Exam 32: Further Consolidation Issues Iv: Accounting for Changes in the Deg

Exam 1: An Overview of the Australian External Reporting Environment50 Questions

Exam 2: The Conceptual Framework of Accounting and Its Relevance to Financ62 Questions

Exam 3: Theories of Financial Accounting61 Questions

Exam 4: An Overview of Accounting for Assets62 Questions

Exam 5: Depreciation of Property, Plant and Equipment62 Questions

Exam 6: Revaluation and Impairment Testing of Non-Current Assets59 Questions

Exam 7: Inventory60 Questions

Exam 8: Accounting for Intangibles63 Questions

Exam 9: Accounting for Heritage Assets and Biological Assets61 Questions

Exam 10: An Overview of Accounting for Liabilities58 Questions

Exam 11: Accounting for Lease66 Questions

Exam 12: Set-Off and Extinguishment of Debt47 Questions

Exam 13: Accounting for Employee Benefits67 Questions

Exam 15: Accounting for Financial Instruments72 Questions

Exam 16: Revenue Recognition Issues64 Questions

Exam 17: The Statement of Comprehensive Income and Statement of Changes in E62 Questions

Exam 19: Accounting for Income Taxes65 Questions

Exam 20: Cash-Flow Statements60 Questions

Exam 21: Accounting for the Extractive Industries60 Questions

Exam 22: Accounting for General Insurance Contracts58 Questions

Exam 23: Accounting for Superannuation Plans62 Questions

Exam 24: Events Occurring After Balance Sheet Date62 Questions

Exam 25: Segment Reporting61 Questions

Exam 26: Related-Party Disclosures60 Questions

Exam 28: Accounting for Group Structures69 Questions

Exam 29: Further Consolidation Issues I: Accounting for Intragroup Transact46 Questions

Exam 30: Further Consolidation Issues Ii: Accounting for Minority Interests34 Questions

Exam 31: Further Consolidation Issues Iii: Accounting for Indirect Ownershi38 Questions

Exam 32: Further Consolidation Issues Iv: Accounting for Changes in the Deg39 Questions

Exam 33: Accounting for Equity Investments67 Questions

Exam 33: Accounting for Equity Investments59 Questions

Exam 35: Accounting for Foreign Currency Transactions59 Questions

Exam 36: Translation of the Accounts of Foreign Operations42 Questions

Exam 37: Accounting for Corporate Social Responsibility59 Questions

Select questions type

In calculating the profit or loss on the sale of shares in a controlled entity that is to be included in the group accounts, consideration should be given to the share of post-acquisition profits and movements in reserves that have been recognised.

(True/False)

4.8/5  (37)

(37)

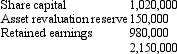

Dolly Ltd acquired a 60 per cent interest in Vardon Ltd on 1 July 2002 for a cash consideration of $1,300,000. At that date fair value of the net assets of Vardon Ltd were represented by:

On 1 July 2004 Dolly Ltd purchased the final 40 per cent of the issued capital of Vardon Ltd for cash consideration of $950,000. At this date the fair value of the net assets of Vardon Ltd were represented by:

On 1 July 2004 Dolly Ltd purchased the final 40 per cent of the issued capital of Vardon Ltd for cash consideration of $950,000. At this date the fair value of the net assets of Vardon Ltd were represented by:

Impairment of goodwill was assessed at $3,000; of which $2,000 related to the year ended 30 June 2005. There were no intragroup transactions. What are the consolidation entries to eliminate the investment in the subsidiary and amortise goodwill for the period ended 30 June 2006?

Impairment of goodwill was assessed at $3,000; of which $2,000 related to the year ended 30 June 2005. There were no intragroup transactions. What are the consolidation entries to eliminate the investment in the subsidiary and amortise goodwill for the period ended 30 June 2006?

(Multiple Choice)

5.0/5  (34)

(34)

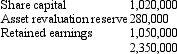

The following consolidation adjusting journal entries appeared at the end of a period in which the parent sold all of its shareholding in a subsidiary. It received $1,200,000 for the shares.

The amount of the share of post-acquisition profits and movements in equity balances, contributed to the group by the subsidiary, and attributable to the parent, is:

The amount of the share of post-acquisition profits and movements in equity balances, contributed to the group by the subsidiary, and attributable to the parent, is:

(Multiple Choice)

4.7/5  (40)

(40)

AASB 127 "Consolidated and Separate Financial Statements" prescribes that changes in the parent's ownership interest in a subsidiary that do not result in a loss of control are accounted for as equity transactions.

