Exam 13: Activity-Based Costing: a Tool to Aid Decision Making

Exam 1: Managerial Accounting and Cost Concepts190 Questions

Exam 2: Least-Squares Regression Computations21 Questions

Exam 3: Cost of Quality42 Questions

Exam 4: Job-Order Costing166 Questions

Exam 5: Activity-Based Absorption Costing17 Questions

Exam 6: The Predetermined Overhead Rate and Capacity28 Questions

Exam 7: Process Costing126 Questions

Exam 8: Fifo Method82 Questions

Exam 9: Service Department Allocations56 Questions

Exam 10: Cost-Volume-Profit Relationships187 Questions

Exam 11: Variable Costing and Segment Reporting: Tools for Management236 Questions

Exam 12: Super-Variable Costing49 Questions

Exam 13: Activity-Based Costing: a Tool to Aid Decision Making150 Questions

Exam 14: Abc Action Analysis16 Questions

Select questions type

What would be the total overhead cost per bouquet according to the activity based costing system? In other words, what would be the overall activity rate for the making bouquets activity cost pool? (Round to the nearest whole cent.)

(Multiple Choice)

4.8/5  (37)

(37)

The activity rate under the activity-based costing system for Activity 2 is closest to:

(Multiple Choice)

5.0/5  (41)

(41)

How much indirect factory wages and factory equipment depreciation cost would NOT be assigned to products using the activity-based costing system?

(Multiple Choice)

4.8/5  (38)

(38)

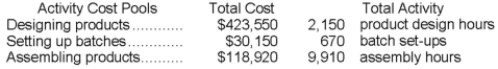

Malan Corporation has provided the following data from its activity-based costing accounting system:  Required:

Compute the activity rates for each of the three cost pools. Show your work!

Required:

Compute the activity rates for each of the three cost pools. Show your work!

(Essay)

4.7/5  (47)

(47)

When a company shifts from a traditional cost system in which manufacturing overhead is applied based on direct labor-hours to an activity-based costing system with batch-level and product-level costs, the unit product costs of low volume products typically decrease whereas the unit product costs of high volume products typically increase.

(True/False)

4.8/5  (33)

(33)

How much cost, in total, would be allocated in the first-stage allocation to the Customer Support activity cost pool?

(Multiple Choice)

4.9/5  (31)

(31)

Lindsey Company uses activity-based costing. The company has two products: A and B. The annual production and sales of Product A is 5,000 units and of Product B is 2,000 units. There are three activity cost pools, with total cost and activity as follows:  The activity-based costing cost per unit of Product A is closest to:

The activity-based costing cost per unit of Product A is closest to:

(Multiple Choice)

4.9/5  (40)

(40)

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

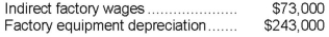

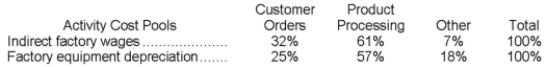

Schulenburg Corporation has provided the following data from its activity-based costing accounting system:  Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

Required:

a. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool. Show your work!

b. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products. Show your work!

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

Required:

a. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool. Show your work!

b. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products. Show your work!

(Essay)

4.8/5  (35)

(35)

Grammer Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs:  The distribution of resource consumption across the three activity cost pools is given below:

The distribution of resource consumption across the three activity cost pools is given below:  How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?

(Multiple Choice)

4.9/5  (35)

(35)

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.8/5  (37)

(37)

What is the product margin for Product C4 under activity-based costing?

(Multiple Choice)

4.8/5  (34)

(34)

Assuming that the company charges $584.18 for the Strobl wedding cake, what would be the overall margin on the order?

(Multiple Choice)

4.8/5  (38)

(38)

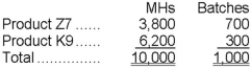

Deraney Corporation has an activity-based costing system with three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $5,800 for the Machining cost pool, $4,700 for the Setting Up cost pool, and $7,500 for the Other cost pool. Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products appear below:  Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

(Essay)

4.9/5  (40)

(40)

What is the overhead cost assigned to Product S4 under activity-based costing?

(Multiple Choice)

4.8/5  (40)

(40)

Activity-based costing uses a number of activity cost pools, each of which may have a different allocation base.

(True/False)

4.7/5  (37)

(37)

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.8/5  (38)

(38)

In traditional costing, some manufacturing costs may be excluded from product costs.

(True/False)

4.8/5  (34)

(34)

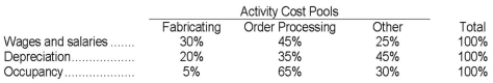

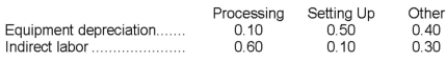

Loader Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other. The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation totals $88,000 and indirect labor totals $1,000. Data concerning the distribution of resource consumption across activity cost pools appear below:  Required:

Assign overhead costs to activity cost pools using activity-based costing.

Required:

Assign overhead costs to activity cost pools using activity-based costing.

(Essay)

4.8/5  (37)

(37)

Showing 41 - 60 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)