Exam 7: Allocating Costs of Support Departments and Joint Products

Exam 1: Introduction to Cost Management151 Questions

Exam 2: Basic Cost Management Concepts199 Questions

Exam 3: Cost Behavior193 Questions

Exam 4: Activity-Based Costing198 Questions

Exam 5: Product and Service Costing: Job-Order System149 Questions

Exam 6: Process Costing181 Questions

Exam 7: Allocating Costs of Support Departments and Joint Products171 Questions

Exam 8: Budgeting for Planning and Control202 Questions

Exam 9: Standard Costing: a Functional-Based Control Approach125 Questions

Exam 10: Decentralization: Responsibility, Accounting, Performance Evaluation, and Transfer Pricing134 Questions

Exam 11: Strategic Cost Management148 Questions

Exam 12: Activity-Based Management146 Questions

Exam 13: The Balanced Scorecard: Strategic-Based Control124 Questions

Exam 14: Quality and Environmental Cost Management199 Questions

Exam 15: Lean Accounting and Productivity Measurement161 Questions

Exam 16: Cost-Volume-Profit Analysis128 Questions

Exam 17: Activity Resource Usage Model and Tactical Decision Making121 Questions

Exam 18: Pricing and Profitability Analysis159 Questions

Exam 19: Capital Investment125 Questions

Exam 20: Inventory Management: Economic Order Quantity, Jit, and the Theory of Constraints127 Questions

Select questions type

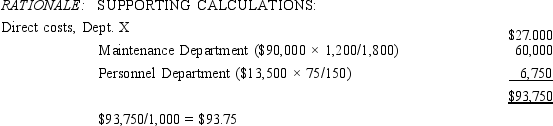

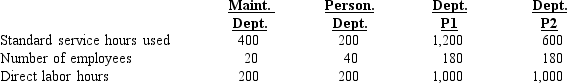

Morton Manufacturing Company has two support departments, Maintenance Department and Personnel Department, and two producing departments, X and Y. The Maintenance Department costs of $90,000 are allocated on the basis of standard service hours used. The Personnel Department costs of $13,500 are allocated on the basis of number of employees. The direct costs of Departments X and Y are $27,000 and $45,000, respectively.

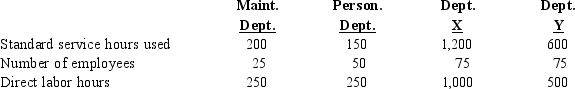

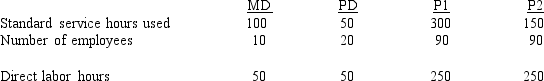

Data on standard service hours and number of employees are as follows:

Predetermined overhead rates for Departments X and Y, respectively, are based on direct labor hours.

What is the overhead rate for Department X assuming the direct method is used?

a. $27.00

b. $81.00

c. $46.88

d. $93.75

Predetermined overhead rates for Departments X and Y, respectively, are based on direct labor hours.

What is the overhead rate for Department X assuming the direct method is used?

a. $27.00

b. $81.00

c. $46.88

d. $93.75

Free

(Essay)

4.7/5  (28)

(28)

Correct Answer:

d

The method of allocating costs, allocates costs from support to producing departments.

Free

(Short Answer)

4.9/5  (33)

(33)

Correct Answer:

direct

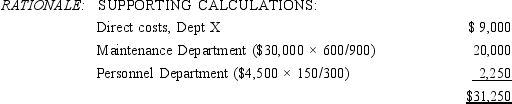

Diane's Pottery Manufacturing Company has two support departments, Maintenance Department and Personnel Department, and two producing departments, X and Y. The Maintenance Department costs of $30,000 are allocated on the basis of standard service hours used. The Personnel Department costs of $4,500 are allocated on the basis of number of employees. The direct costs of Departments X and Y are $9,000 and $15,000, respectively.

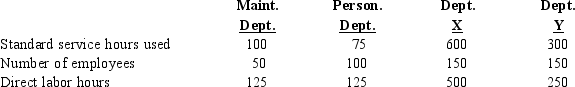

Data on standard service hours and number of employees are as follows:

What are the total overhead costs associated with Department X after allocating the Maintenance and Personnel

Departments using the direct method?

a. $31,250

b. $29,000

c. $11,250

d. $9,000

What are the total overhead costs associated with Department X after allocating the Maintenance and Personnel

Departments using the direct method?

a. $31,250

b. $29,000

c. $11,250

d. $9,000

Free

(Essay)

4.7/5  (52)

(52)

Correct Answer:

a

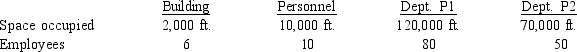

Fairfield Company allocates common Building Department costs to producing departments (P1 and P2) based on space occupied, and it allocates common Personnel Department costs based on the number of employees. Space occupancy and employee data are as follows:  If Fairfield Company uses the direct allocation method, the ratio representing the portion of building costs allocated to Department P1 is

If Fairfield Company uses the direct allocation method, the ratio representing the portion of building costs allocated to Department P1 is

(Multiple Choice)

4.8/5  (27)

(27)

The sales-value-at-split-off method allocates joint production costs based on each product's share of

(Multiple Choice)

4.8/5  (26)

(26)

Which of the major objectives of allocation as identified by the IMA would NOT be relevant in a service organization?