(True/False)

4.8/5  (37)

(37)

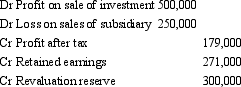

Spock Ltd acquired a 10 per cent holding in Kirk Ltd on 1 July 2011 for $350,000 cash, being the fair value of consideration transferred.

On 30 June 2012, Spock Ltd acquired a further 75 per cent of the contributed capital of Kirk Ltd for $3,300,000, which represents the fair value of consideration transferred. After the latest acquisition, Spock Ltd gained control of Kirk Ltd. The fair value of the net assets acquired and the liabilities assumed of Kirk Ltd at the acquisition date of 30 June 2012 was $3,500,000 and all assets were recorded at far value in the financial statements of Kirk Ltd.

At that date fair value of the net assets of Kirk Ltd were represented by:

Goodwill is also attributed to the non-controlling interest.

What is the consolidation entry to eliminate the investment in Kirk Ltd on consolidation for the financial year ended 30 June 2012?

Goodwill is also attributed to the non-controlling interest.

What is the consolidation entry to eliminate the investment in Kirk Ltd on consolidation for the financial year ended 30 June 2012?

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following is not a reason for a parent to lose control of a subsidiary?

(Multiple Choice)

4.9/5  (29)

(29)

The profit or loss on the sale of shares in a controlled entity will be the same in the parent entity's legal books as it is in the consolidated accounts:

(True/False)

4.9/5  (41)

(41)

Under the step-by-step method, the need to revalue the subsidiary's assets, liabilities and contingent liabilities to fair value at each acquisition date, is not an indication that the acquirer has elected to apply the revaluation method for measuring assets, such as that prescribed by AASB 116:

(True/False)

4.9/5  (40)

(40)

The profit or loss on the sale of shares in a subsidiary will be reported in both the books of the parent legal entity and the consolidated accounts. The method of calculating the profit or loss in the parent's individual legal entity books is to:

(Multiple Choice)

4.9/5  (43)

(43)

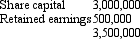

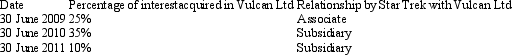

Star Trek Ltd acquires shares in Vulcan Ltd at various stages summarised as follows:

Which of the following statements is not? in accordance with AASB 127 "Consolidated Financial Statements"?

Which of the following statements is not? in accordance with AASB 127 "Consolidated Financial Statements"?

(Multiple Choice)

4.8/5  (40)

(40)

Additional purchases of shares in a subsidiary should be accounted for by the combined tranche method, according to AASB 3:

(True/False)

4.8/5  (39)

(39)

When additional shares in a subsidiary are acquired, AASB 3 requires each acquisition to be accounted for separately:

(True/False)

4.8/5  (34)

(34)

The consolidated balance sheet at year-end, in a period when the parent sold its interests in a subsidiary:

(Multiple Choice)

4.7/5  (34)

(34)

Where a parent entity with a controlling interest in a subsidiary obtains additional equity, the carrying amounts of the controlling and non-controlling interests should be adjusted to reflect the changes in their relative interests in the subsidiary. Any difference between the fair value paid and the carrying amount of the additional interest acquired is recognised directly in profit or loss of the parent entity.

(True/False)

4.8/5  (40)

(40)

The profit or loss on the sale of shares in a subsidiary will be reported in the books of both the parent legal entity and the consolidated accounts. The method of calculating the profit or loss in the consolidated accounts is to:

(Multiple Choice)

4.8/5  (42)

(42)

AASB 3 specifies that where a parent entity purchases additional shares in a subsidiary over time:

(Multiple Choice)

4.9/5  (34)

(34)

Once control over a subsidiary has been lost, the parent entity must derecognise the individual assets, liabilities and equity including any non-controlling interest relating to that subsidiary.

(True/False)

4.8/5  (31)

(31)

In a business combination achieved in stages, the acquirer shall re-measure its previously held equity interest in the acquiree at its acquisition-date fair value and recognise the resulting gain or loss, if any, in equity.

(True/False)

4.8/5  (34)

(34)

Two common approaches to accounting for acquisition of additional shares in a subsidiary include:

(Multiple Choice)

4.8/5  (42)

(42)

Showing 21 - 39 of 39

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)