Exam 9: Performance Measurement and Responsibility Accounting

Exam 1: Managerial Accounting Concepts and Principles251 Questions

Exam 2: Job Order Costing and Analysis216 Questions

Exam 3: Process Costing and Analysis231 Questions

Exam 4: Activity-Based Costing and Analysis223 Questions

Exam 5: Cost Behavior and Cost-Volume-Profit Analysis248 Questions

Exam 6: Variable Costing and Analysis202 Questions

Exam 7: Master Budgets and Performance Planning215 Questions

Exam 8: Flexible Budgets and Standard Costs221 Questions

Exam 9: Performance Measurement and Responsibility Accounting210 Questions

Exam 10: Relevant Costing for Managerial Decisions145 Questions

Exam 11: Capital Budgeting and Investment Analysis157 Questions

Exam 12: Reporting Cash Flows240 Questions

Exam 13: Analysis of Financial Statements235 Questions

Exam 14: Time Value of Money83 Questions

Exam 15: Lean Principles and Accounting27 Questions

Exam 16: Accounting for Business Transactions251 Questions

Select questions type

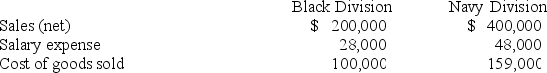

Marian Corporation has two separate divisions that operate as profit centers. The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the Black and Navy Divisions, respectively.

The Black Division occupies 20,000 square feet in the plant. The Navy Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Compute departmental income for the Black and Navy Divisions, respectively.

(Multiple Choice)

4.8/5  (42)

(42)

The difference between a profit center and an investment center is

(Multiple Choice)

4.9/5  (37)

(37)

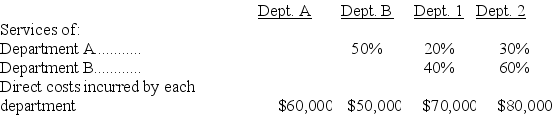

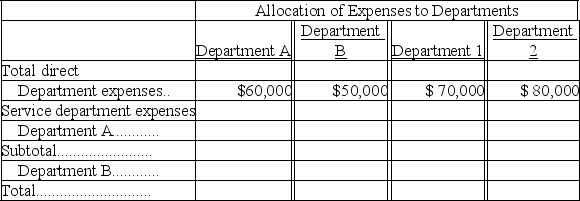

Chancellor Company is divided into four departments. Departments A and B are service departments and Departments 1 and 2 are operating (production) departments. The services of the two service departments are used by the other departments as follows:

Complete the following table:

Complete the following table:

(Essay)

4.8/5  (36)

(36)

Joint costs are costs incurred in producing or purchasing a single product.

(True/False)

4.8/5  (34)

(34)

What is the cash conversion cycle and what does it indicate about the company?

(Essay)

4.8/5  (34)

(34)

Part 7B costs the Midwest Division of Frackle Corporation $30 to make, of which $21 is variable. Midwest Division sells Part 7B to other companies for $47. The Northern Division of Frackle Corporation can use Part 7B in one of its products. The Midwest Division has enough idle capacity to produce all of the units of Part 7B that the Northern Division would require. What is the lowest transfer price at which the Midwest Division should be willing to sell Part 7B to the Northern Division?

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following is not a step in creating operating department income statements?

(Multiple Choice)

4.8/5  (33)

(33)

Departmental information is usually distributed to the public as part of the company's annual report and footnotes.

(True/False)

4.8/5  (36)

(36)

The concepts of direct expenses and uncontrollable costs are essentially the same; also, indirect expenses and controllable costs are essentially the same.

(True/False)

5.0/5  (25)

(25)

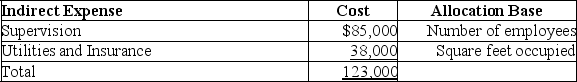

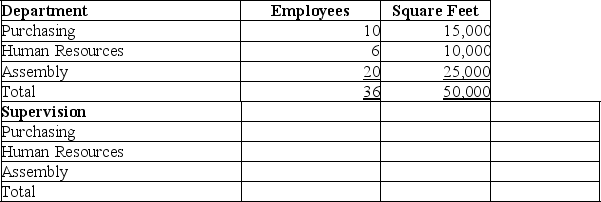

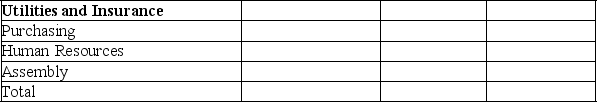

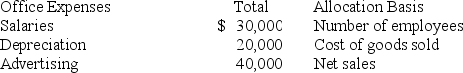

Franklin Co. has three departments: purchasing, human resources, and assembly. In a recent month the three departments incurred two shared indirect expenses. The amounts of the indirect expenses and the bases used to allocate them follow. Use this information to allocate each of the two indirect expenses across the three departments using the tables provided below.

