Essay

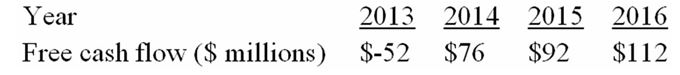

The following table presents a four-year forecast for Kenmore Air, Inc.:

-Estimate the fair market value of Kenmore Air at the end of 2012.Assume that after 2016,earnings before interest and tax will remain constant at $200 million,depreciation will equal capital expenditures in each year,and working capital will not change.Kenmore Air's weighted-average cost of capital is 11 percent and its tax rate is 40 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following statements are correct?<br>I.Going-concern

Q3: Which of the following statements are correct?<br>I.Liquidation

Q4: Assume that in the years after 2015

Q5: Estimate BSL's value (in $ millions)at the

Q6: Ginormous Oil entered into an agreement to

Q7: Assume that at year-end 2015 the company's

Q8: The following table presents a four-year forecast

Q9: The following table presents a four-year forecast

Q10: Estimate BSL's value (in $ millions)at the

Q11: Consider the following premerger information about a