Exam 23: Associates and Joint Ventures

Exam 1: Nature and Regulation of Companies50 Questions

Exam 2: Financing Company Operations48 Questions

Exam 3: Company Operations49 Questions

Exam 4: Fundamental Concepts of Corporate Governance50 Questions

Exam 5: Fair Value Measurement50 Questions

Exam 6: Accounting for Company Income Tax18 Questions

Exam 7: Financial Instruments20 Questions

Exam 8: Foreign Currency Transactions and Forward Exchange Contracts20 Questions

Exam 9: Property, Plant and Equipment47 Questions

Exam 10: Leases18 Questions

Exam 11: Intangible Assets50 Questions

Exam 12: Business Combinations49 Questions

Exam 13: Impairment of Assets49 Questions

Exam 14: Disclosure: Legal Requirements and Accounting Polices50 Questions

Exam 15: Disclosure: Presentation of Financial Statements50 Questions

Exam 16: Disclosure: Statement of Cash Flows18 Questions

Exam 17: Disclosure: Translation of Financial Statements Into a Presentation Currency29 Questions

Exam 18: Consolidation: Controlled Entities49 Questions

Exam 19: Consolidation: Wholly Owned Subsidiaries47 Questions

Exam 20: Consolidation: Intragroup Transactions47 Questions

Exam 21: Consolidation: Non-Controlling Interest50 Questions

Exam 22: Consolidation: Other Issues48 Questions

Exam 23: Associates and Joint Ventures48 Questions

Exam 24: Investments in Joint Arrangements23 Questions

Exam 25: Insolvency and Liquidation46 Questions

Select questions type

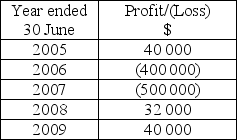

On 1 July 2004 Girls Ltd acquired 25% of the shares of Spice Ltd for $200 000.At that date the equity of Spice Ltd was $800 000,with all identifiable assets and liabilities being measured at fair value.Profits/(losses)made since the date of acquisition are as follows.

There have been no dividends paid or movements in reserves since the date of acquisition.

At 30 June 2006 the equity accounted balance of the investment in Spice was:

There have been no dividends paid or movements in reserves since the date of acquisition.

At 30 June 2006 the equity accounted balance of the investment in Spice was:

Free

(Multiple Choice)

4.8/5  (43)

(43)

Correct Answer:

B

Where the investor prepares consolidated financial statements and a dividend is received from an associate,the entry in the investor's books on receipt of the dividend involves a credit adjustment against dividend revenue.

Free

(True/False)

4.8/5  (31)

(31)

Correct Answer:

True

When disclosing information about investments in associates,AASB 128 Investments in Associates,requires separate disclosure of which of the following?

I Shares in associates,in the statement of financial position.

II Share of profit or loss of associates,in the statement of profit or loss and other comprehensive income.

III Share of any discontinuing operations,in the statement of changes in equity.

IV Shares of changes recognised directly in the associate's equity,in the statement of changes in equity.

Free

(Multiple Choice)

4.9/5  (35)

(35)

Correct Answer:

A

Adjustments made for the purpose of calculating the incremental adjustment to the share of profit of an associate are:

(Multiple Choice)

4.8/5  (37)

(37)

Any excess of the investor's share of the net fair value of an associate's identifiable assets and liabilities over the cost of the investment is recognised as income in the determination of the investor's share of the associate's profit or loss in the period in which the investment is acquired.

(True/False)

4.8/5  (36)

(36)

Lady Ltd owns 25% of Gaga Ltd.Gaga's profit after tax for the year ended 30 June 2014 is $60 000.The tax rate is 30%.During the year ended 30 June 2014,Lady sold $10 000 worth of inventory to Gaga.These items had previously cost Lady $6000.All the items remain unsold by Gaga at 30 June 2014.Lady's share of Gaga's profit for the year ended 30 June 2014 is:

(Multiple Choice)

4.9/5  (35)

(35)

