Essay

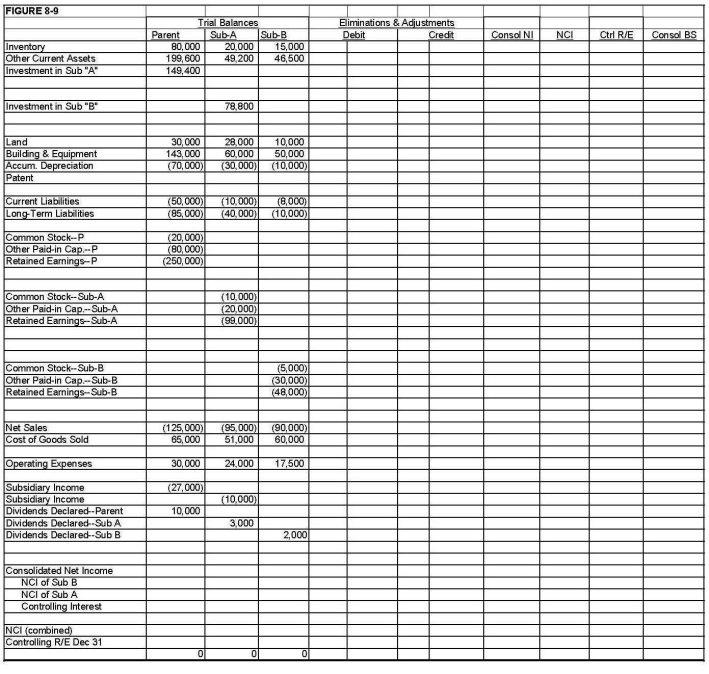

On January 1, 20X1, Parent Company purchased 90% of the common stock of Sub-A Company for $90,000. On this date, Sub-A had common stock, other paid-in capital, and retained earnings of $10,000, $20,000, and $60,000 respectively.

On January 1, 20X2, Sub-A Company purchased 80% of the common stock of Sub-B Company for $64,000. On this date, Sub-B Company had common stock, other paid-in capital, and retained earnings of $5,000, $30,000, and $40,000 respectively.

Any excess of cost over book value on either purchase is due to a patent, to be amortized over ten years.

Both Parent and Sub-A have accounted for their investments using the simple equity method.

During 20X2, Sub-B sold merchandise to Sub-A for $20,000, of which one-fourth is still held by Sub-B on December 31, 20X2. Sub-B's usual gross profit is 40%. During 20X3, Sub-B sold more goods to Sub-A for $30,000, of which $10,000 is still on hand on December 31, 20X3.

Required:

Complete the Figure 8-9 worksheet for consolidated financial statements for 20X3.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following situations is a

Q3: On January 1, 20X1, Parent Company

Q4: Paula Inc. purchased an 80% interest

Q6: Able Company owns an 80% interest in

Q7: On 1/1/X1 Poncho acquired an 80%

Q8: Apple Inc. owns a 90% interest in

Q9: Able Company owns an 80% interest in

Q10: Paul & Stephan: On January 1,

Q11: On January 1, 20X1, Parent Company purchased

Q21: Two types of intercompany stock purchases significantly