(Multiple Choice)

4.9/5  (40)

(40)

Oxide Company has two support departments (S1 and S2) and two producing departments (X and Y). Department S1 serves Departments S2, X, and Y in the following percentages, respectively: 10%, 35%, 55%. Department S2 serves Departments S1, X, and Y in the following percentages, respectively: 6%, 50%, and 44%. Direct department costs for S1, S2, X, and Y are $15,000, $8,000, $105,000, and $97,500, respectively. What is S2's cost equation?

(Multiple Choice)

4.8/5  (41)

(41)

Gravity Company has two support departments, Maintenance Department (MD) and Personnel Department (PD), and two producing departments, P1 and P2. The Maintenance Department costs of $120,000 are allocated on the basis of standard service hours used. The Personnel Department costs of $18,000 are allocated on the basis of number of employees. The direct costs of Departments P1 and P2 are $36,000 and $60,000, respectively. Data on standard service hours and number of employees are as follows:

What are the total overhead costs associated with P1 after allocating the Maintenance and Personnel Departments using the direct method?

What are the total overhead costs associated with P1 after allocating the Maintenance and Personnel Departments using the direct method?

(Multiple Choice)

4.9/5  (41)

(41)

Lennon Company has two support departments, Maintenance Department and Personnel Department, and two producing departments, X and Y. The Maintenance Department costs of $30,000 are allocated on the basis of standard service used. The Personnel Department costs of $6,000 are allocated on the basis of number of employees. The direct costs of Departments X and Y are $18,000 and $30,000, respectively.

Data on standard service hours and number of employees are as follows:

Predetermined overhead rates for Departments X and Y, respectively, are based on direct labor hours.

What is the overhead rate for Department X assuming the direct method is used?

a. $47.00

b. $82.00

c. $152.00

d. $164.00

Predetermined overhead rates for Departments X and Y, respectively, are based on direct labor hours.

What is the overhead rate for Department X assuming the direct method is used?

a. $47.00

b. $82.00

c. $152.00

d. $164.00

(Essay)

4.8/5  (34)

(34)

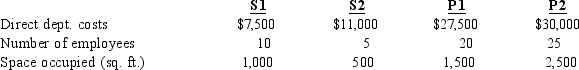

Howard Company has two support departments (S1 and S2) and two producing departments (P1 and P2). Department S1 costs are allocated on the basis of number of employees, and Department S2 costs are allocated on the basis of space occupied expressed in square feet.

Data on direct department costs, number of employees, and space occupied are as follows:

If Howard used the reciprocal method, the algebraic equation expressing the total costs allocated from S1 is

If Howard used the reciprocal method, the algebraic equation expressing the total costs allocated from S1 is

(Multiple Choice)

4.9/5  (32)

(32)

If the allocation is for product costing, the allocation of variable support department costs would be calculated as

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following methods allocates joint production costs based on the pounds of product produced?

(Multiple Choice)

4.8/5  (42)

(42)

The reciprocal method of allocation recognizes only some of the support departments' interactions.

(True/False)

4.9/5  (35)

(35)

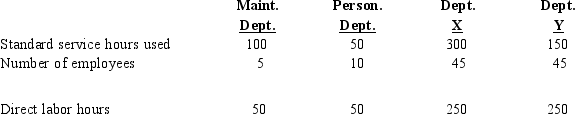

Figure 7-6

Golden Leaves Company has two support departments, Maintenance Department (MD) and Personnel Department (PD), and two producing departments, P1 and P2. The Maintenance Department costs of $30,000 are allocated on the basis of standard service used. The Personnel Department costs of $4,500 are allocated on the basis of number of employees. The direct costs of Departments P1 and P2 are $9,000 and $15,000, respectively.

Data on standard service hours and number of employees are as follows:

-Refer to Figure 7-6. Using the direct method, the cost of the Maintenance Department allocated to Department P1 is

-Refer to Figure 7-6. Using the direct method, the cost of the Maintenance Department allocated to Department P1 is

(Multiple Choice)

4.9/5  (33)

(33)

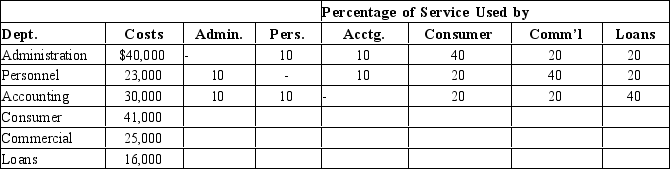

Astoria Savings & Loans of New York has three revenue-generating departments: Consumer accounts, Commercial accounts, and Loans. The bank also has three service areas: administration, personnel, and accounting. The direct costs per month and the interdepartmental service structure are shown below:  How much cost would be allocated to the Commercial account area from administration using the direct method?

How much cost would be allocated to the Commercial account area from administration using the direct method?

(Multiple Choice)

4.8/5  (38)

(38)

Figure 7-7

Garden of Eden Company manufactures two products, Brights and Dulls, from a joint process. A production run costs $50,000 and results in 250 units of Brights and 1,000 units of Dulls. Both products must be processed past the split-off point, incurring separable costs for Brights of $60 per unit and $40 per unit for Dulls. The market price is

$250 for Brights and $200 for Dulls.

-Refer to Figure 7-7. What is the amount of joint costs allocated to Brights using the net realizable value method?

(Multiple Choice)

4.8/5  (31)

(31)

Showing 1 - 20 of 171

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)