Essay

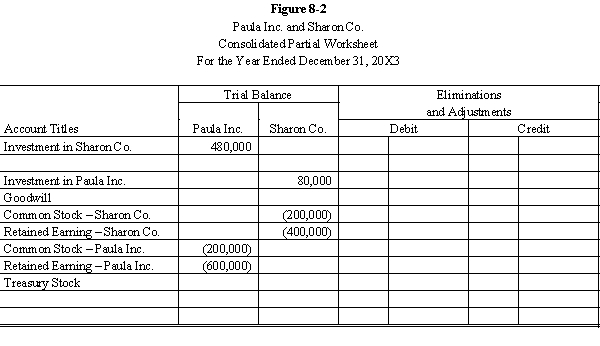

Paula Inc. purchased an 80% interest in the Sharon Co. for $480,000 on January 1, 20X1, when Sharon Co. had the following stockholders' equity:

Any excess is attributable to goodwill.

On January 1, 20X3, Sharon Co. purchased a 10% interest in the Paula Inc. at a price equal to book value. Both firms maintain investments under the cost method.

Required:

a.

Complete the Figure 8-2 partial worksheet for December 31, 20X3, assuming the use of the treasury stock method.

b.

Calculate the distribution of income for 20X3, assuming that internally generated net income is $50,000 for Paula and $20,000 for Sharon.

Correct Answer:

Verified

a.

For the worksheet...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

For the worksheet...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: On January 1, 20X1, Parent Company purchased

Q2: Which of the following situations is a

Q3: On January 1, 20X1, Parent Company

Q6: Able Company owns an 80% interest in

Q7: On 1/1/X1 Poncho acquired an 80%

Q8: Apple Inc. owns a 90% interest in

Q9: Able Company owns an 80% interest in

Q10: Paul & Stephan: On January 1,

Q11: On January 1, 20X1, Parent Company purchased

Q21: Two types of intercompany stock purchases significantly