Exam 8: Profit Maximization and Competitive Supply

Exam 1: Preliminaries77 Questions

Exam 2: The Basics of Supply and Demand135 Questions

Exam 3: Consumer Behavior146 Questions

Exam 4: Individual and Market Demand173 Questions

Exam 5: Uncertainty and Consumer Behavior177 Questions

Exam 6: Production123 Questions

Exam 7: The Cost of Production166 Questions

Exam 8: Profit Maximization and Competitive Supply149 Questions

Exam 9: The Analysis of Competitive Markets177 Questions

Exam 10: Market Power: Monopoly and Monopsony158 Questions

Exam 11: Pricing With Market Power122 Questions

Exam 12: Monopolistic Competition and Oligopoly113 Questions

Exam 13: Game Theory and Competitive Strategy150 Questions

Exam 14: Markets for Factor Inputs123 Questions

Exam 15: Investment, Time, and Capital Markets153 Questions

Exam 16: General Equilibrium and Economic Efficiency111 Questions

Exam 17: Markets With Asymmetric Information130 Questions

Exam 18: Externalities and Public Goods123 Questions

Select questions type

A firm maximizes profit by operating at the level of output where

(Multiple Choice)

4.8/5  (36)

(36)

The authors note that the goal of maximizing the market value of the firm may be more appropriate than maximizing short-run profits because:

(Multiple Choice)

4.8/5  (45)

(45)

If a graph of a perfectly competitive firm shows that the MR = MC point occurs where MR is above AVC but below ATC,

(Multiple Choice)

4.8/5  (29)

(29)

The amount of output that a firm decides to sell has no effect on the market price in a competitive industry because

(Multiple Choice)

4.9/5  (43)

(43)

The long-run supply curve in a constant-cost industry is linear and

(Multiple Choice)

4.9/5  (37)

(37)

Homer's Boat Manufacturing cost function is: C(q) =  q4 + 10,240. The marginal cost function is: MC(q) =

q4 + 10,240. The marginal cost function is: MC(q) =  q3. If Homer can sell all the boats he produces for $1,200, what is his optimal output? Calculate Homer's profit or loss.

q3. If Homer can sell all the boats he produces for $1,200, what is his optimal output? Calculate Homer's profit or loss.

(Essay)

4.9/5  (40)

(40)

Assume the market for tortillas is perfectly competitive. The market supply and demand curves for tortillas are given as follows:

supply curve:

P = .000002Q demand curve: P = 11 - .00002Q

The short run marginal cost curve for a typical tortilla factory is:

MC = .1 + .0009Q

a. Determine the equilibrium price for tortillas.

b. Determine the profit maximizing short run equilibrium level of output for a tortilla factory.

c. At the level of output determined above, is the factory making a profit, breaking-even, or making a loss? Explain your answer.

d. Assuming that all of the tortilla factories are identical, how many tortilla factories are producing tortillas?

(Essay)

4.9/5  (40)

(40)

In a constant-cost industry, an increase in demand will be followed by

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following events does NOT occur when market demand shifts leftward in an increasing-cost industry?

(Multiple Choice)

4.7/5  (39)

(39)

The market for wheat consists of 500 identical firms, each with the total and marginal cost functions shown:

TC = 90,000 + 0.00001Q2

MC = 0.00002Q,

where Q is measured in bushels per year. The market demand curve for wheat is Q = 90,000,000 20,000,000P, where Q is again measured in bushels and P is the price per bushel.

a. Determine the short-run equilibrium price and quantity that would exist in the market.

b. Calculate the profit maximizing quantity for the individual firm. Calculate the firm's short-run profit (loss) at that quantity.

c. Assume that the short-run profit or loss is representative of the current long-run prospects in this market. You may further assume that there are no barriers to entry or exit in the market. Describe the expected long-run response to the conditions described in part b. (The TC function for the firm may be regarded as an economic cost function that captures all implicit and explicit costs.)

(Essay)

4.9/5  (40)

(40)

In the local cotton market, there are 1,000 producers that have identical short-run cost functions. They are: C(q) = 0.025q2 + 200, where q is the number of bales produced each period. The short-run marginal cost function for each producer is: MC(q) = 0.05q. If the local cotton market is perfectly competitive, what is each cotton producer's short-run supply curve? Derive the local market supply curve of cotton.

(Essay)

4.8/5  (34)

(34)

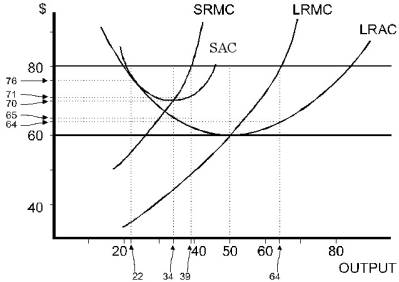

Figure 8.2

-Refer to Figure 8.2. If the firm expects $80 to be the long-run price, how many units of output will it plan to produce in the long run?

Figure 8.2

-Refer to Figure 8.2. If the firm expects $80 to be the long-run price, how many units of output will it plan to produce in the long run?

(Multiple Choice)

4.8/5  (35)

(35)

Spacely Sprockets' short-run cost curve is: C(q, K) =  + 15K, where q is the number of Sprockets produced and K is the number of robot hours Spacely hires. Currently, Spacely hires 10 robot hours per period. The short-run marginal cost curve is: MC(q, K) = 50

+ 15K, where q is the number of Sprockets produced and K is the number of robot hours Spacely hires. Currently, Spacely hires 10 robot hours per period. The short-run marginal cost curve is: MC(q, K) = 50  . If Spacely receives $250 for every sprocket he produces, what is his profit maximizing output level? Calculate Spacely's profits.

. If Spacely receives $250 for every sprocket he produces, what is his profit maximizing output level? Calculate Spacely's profits.

(Essay)

4.8/5  (35)

(35)

Suppose your firm operates in a perfectly competitive market and decides to double its output. How does this affect the firm's marginal profit?

(Multiple Choice)

4.9/5  (44)

(44)

Bud Owen operates Bud's Package Store in a small college town. Bud sells six packs of beer for off-premises consumption. Bud has very limited store space and has decided to limit his product line to one brand of beer, choosing to forego the snack food lines that normally accompany his business. Bud's is the only beer retailer physically located within the town limits. He faces considerable competition, however, from sellers located outside of town. Bud regards the market as highly competitive and considers the current $2.50 per six pack selling price to be beyond his control. Bud's total and marginal cost functions are:

TC = 2000 + 0.0005Q2

MC = 0.001Q,

where Q refers to six packs per week. Included in the fixed cost figure is a $750 per week salary for Bud, which he considers to be his opportunity cost.

a. Calculate the profit maximizing output for Bud. What is his profit? Is this an economic profit or an accounting profit?

b. The town council has voted to impose a tax of $.50 per six pack sold in the town, hoping to discourage beer consumption. What impact will the tax have on Bud? Should Bud continue to operate? What impact will the tax have on Bud's out-of-town competitors?

(Essay)

4.8/5  (39)

(39)

A few sellers may behave as if they operate in a perfectly competitive market if the market demand is:

(Multiple Choice)

4.8/5  (39)

(39)

Showing 41 - 60 of 149

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)