.At 30 June 2011,Eyes must recognise which of the following entries,in relation to depreciation,in its records?

(Multiple Choice)

4.8/5  (26)

(26)

In relation to the supply of a service to a joint operation by one of the joint operators,which of the following statements is correct?

(Multiple Choice)

4.7/5  (26)

(26)

Ally Ltd and Cat Ltd have established the Ally Cat Joint Operation.Ally Ltd has a 60% interest in the joint operation and Cat Ltd has a 40% interest.

Ally Ltd contributed an asset with a carrying amount of $180 000 and a fair value of $240 000 and Cat Ltd agreed to provide technical services to the joint operation over the first two years of operations.The fair value of the technical services was agreed to be $160 000 and the cost to provide the services was estimated at $130 000 at the inception of the joint operation.

As part of its initial contribution entry Cat Ltd will record a:

(Multiple Choice)

4.9/5  (33)

(33)

When eliminating any unrealised profit arising when a joint operator provides services to a joint operation,the profit is eliminated against:

(Multiple Choice)

4.9/5  (41)

(41)

Showing 1 - 20 of 23

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)