Exam 1: Business Combinations: New Rules for a Long-Standing Business Practice

Exam 1: Business Combinations: New Rules for a Long-Standing Business Practice32 Questions

Exam 2: Consolidated Statements: Date of Acquisition29 Questions

Exam 3: Consolidated Statements: Subsequent to Acquisition30 Questions

Exam 4: Intercompany Transactions: Merchandise, Plant Assets, and Notes29 Questions

Exam 5: Intercompany Transactions: Bonds and Leases54 Questions

Exam 6: Cash Flow, Eps, and Taxation44 Questions

Exam 7: Special Issues in Accounting for an Investment in a Subsidiary35 Questions

Exam 8: Subsidiary Equity Transactions; Indirect and Mutual Holdings36 Questions

Exam 9: The International Accounting Environment28 Questions

Exam 10: Foreign Currency Transactions61 Questions

Exam 11: Translation of Foreign Financial Statements62 Questions

Exam 12: Interim Reporting and Disclosures About Segments of an Enterprise50 Questions

Exam 13: Partnerships: Characteristics, Formation, and Accounting for Activities32 Questions

Exam 14: Partnerships: Ownership Changes and Liquidations48 Questions

Exam 15: Governmental Accounting: the General Fund and the Account Groups53 Questions

Exam 16: Governmental Accounting: Other Governmental Funds, Proprietary Funds, and Fiduciary Funds43 Questions

Exam 17: Financial Reporting Issues29 Questions

Exam 18: Accounting for Private Not-For-Profit Organizations45 Questions

Exam 19: Accounting for Not-For-Profit Colleges and Universities and Health Care Organizations64 Questions

Exam 20: Estates and Trusts: Their Nature and the Accountants Role46 Questions

Exam 21: Debt Restructuring, Corporate Reorganizations, and Liquidations44 Questions

Select questions type

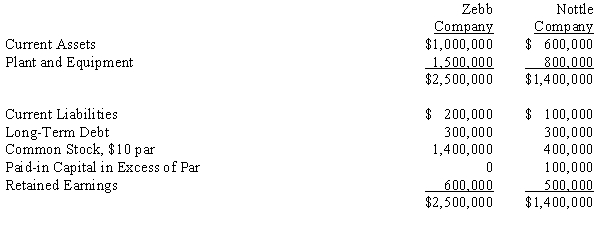

On January 1, 20X5, Zebb and Nottle Companies had condensed balance sheets as shown below:

Required:

Record the acquisition of Nottle's net assets, the issuance of the stock and/or payment of cash, and payment of the related costs. Assume that Zebb issued 30,000 shares of new common stock with a fair value of $25 per share and paid $500,000 cash for all of the net assets of Nottle. Acquisition costs of $50,000 and stock issuance costs of $20,000 were paid in cash. Current assets had a fair value of $650,000, plant and equipment had a fair value of $900,000, and long-term debt had a fair value of $330,000.

Required:

Record the acquisition of Nottle's net assets, the issuance of the stock and/or payment of cash, and payment of the related costs. Assume that Zebb issued 30,000 shares of new common stock with a fair value of $25 per share and paid $500,000 cash for all of the net assets of Nottle. Acquisition costs of $50,000 and stock issuance costs of $20,000 were paid in cash. Current assets had a fair value of $650,000, plant and equipment had a fair value of $900,000, and long-term debt had a fair value of $330,000.

(Essay)

4.8/5  (40)

(40)

ACME Co. paid $110,000 for the net assets of Comb Corp. At the time of the acquisition the following information was available related to Comb's balance sheet:

-Refer to ACME Co. and Comb Corp. What is the amount recorded by ACME for the Building?

-Refer to ACME Co. and Comb Corp. What is the amount recorded by ACME for the Building?

(Multiple Choice)

4.8/5  (39)

(39)

Goodwill is an intangible asset. There are a variety of recommendations about how intangible assets should be included in the financial statements. Discuss the recommendations for proper disclosure of goodwill. Include a comparison with disclosure of other intangible assets.

