Exam 12: Monopolistic Competition and Oligopoly

Exam 1: Preliminaries78 Questions

Exam 2: The Basics of Supply and Demand139 Questions

Exam 3: Consumer Behavior134 Questions

Exam 4: Individual and Market Demand131 Questions

Exam 5: Uncertainty and Consumer Behavior150 Questions

Exam 6: Production125 Questions

Exam 7: The Cost of Production178 Questions

Exam 8: Profit Maximization and Competitive Supply164 Questions

Exam 9: The Analysis of Competitive Markets183 Questions

Exam 10: Market Power: Monopoly and Monopsony158 Questions

Exam 11: Pricing With Market Power130 Questions

Exam 12: Monopolistic Competition and Oligopoly120 Questions

Exam 13: Game Theory and Competitive Strategy150 Questions

Exam 14: Markets for Factor Inputs134 Questions

Exam 15: Investment, Time, and Capital Markets153 Questions

Exam 16: General Equilibrium and Economic Efficiency126 Questions

Exam 17: Markets With Asymmetric Information133 Questions

Exam 18: Externalities and Public Goods131 Questions

Exam 19: Behavioral Economics101 Questions

Select questions type

In the Stackelberg model, suppose the first-mover has MR = 15 - Q1, the second firm has reaction function Q2 = 15 - Q1/2, and production occurs at zero marginal cost. Why doesn't the first-mover announce that its production is Q1 = 30 in order to exclude the second firm from the market (i.e., Q2 = 0 in this case)?

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

B

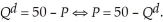

The market structure of Red Raider Gear is best characterized by monopolistic competition. Red Raider Gear is one of the producers in this market. The demand for Red Raider Gear is:  The resulting marginal revenue curve is

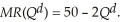

The resulting marginal revenue curve is  The Red Raider Gear cost function is

The Red Raider Gear cost function is  Therefore we have MC (Q) = 0.25Q. Determine the profit maximizing level of output and the price charged to customers for Red Raider Gear. Is this a long-run equilibrium?

Therefore we have MC (Q) = 0.25Q. Determine the profit maximizing level of output and the price charged to customers for Red Raider Gear. Is this a long-run equilibrium?

Free

(Essay)

4.9/5  (30)

(30)

Correct Answer:

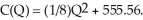

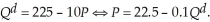

To determine Red Raider's optimal output, we set Red Raider's marginal revenue equal to marginal cost. Then we have  and therefore

and therefore  The market price for Red Raider Gear at this level of output is $27.78. This is a long-run equilibrium because Red Raider Gear is earning zero profit. Thus, no firms have an incentive to exit or enter the industry.

The market price for Red Raider Gear at this level of output is $27.78. This is a long-run equilibrium because Red Raider Gear is earning zero profit. Thus, no firms have an incentive to exit or enter the industry.

A situation in which each firm selects its best action, given what its rivals are doing, is called a:

Free

(Multiple Choice)

4.7/5  (31)

(31)

Correct Answer:

A

The market structure of the local pizza industry is best characterized by monopolistic competition. One Guy's Pizza is one of the producers in the local market. The demand for One Guy's Pizza is:  The resulting marginal revenue curve is

The resulting marginal revenue curve is  One Guy's cost function is:

One Guy's cost function is:  Determine One Guy's profit maximizing level of output and the price charged to customers. Is this a long-run equilibrium?

Determine One Guy's profit maximizing level of output and the price charged to customers. Is this a long-run equilibrium?

(Essay)

4.8/5  (36)

(36)

Under the kinked demand curve model, a small increase in marginal cost will lead to:

(Multiple Choice)

4.8/5  (40)

(40)

Scenario 12.2:

Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows:

P = 30 - Q

The marginal cost to produce this new drink is $3.

-Refer to Scenario 12.2. What will be the price of this new drink in the long run if the firms in the industry collude with one another to maximize joint profit?

(Multiple Choice)

4.9/5  (31)

(31)

Refer to Scenario 12.3. What is the profit maximizing price?

(Multiple Choice)

4.8/5  (40)

(40)

Suppose the supply of non-OPEC oil increases due to new petroleum discoveries in other countries. What happens to OPEC's share of the world oil market?

