Exam 8: Profit Maximization and Competitive Supply

Exam 1: Preliminaries77 Questions

Exam 2: The Basics of Supply and Demand135 Questions

Exam 3: Consumer Behavior146 Questions

Exam 4: Individual and Market Demand173 Questions

Exam 5: Uncertainty and Consumer Behavior177 Questions

Exam 6: Production123 Questions

Exam 7: The Cost of Production166 Questions

Exam 8: Profit Maximization and Competitive Supply149 Questions

Exam 9: The Analysis of Competitive Markets177 Questions

Exam 10: Market Power: Monopoly and Monopsony158 Questions

Exam 11: Pricing With Market Power122 Questions

Exam 12: Monopolistic Competition and Oligopoly113 Questions

Exam 13: Game Theory and Competitive Strategy150 Questions

Exam 14: Markets for Factor Inputs123 Questions

Exam 15: Investment, Time, and Capital Markets153 Questions

Exam 16: General Equilibrium and Economic Efficiency111 Questions

Exam 17: Markets With Asymmetric Information130 Questions

Exam 18: Externalities and Public Goods123 Questions

Select questions type

The demand for pizzas in the local market is given by: QD = 25,000 - 1,500P. There are 100 pizza firms currently in the market. The long-run cost function for each pizza firm is: C(q, w) =  wq, where w is the wage rate pizza firms pay for a labor hour and q is the number of pizzas produced. The marginal cost function for each firm is: MC(q, w) =

wq, where w is the wage rate pizza firms pay for a labor hour and q is the number of pizzas produced. The marginal cost function for each firm is: MC(q, w) =  w. If the current wage rate is $7 and the industry is competitive, calculate the optimal output of each firm given each firm produces the same level of output. Do you anticipate firms entering or exiting the pizza industry? Suppose that the wage rate increases to $8.40. Calculate optimal output for each of the 100 firms. Do you anticipate firms entering or exiting the pizza industry? What happens to the market output of pizzas with the higher wage rate? What happens to the market price for pizza?

w. If the current wage rate is $7 and the industry is competitive, calculate the optimal output of each firm given each firm produces the same level of output. Do you anticipate firms entering or exiting the pizza industry? Suppose that the wage rate increases to $8.40. Calculate optimal output for each of the 100 firms. Do you anticipate firms entering or exiting the pizza industry? What happens to the market output of pizzas with the higher wage rate? What happens to the market price for pizza?

(Essay)

4.7/5  (40)

(40)

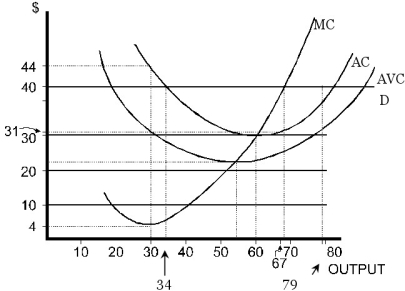

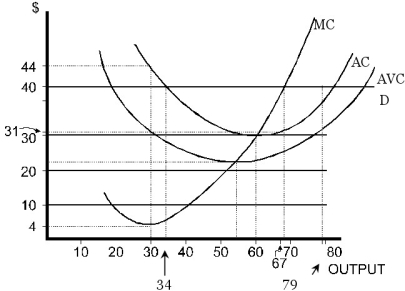

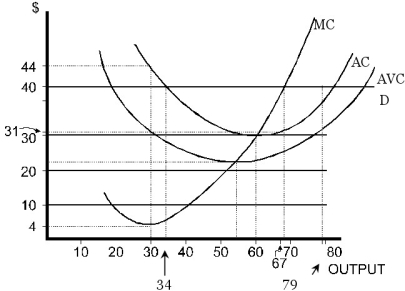

Consider the following diagram where a perfectly competitive firm faces a price of $40.  Figure 8.1

-Refer to Figure 8.1. The profit-maximizing output is

Figure 8.1

-Refer to Figure 8.1. The profit-maximizing output is

(Multiple Choice)

4.8/5  (39)

(39)

The authors explain that a firm earning a zero economic profit in the long run has earned a competitive return on their investment. What do they mean by "competitive" return in this context?