Departmental data for the company's recent reporting period follow.

Departmental data for the company's recent reporting period follow.

(Essay)

4.9/5  (31)

(31)

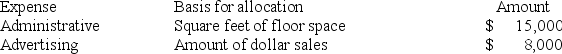

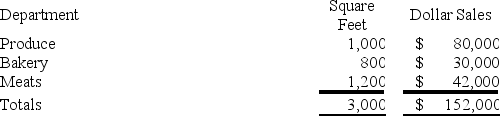

Super Grocery store allocates its service department expenses to its various operating (sales) departments. The following data is available for its service departments:  The following information is available for its three operating (sales) departments:

The following information is available for its three operating (sales) departments:

What is the total administrative expense allocated to the Meats department?

What is the total administrative expense allocated to the Meats department?

(Multiple Choice)

4.8/5  (34)

(34)

What is the main difference between a cost center and a profit center?

(Essay)

4.9/5  (39)

(39)

A challenge in calculating the total costs and expenses of a department is:

(Multiple Choice)

4.9/5  (35)

(35)

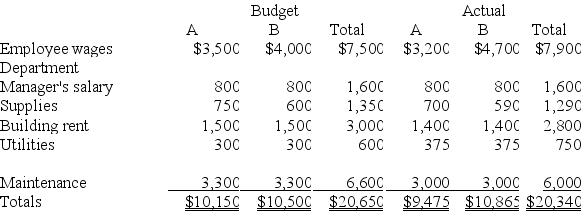

Marsha Hansen, the manager of the Flint Plant of the Michigan Company is responsible for all of the plant's costs except her own salary. There are two operating departments within the plant, Departments A and B. Each department has its own manager. There is also a maintenance department that provides services equally to the two operating departments. The following information is available.

Department managers are responsible for the wages and supplies in their department. They are not responsible for their own salary. Building rent, utilities, and maintenance are allocated to each department based on square footage.

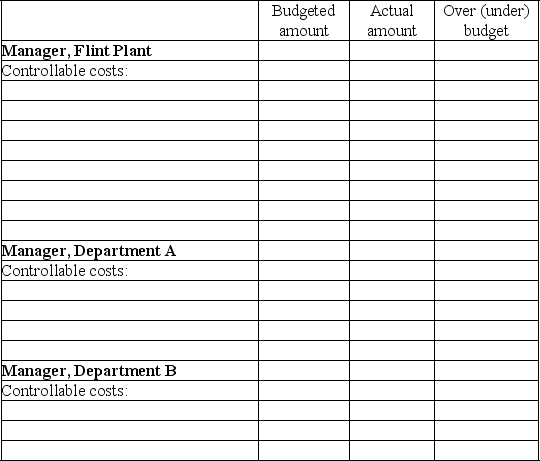

Required: Complete the responsibility accounting performance reports below that list costs controllable by the manager of Department A, the manager of Department B, and the manager of the Flint plant.

Department managers are responsible for the wages and supplies in their department. They are not responsible for their own salary. Building rent, utilities, and maintenance are allocated to each department based on square footage.

Required: Complete the responsibility accounting performance reports below that list costs controllable by the manager of Department A, the manager of Department B, and the manager of the Flint plant.

(Essay)

5.0/5  (38)

(38)

A ________ accumulates and reports costs and expenses that a manager is responsible for, including budgeted amounts.

(Essay)

4.7/5  (33)

(33)

A ________ provides information for managers to use to evaluate the profitability or cost effectiveness of each department's activities.

(Short Answer)

5.0/5  (40)

(40)

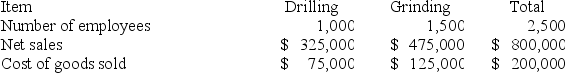

Marks Corporation has two operating departments, Drilling and Grinding, and an office. The three categories of office expenses are allocated to the two departments using different allocation bases. The following information is available for the current period:

The amount of depreciation that should be allocated to Drilling for the current period is:

The amount of depreciation that should be allocated to Drilling for the current period is:

(Multiple Choice)

4.9/5  (37)

(37)

Showing 101 - 120 of 210

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)