Exam 18: Pricing and Profitability Analysis

Exam 1: Introduction to Cost Management151 Questions

Exam 2: Basic Cost Management Concepts199 Questions

Exam 3: Cost Behavior193 Questions

Exam 4: Activity-Based Costing198 Questions

Exam 5: Product and Service Costing: Job-Order System149 Questions

Exam 6: Process Costing181 Questions

Exam 7: Allocating Costs of Support Departments and Joint Products171 Questions

Exam 8: Budgeting for Planning and Control202 Questions

Exam 9: Standard Costing: a Functional-Based Control Approach125 Questions

Exam 10: Decentralization: Responsibility, Accounting, Performance Evaluation, and Transfer Pricing134 Questions

Exam 11: Strategic Cost Management148 Questions

Exam 12: Activity-Based Management146 Questions

Exam 13: The Balanced Scorecard: Strategic-Based Control124 Questions

Exam 14: Quality and Environmental Cost Management199 Questions

Exam 15: Lean Accounting and Productivity Measurement161 Questions

Exam 16: Cost-Volume-Profit Analysis128 Questions

Exam 17: Activity Resource Usage Model and Tactical Decision Making121 Questions

Exam 18: Pricing and Profitability Analysis159 Questions

Exam 19: Capital Investment125 Questions

Exam 20: Inventory Management: Economic Order Quantity, Jit, and the Theory of Constraints127 Questions

Select questions type

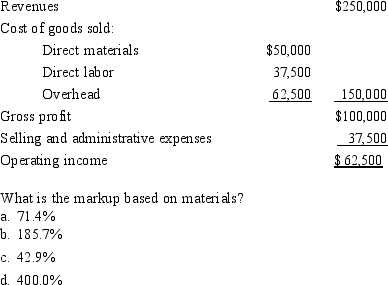

Consolidated Corporation had the following information:

Free

(Not Answered)

This question doesn't have any answer yet

The San Quintin Corporation manufactures automobile hub caps. In 2016, it expected to produce 385,000 hub caps at $6 per unit. The 2016 actual figures were 432,100 units which sold at $7 each.

Compute:

a. The Sales Price Variance

b. The Sales Volume Variance

c. The Overall (Total) Sales Variance Indicate whether Favorable or Unfavorable

Free

(Essay)

4.8/5  (39)

(39)

Correct Answer:

a. Sales Price Variance = (Actual Price - Expected Price) × Αctual Volume

= ($7 - 6)432,000 = $432,100(F)

b. Sales Volume Variance = (Actual Volume - Expected Volume) × Expected Price

b. Sales Volume Variance = (Actual Volume - Expected Volume) × Expected Price

= 432,100 - 385,000)$6 = $282,000(F)

c. Overall (Total) Sales Variance = Sales Price Variance + Sales Volume Variance

c. Overall (Total) Sales Variance = Sales Price Variance + Sales Volume Variance

= 432,000(F) + 282,000(F) = $714,000(F)

Scottish Company manufactures a variety of toys and games. John Chisholm, president, is disappointed in the sales of a new board game. The game sold only 10,000 units in 2016 when 30,000 were projected. Sales for 2017 look no better. At $100 per game, it is not a hot seller. Direct costs of the board game are $56 variable cost and $100,000 fixed. John is considering several options. Option One: Cut the price to $70 and perhaps sell 15,000 units. Option Two: Cut the price to $60, reduce material costs by $10, and cut advertising by $60,000. Anticipated volume for this option is 10,000 units. Option Three: Cut the price to $80 and include a $10 mail-in rebate offer. It is anticipated that 15,000 units could be sold and only 30 percent of the rebate coupons would be redeemed. What is the profit (loss) from Option Three?

Free

(Multiple Choice)

4.8/5  (45)

(45)

Correct Answer:

C

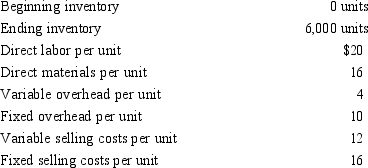

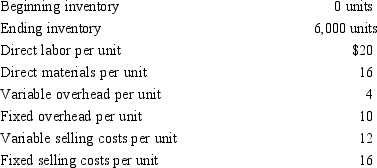

The following information pertains to Cumberland Corporation:  Absorption costing net income would be how much greater or less than the variable costing net income?

Absorption costing net income would be how much greater or less than the variable costing net income?

(Multiple Choice)

4.8/5  (37)

(37)

Too much emphasis on short-run optimization can lead to problems.

(Short Answer)

4.9/5  (36)

(36)

Firms enjoy greater success when they include the impact of profits on their employees and the community.

(True/False)

4.8/5  (27)

(27)

Which of the following markets is characterized by the following: a single firm in the industry, a unique product, and difficult entry into the industry?