(Multiple Choice)

4.7/5  (44)

(44)

The long-run cost function for LeAnn's telecommunication firm is: C(q) = 0.03q2. A local telecommunication tax of $0.01 has been implemented for each unit LeAnn sells. This implies the marginal cost function becomes: MC(q, t) = 0.06q + t. If LeAnn can sell all the units she produces at the market price of $0.70, calculate LeAnn's optimal output before and after the tax. What effect did the tax have on LeAnn's output level? How did LeAnn's profits change?

(Essay)

4.8/5  (28)

(28)

Bette's Breakfast, a perfectly competitive eatery, sells its "Breakfast Special" (the only item on the menu) for $5.00. The costs of waiters, cooks, power, food etc. average out to $3.95 per meal; the costs of the lease, insurance and other such expenses average out to $1.25 per meal. Bette should

(Multiple Choice)

4.7/5  (34)

(34)

Consider the following diagram where a perfectly competitive firm faces a price of $40.  Figure 8.1

-Refer to Figure 8.1. At the profit-maximizing level of output, AVC is

Figure 8.1

-Refer to Figure 8.1. At the profit-maximizing level of output, AVC is

(Multiple Choice)

4.7/5  (40)

(40)

Consider the following diagram where a perfectly competitive firm faces a price of $40.  Figure 8.1

-Refer to Figure 8.1. At the profit-maximizing level of output, total profit is

Figure 8.1

-Refer to Figure 8.1. At the profit-maximizing level of output, total profit is

(Multiple Choice)

4.9/5  (42)

(42)

If a competitive firm's marginal cost curve is U-shaped then

(Multiple Choice)

4.9/5  (28)

(28)

Conigan Box Company produces cardboard boxes that are sold in bundles of 1000 boxes. The market is highly competitive, with boxes currently selling for $100 per thousand. Conigan's total and marginal cost curves are:

TC = 3,000,000 + 0.001Q2

MC = 0.002Q

where Q is measured in thousand box bundles per year.

a. Calculate Conigan's profit maximizing quantity. Is the firm earning a profit?

b. Analyze Conigan's position in terms of the shutdown condition. Should Conigan operate or shut down in the shortrun?

(Essay)

4.9/5  (37)

(37)

Which of following is a key assumption of a perfectly competitive market?

(Multiple Choice)

4.8/5  (35)

(35)

Consider the following statements when answering this question

I. If the cost of producing each unit of output falls $5, then the short-run market price falls $5.

II. If the cost of producing each unit of output falls $5, then the long-run market price falls $5.

(Multiple Choice)

4.9/5  (39)

(39)

If a competitive firm's marginal costs always increase with output, then at the profit maximizing output level, producer surplus is

(Multiple Choice)

4.8/5  (39)

(39)

Suppose your firm has a U-shaped average variable cost curve and operates in a perfectly competitive market. If you produce where the product price (marginal revenue) equals average variable cost (on the upward sloping portion of the AVC curve), then your output will:

(Multiple Choice)

4.9/5  (35)

(35)

At the profit-maximizing level of output, what is relationship between the total revenue (TR) and total cost (TC) curves?

(Multiple Choice)

4.8/5  (39)

(39)

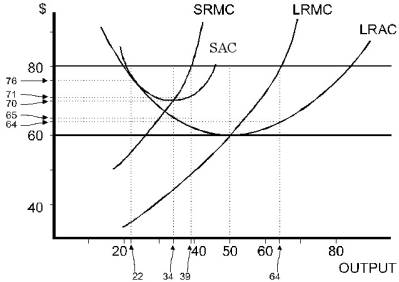

Figure 8.2

-Refer to Figure 8.2. At P = $80, the profit-maximizing output in the short run is

Figure 8.2

-Refer to Figure 8.2. At P = $80, the profit-maximizing output in the short run is

(Multiple Choice)

4.8/5  (48)

(48)

The shutdown decision can be restated in terms of producer surplus by saying that a firm should produce in the short run as long as

(Multiple Choice)

4.8/5  (36)

(36)

Showing 61 - 80 of 149

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)