(Essay)

4.7/5  (41)

(41)

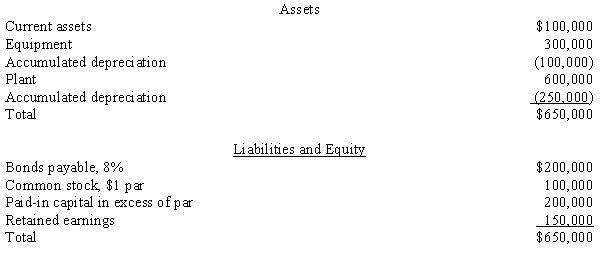

The Chan Corporation purchased the net assets (existing liabilities were assumed) of the Don Company for $900,000 cash. The balance sheet for the Don Company on the date of acquisition showed the following:

Required:

The equipment has a fair value of $300,000, and the plant assets have a fair value of $500,000. Assume that the Chan Corporation has an effective tax rate of 40%. Prepare the entry to record the purchase of the Don Company for each of the following separate cases with specific added information:

a.

The sale is a nontaxable exchange to the seller that limits the buyer to depreciation and amortization on only book value for tax purposes.

b.

The bonds have a current fair value of $190,000. The transaction is a taxable exchange.

c.

There are $100,000 of prior-year losses that can be used to claim a tax refund. The transaction is a taxable exchange.

d.

There are $150,000 of past losses that can be carried forward to future years to offset taxes that will be due. The transaction is a nontaxable exchange.

Required:

The equipment has a fair value of $300,000, and the plant assets have a fair value of $500,000. Assume that the Chan Corporation has an effective tax rate of 40%. Prepare the entry to record the purchase of the Don Company for each of the following separate cases with specific added information:

a.

The sale is a nontaxable exchange to the seller that limits the buyer to depreciation and amortization on only book value for tax purposes.

b.

The bonds have a current fair value of $190,000. The transaction is a taxable exchange.

c.

There are $100,000 of prior-year losses that can be used to claim a tax refund. The transaction is a taxable exchange.

d.

There are $150,000 of past losses that can be carried forward to future years to offset taxes that will be due. The transaction is a nontaxable exchange.

(Essay)

4.8/5  (37)

(37)

On January 1, 20X5, Brown Inc. acquired Larson Company's net assets in exchange for Brown's common stock with a par value of $100,000 and a fair value of $800,000. Brown also paid $10,000 in direct acquisition costs and $15,000 in stock issuance costs.

On this date, Larson's condensed account balances showed the following:

Book Value Fair Value Current Assets \ 280,000 \ 370,000 Plant and Equipment 440,000 480,000 Accumulated Depreciation (100,000) Intangibles - Patents 80,000 120,000 Current Liabilities (140,000) (140,000) Long-Term Debt (100,000) (110,000) Common Stock (200,000) Other Paid-in Capital (120,000) Retained Earnings (140,000) Required:

Record Brown's purchase of Larson Company's net assets.

(Essay)

4.8/5  (39)

(39)

A tax advantage of business combination can occur when the existing owner of a company sells out and receives:

(Multiple Choice)

4.8/5  (37)

(37)

Diamond acquired Heart's net assets. At the time of the acquisition Heart's Balance sheet was as follows:

Accounts Receivable \ 130,000 Inventory 70,000 Equipment, Net 50,000 Building, Net 250,000 Land \& Building, Net 100,000 Total Assets \ 600,000 Bonds Payable \ 100,000 Common Stock 50,000 Retained Earnings 450,000 Total Liabilities and Stockholders' Equity \ 600,000 Fair values on the date of acquisition:

Inventory \ 100,000 Equipment 30,000 Building 350,000 Land 120,000 Brand name copyright 50,000 Bonds payable 120,000 Acqui sition costs: \ 5,000 Required:

Record the entry for the purchase of the net assets of Heart by Diamond at the following cash prices:

a.