(Multiple Choice)

4.9/5  (37)

(37)

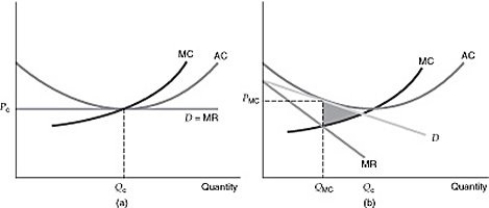

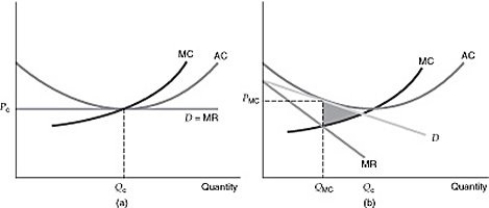

Figure 12.1.2

-Refer to Figure 12.1.2 above. Which of the following best describes the reason for the shaded triangle in panel (b)?

Figure 12.1.2

-Refer to Figure 12.1.2 above. Which of the following best describes the reason for the shaded triangle in panel (b)?

(Multiple Choice)

4.8/5  (36)

(36)

What characteristic of monopolistic competition may help to offset the inefficiency of this market structure?

(Multiple Choice)

4.9/5  (37)

(37)

This market situation is much like a pure monopoly except that its member firms tend to cheat on agreed upon price and output strategies. What is it?

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following is NOT conducive to the successful operation of a cartel?

(Multiple Choice)

4.9/5  (34)

(34)

Two large diversified consumer products firms are about to enter the market for a new pain reliever. The two firms are very similar in terms of their costs, strategic approach, and market outlook. Moreover, the firms have very similar individual demand curves so that each firm expects to sell one-half of the total market output at any given price. The market demand curve for the pain reliever is given as:

Q = 2600 - 400P.

Both firms have constant long-run average costs of $2.00 per bottle. Patent protection insures that the two firms will operate as a duopoly for the foreseeable future. Price and quantity values are stated in per-bottle terms. If the firms act as Cournot duopolists, solve for the firm and market outputs and equilibrium prices.

(Essay)

4.8/5  (31)

(31)

Figure 12.1.2

-Which of the following is true in long-run equilibrium for a firm in monopolistic competition?

Figure 12.1.2

-Which of the following is true in long-run equilibrium for a firm in monopolistic competition?

(Multiple Choice)

5.0/5  (40)

(40)

The market for an industrial chemical has a single dominant firm and a competitive fringe comprised of many firms that behave as price takers. The dominant firm has recently begun behaving as a price leader, setting price while the competitive fringe follows. The market demand curve and competitive fringe supply curve are given below. Marginal cost for the dominant firm is $0.75 per gallon.

QM = 140,000 - 32,000P

QF = 60,000 + 8,000P,

where QM = market quantity demanded, and  . Quantities are measured in gallons per week, and price is measured as a price per gallon.

a. Determine the price and output that would prevail in the market under the conditions described above. Identify output for the dominant firm as well as the competitive fringe.

b. Assume that the market demand curve shifts rightward by 40,000 units. Show that the dominant firm is indeed a price leader. What output (leader and follower) and market price will prevail after the change in demand?

. Quantities are measured in gallons per week, and price is measured as a price per gallon.

a. Determine the price and output that would prevail in the market under the conditions described above. Identify output for the dominant firm as well as the competitive fringe.

b. Assume that the market demand curve shifts rightward by 40,000 units. Show that the dominant firm is indeed a price leader. What output (leader and follower) and market price will prevail after the change in demand?

(Essay)

4.8/5  (36)

(36)

Use the following statements to answer this question: I. Under the dominant firm model, the dominant firm effectively acts like a monopolist who is facing the excess market demand that cannot be supplied by the fringe firms.

II) Under the dominant firm model, the fringe firms also act like profit maximizing monopolists.

(Multiple Choice)

4.8/5  (27)

(27)

The key disadvantage of the kinked-demand model is that it:

(Multiple Choice)

4.9/5  (32)

(32)

What happens to the market outcome if cartel members cheat on the collusive agreement?

(Multiple Choice)

4.7/5  (33)

(33)

Showing 1 - 20 of 120

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)