(Multiple Choice)

4.8/5  (35)

(35)

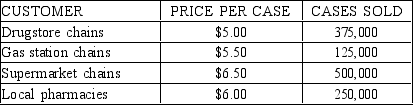

Figure 18-1

The Lancashire Corporation manufactures bottled water with an average manufacturing cost of $2 per case (a case contains 24 bottles). Bayview sold 1,000,000 cases last year to the following types of customers:

The drugstore chains have special handling costs of $0.20 a case and increased administrative assistance costing $45,000 per year.

The gas station chains require special marketing promotions that cost $50,000. Sales commissions of 10% are paid.

The supermarket chains order electronically through EDI which costs $25,000 annually. Bayview is responsible for shipping costs, which totaled $0.50 a case and special labels costing $0.02 per bottle

Local pharmacies have special handling costs of $0.10 per case and sales commissions are paid to agents costing

$0.25 per case. Bad debt expense averages 10% of sales.

-Refer to Figure 18-1. What is the profit per case for drugstore chains?

The drugstore chains have special handling costs of $0.20 a case and increased administrative assistance costing $45,000 per year.

The gas station chains require special marketing promotions that cost $50,000. Sales commissions of 10% are paid.

The supermarket chains order electronically through EDI which costs $25,000 annually. Bayview is responsible for shipping costs, which totaled $0.50 a case and special labels costing $0.02 per bottle

Local pharmacies have special handling costs of $0.10 per case and sales commissions are paid to agents costing

$0.25 per case. Bad debt expense averages 10% of sales.

-Refer to Figure 18-1. What is the profit per case for drugstore chains?

(Multiple Choice)

4.7/5  (43)

(43)

Johanson Company had the following information: Revenues $400,000

Cost of goods sold:

Direct materials $100,000 Direct labor 50,000

Overhead 50,000 200,000

Gross profit $200,000

Selling and administrative expenses

75,000

Operating income $125,000

What is the markup based on prime costs?

What is the markup based on prime costs?

(Multiple Choice)

4.9/5  (34)

(34)

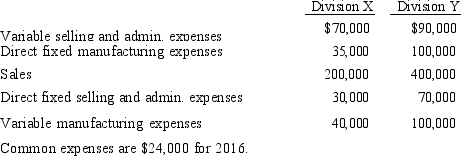

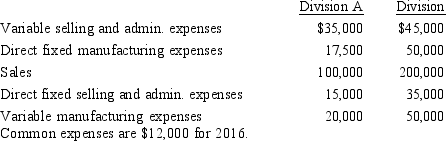

Normandy Company has the following information pertaining to its two divisions for 2016:  What is the operating income for Normandy Company?

What is the operating income for Normandy Company?

(Multiple Choice)

4.8/5  (37)

(37)

Scottish Company manufactures a variety of toys and games. John Chisholm, president, is disappointed in the sales of a new board game. The game sold only 10,000 units in 2016 when 30,000 were projected. Sales for 2017 look no better. At $100 per game, it is not a hot seller. Direct costs of the board game are $56 variable cost and $100,000 fixed. John is considering several options. Option One: Cut the price to $70 and perhaps sell 15,000 units. Option Two: Cut the price to $60, reduce material costs by $10, and cut advertising by $60,000. Anticipated volume for this option is 10,000 units. Option Three: Cut the price to $80 and include a $10 mail-in rebate offer. It is anticipated that 15,000 units could be sold and only 30 percent of the rebate coupons would be redeemed. Which option is preferred?

(Multiple Choice)

4.9/5  (35)

(35)

The market share and market size variances allow firms to compare their performance with the:

(Multiple Choice)

4.8/5  (28)

(28)

The market size variance is favorable when the budgeted industry sales in units is:

(Multiple Choice)

4.7/5  (42)

(42)

The pricing of a new product at a low initial price to build market share quickly is called:

(Multiple Choice)

4.9/5  (37)

(37)

Sarandon Company has the following information pertaining to its two divisions for 2016:  What is the operating income for Sarandon Company?

What is the operating income for Sarandon Company?

(Multiple Choice)

4.8/5  (37)

(37)

The following information pertains to Cumberland Corporation:  What is the value of ending inventory using the absorption costing method?

What is the value of ending inventory using the absorption costing method?

(Multiple Choice)

4.9/5  (26)

(26)

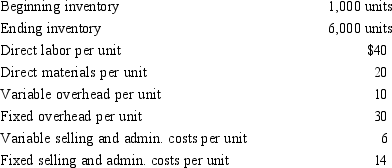

The following information pertains to Guillotine Corporation:  What is the value of the ending inventory using the absorption costing method?

What is the value of the ending inventory using the absorption costing method?

(Multiple Choice)

4.8/5  (29)

(29)

When firms with market power price products "too high", companies are:

(Multiple Choice)

4.9/5  (35)

(35)

Showing 1 - 20 of 159

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)