Broncos Limited acquired a 30% interest in Bennett Limited for $54 000.Broncos holds other equity investments but does not prepare consolidated financial statements.Bennett Limited revalued its buildings upwards by $20 000 during the current financial period.The balance of the investment in associate account at the end of the current financial period is:

(Multiple Choice)

4.9/5  (34)

(34)

Where an investor has discontinued the use of the equity method because the associate has incurred losses,it must disclose the:

(Multiple Choice)

4.8/5  (35)

(35)

For the purposes of equity accounting,it is presumed that the investor has significant influence over the other entity where the investor holds:

(Multiple Choice)

4.8/5  (33)

(33)

The investor's share of current period profits is disclosed as a separate line item in the statement of profit or loss and other comprehensive income.

(True/False)

4.8/5  (32)

(32)

Significant influence is defined as the power to participate in the financing or operating policy decisions of the investee.

(True/False)

4.8/5  (37)

(37)

Significant influence automatically arises where the investor holds 20% or more of the shares in the investee.

(True/False)

4.9/5  (30)

(30)

Which of the following are regarded as factors indicating the existence of significant influence over another entity?

I II III IV

Representation on the board of directors Yes Yes Yes Yes

Participation in decisions about dividends No Yes Yes Yes

Provision of essential technical information No No No Yes

Ability to control the investee's operating policies No Yes No No

(Multiple Choice)

4.8/5  (34)

(34)

The classification of an investment as an associate relies on the existence of significant influence.

(True/False)

4.8/5  (45)

(45)

The accounting method applied to investments in associates,known as the equity method,is also known as the:

(Multiple Choice)

4.8/5  (28)

(28)

Warriors Limited acquired a 20% share in Tomkins Limited for $36 000.Warriors Limited has no other investments.At the date on which it became an associate,Tomkins Limited had the following equity:

- share capital $100 000

- retained earnings $80 000.

At the end of the financial year following the investment,Tomkins Limited generated a profit after tax of $12 000.After applying the equity method of accounting,Warriors Limited will have which of the following carrying amounts for the investment?

(Multiple Choice)

4.9/5  (38)

(38)

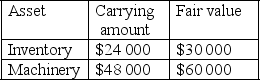

On 1 July 2016 Titans Ltd acquired a 25% share of Taylor Ltd.At that date,the following assets had carrying amounts different to their fair values in Taylor's books.

All inventory was sold to third parties by 30 June 2017.On 1 July 2016,the machinery had a remaining useful life of 3 years.

The tax rate is 30%.

The adjustment required to the investment in associate account at 30 June 2017 in relation to the above assets is:

All inventory was sold to third parties by 30 June 2017.On 1 July 2016,the machinery had a remaining useful life of 3 years.

The tax rate is 30%.

The adjustment required to the investment in associate account at 30 June 2017 in relation to the above assets is:

(Multiple Choice)

4.8/5  (33)

(33)

The holding of debentures by an investor in an associate,and the payment of interest on those debentures,requires adjustment under equity accounting.

(True/False)

4.9/5  (28)

(28)

Kanga Limited acquired a 35% investment in Roo Limited for $20 000.Kanga Limited also owns two subsidiaries and prepares consolidated financial statements.Roo Limited declared and paid a dividend of $5000 during the current financial year.The appropriate consolidation adjustment to record this transaction will include which of the following?

(Multiple Choice)

4.9/5  (38)

(38)

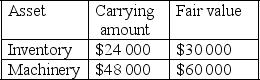

On 1 July 2016 Titans Ltd acquired a 25% share of Taylor Ltd.At that date,the following assets had carrying amounts different to their fair values in Taylor's books.

All inventory was sold to third parties by 30 June 2017.On 1 July 2016,the machinery had a remaining useful life of 3 years.

The tax rate is 30%.

The adjustment required to the investment in associate account at 30 June 2018 in relation to the above assets is:

All inventory was sold to third parties by 30 June 2017.On 1 July 2016,the machinery had a remaining useful life of 3 years.

The tax rate is 30%.

The adjustment required to the investment in associate account at 30 June 2018 in relation to the above assets is:

(Multiple Choice)

4.8/5  (29)

(29)

Showing 1 - 20 of 48

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)