Exam 5: Product and Service Costing: Job-Order System

Exam 1: Introduction to Cost Management151 Questions

Exam 2: Basic Cost Management Concepts199 Questions

Exam 3: Cost Behavior193 Questions

Exam 4: Activity-Based Costing198 Questions

Exam 5: Product and Service Costing: Job-Order System149 Questions

Exam 6: Process Costing181 Questions

Exam 7: Allocating Costs of Support Departments and Joint Products171 Questions

Exam 8: Budgeting for Planning and Control202 Questions

Exam 9: Standard Costing: a Functional-Based Control Approach125 Questions

Exam 10: Decentralization: Responsibility, Accounting, Performance Evaluation, and Transfer Pricing134 Questions

Exam 11: Strategic Cost Management148 Questions

Exam 12: Activity-Based Management146 Questions

Exam 13: The Balanced Scorecard: Strategic-Based Control124 Questions

Exam 14: Quality and Environmental Cost Management199 Questions

Exam 15: Lean Accounting and Productivity Measurement161 Questions

Exam 16: Cost-Volume-Profit Analysis128 Questions

Exam 17: Activity Resource Usage Model and Tactical Decision Making121 Questions

Exam 18: Pricing and Profitability Analysis159 Questions

Exam 19: Capital Investment125 Questions

Exam 20: Inventory Management: Economic Order Quantity, Jit, and the Theory of Constraints127 Questions

Select questions type

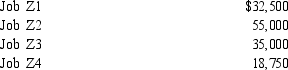

Figure 5-5

Tonneau Corporation had the following information available for October 2016:

Work in Process, October 1 $20,000

Materials placed into production, October 27,500

Direct labor, October 37,500

Factory overhead rate is 150 percent of direct labor costs. Job cost sheets had the following balances:

Jobs Z3 and Z4 were not completed at the end of December.

-Refer to Figure 5-5. What is the cost of goods finished during October for Tonneau Corporation?

Jobs Z3 and Z4 were not completed at the end of December.

-Refer to Figure 5-5. What is the cost of goods finished during October for Tonneau Corporation?

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

B

A debit to Materials Inventory indicates materials were

Free

(Multiple Choice)

4.9/5  (28)

(28)

Correct Answer:

D

The predetermined overhead rate is usually calculated at the

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

C

The costs of a completed job are transferred from the work-in-process inventory account to the finished goods inventory account.

(True/False)

4.9/5  (31)

(31)

The total applied overhead at a given point in time is given by the credit balance in the control account.

(Short Answer)

4.8/5  (31)

(31)

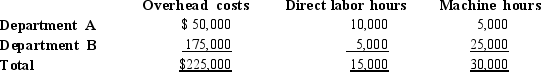

Stainless Steel Company has two production departments: A and B. Stainless Steel has following budgeted overhead costs and activity:

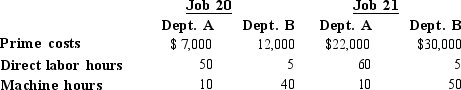

Production data for job 20 and 21 are given below:

Production data for job 20 and 21 are given below:

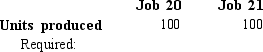

a. Compare the costs per unit of Job 20 if Stainless Steel uses

1. a plantwide rate based on direct labor hours;

2. a plantwide rate based on machine hours;

3. departmental rates with Department A based on direct labor hours and Department B using machine hours. (round to 2 decimal places)

b. Why is there such a variation in the cost per unit? Which method provides the best cost assignment?

a. Compare the costs per unit of Job 20 if Stainless Steel uses

a. Compare the costs per unit of Job 20 if Stainless Steel uses

1. a plantwide rate based on direct labor hours;

2. a plantwide rate based on machine hours;

3. departmental rates with Department A based on direct labor hours and Department B using machine hours. (round to 2 decimal places)

b. Why is there such a variation in the cost per unit? Which method provides the best cost assignment?

a. Compare the costs per unit of Job 20 if Stainless Steel uses

(Essay)

4.8/5  (31)

(31)

When a job is shipped to a customer, the finished job cost becomes the cost of the sold.

(Short Answer)

4.8/5  (39)

(39)

Which cost accounting process would be most appropriate for accumulating costs of identical, standardized units?

(Multiple Choice)

4.9/5  (34)

(34)

In a job-order costing system, actual overhead costs never enter the work-in-process inventory accounts

(True/False)

4.9/5  (39)

(39)

The form indicates the type and quantity of each material issued to the factory.

(Short Answer)

4.8/5  (29)

(29)

Figure 5 - 8

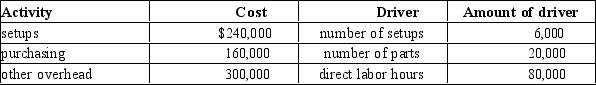

Lamour Corporation is a job order costing company that uses activity-based costing to apply overhead to jobs. The following overhead activities were budgeted for the year.

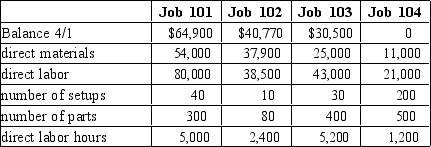

The following information about the jobs was given for April.

The following information about the jobs was given for April.

By April 30, Jobs 102 and 103 were completed and sold. The remaining jobs were still in process.

-Refer to Figure 5-8. The ending work in process would consist of the costs of what jobs?

By April 30, Jobs 102 and 103 were completed and sold. The remaining jobs were still in process.

-Refer to Figure 5-8. The ending work in process would consist of the costs of what jobs?

(Multiple Choice)

4.8/5  (40)

(40)

Figure 5 - 2

The Cameron Corporation manufactures custom-made purses. The following data pertains to Job XY5:

Direct materials placed into production $4,000

Direct labor hours worked 50 hours

Direct labor rate per hour $ 15

Machine hours worked 100 hours

Factory overhead is applied using a plant-wide rate based on direct labor hours. Factory overhead was budgeted at

$80,000 for the year and the direct labor hours were estimated to be 20,000. Job XY5 consists of 50 units.

-Refer to Figure 5-2. What is overhead cost assigned to Job XY5?

(Multiple Choice)

4.7/5  (37)

(37)

When materials are purchased, the costs of the materials "flows" into the materials inventory account.

(True/False)

4.9/5  (44)

(44)

The absolute maximum production activity of a manufacturing firm is called:

(Multiple Choice)

4.9/5  (29)

(29)

Showing 1 - 20 of 149

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)