$700,000

b.

$300,000

(Essay)

4.8/5  (33)

(33)

When an acquisition of another company occurs, FASB recommends disclosing all of the following EXCEPT:

(Multiple Choice)

4.8/5  (33)

(33)

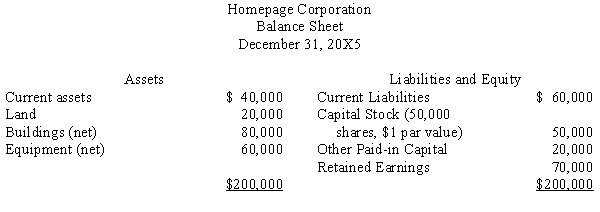

Internet Corporation is considering the acquisition of Homepage Corporation and has obtained the following audited condensed balance sheet:

Internet also acquired the following fair values for Homepage's assets and liabilities:

Current assets \ 55,000 Land 60,000 Buildings (net) 90,000 Equipment (net) 75,000 Current Liabilities (60,000) \ 220,000 Internet and Homepage agree on a price of $280,000 for Homepage's net assets. Prepare the necessary journal entry to record the purchase given the following scenarios:

a.

Internet pays cash for Homepage Corporation and incurs $5,000 of acquisition costs.

b.

Internet issues its $5 par value stock as consideration. The fair value of the stock at the acquisition date is $50 per share. Additionally, Internet incurs $5,000 of security issuance costs.

Internet also acquired the following fair values for Homepage's assets and liabilities:

Current assets \ 55,000 Land 60,000 Buildings (net) 90,000 Equipment (net) 75,000 Current Liabilities (60,000) \ 220,000 Internet and Homepage agree on a price of $280,000 for Homepage's net assets. Prepare the necessary journal entry to record the purchase given the following scenarios:

a.

Internet pays cash for Homepage Corporation and incurs $5,000 of acquisition costs.

b.

Internet issues its $5 par value stock as consideration. The fair value of the stock at the acquisition date is $50 per share. Additionally, Internet incurs $5,000 of security issuance costs.

(Essay)

4.8/5  (31)

(31)

While acquisitions are often friendly, there are numerous occasions when a party does not want to be acquired. Discuss possible defensive strategies that firms can implement to fend off a hostile takeover attempt.

(Essay)

4.9/5  (42)

(42)

On January 1, July 1, and December 31, 20X5, a condensed trial balance for Nelson Company showed the following debits and (credits):

01/01/5 06/30/X5 12/31/X5 Current Assets \ 200,000 \ 260,000 \ 340,000 Plant and Equipment (net) 500,000 510,000 510,000 Current Liabilities (50,000) (70,000) (60,000) Long-Term Debt (100,000) (100,000) (100,000) Common Stock (150,000) (150,000) (150,000) Other Paid-in Capital (100,000) (100,000) (100,000) Retained Earnings, January 1 (300,000) (300,000) (300,000) Dividends Declared 10,000 Revenues (400,000) (900,000) Expenses 350,000 750,000 Assume that, on July 1, 20X5, Systems Corporation purchased the net assets of Nelson Company for $750,000 in cash. On this date, the fair values for certain net assets were:

Current Assets \ 280,000 Plant and Equipment (remaining life of 10 years) 600,000 Nelson Company's books were NOT closed on June 30, 20X5.

For all of 20X5, Systems' revenues and expenses were $1,500,000 and $1,200,000, respectively.

Required:

(1)

Record the entry on Systems' books for the July 1, 20X5 purchase of Nelson.

(Essay)

4.8/5  (33)

(33)

While performing a goodwill impairment test, the company had the following information: Estimated implied fair value of reporting unit (without goodwill) \ 420,000 Existing net book value of reporting unit (without goodwill) \ 380,000 Book value of goodwill \6 0,000 Based upon this information the proper conclusion is:

(Multiple Choice)

4.9/5  (35)

(35)

Showing 21 - 32 of 32

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)