Exam 1: Managerial Accounting and Cost Concepts

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Costvolumeprofit Relationships260 Questions

Exam 3: Joborder Costing: Calculating Unit Product Costs292 Questions

Exam 4: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 5: Activitybased Costing: a Tool to Aid Decision Making213 Questions

Exam 6: Differential Analysis: the Key to Decision Making203 Questions

Exam 7: Capital Budgeting Decisions179 Questions

Exam 8: Master Budgeting236 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Cost of Quality66 Questions

Exam 13: Analyzing Mixed Costs82 Questions

Exam 14: Activity-Based Absorption Costing20 Questions

Exam 15: the Predetermined Overhead Rate and Capacity42 Questions

Exam 16: Super-Variable Costing49 Questions

Exam 17: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 18: Pricing Decisions149 Questions

Exam 19: the Concept of Present Value16 Questions

Exam 20: Income Taxes and the Net Present Value Method150 Questions

Exam 21: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 22: Transfer Pricing102 Questions

Exam 22: Service Department Charges44 Questions

Select questions type

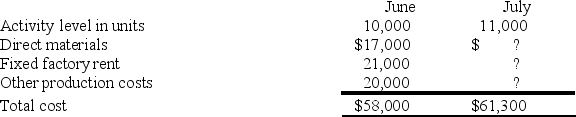

The following data pertains to activity and costs for two months:  Assuming that these activity levels are within the relevant range, the other production costs for July were: (Round intermediate calculations to 2 decimal places.)

Assuming that these activity levels are within the relevant range, the other production costs for July were: (Round intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.8/5  (44)

(44)

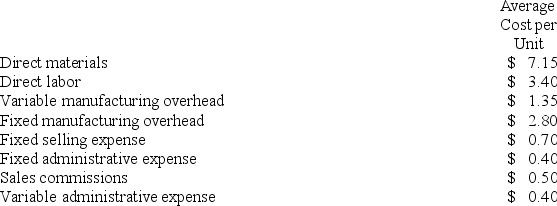

Schonhardt Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows:  If 5,000 units are produced, the total amount of fixed manufacturing cost incurred is closest to:

If 5,000 units are produced, the total amount of fixed manufacturing cost incurred is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

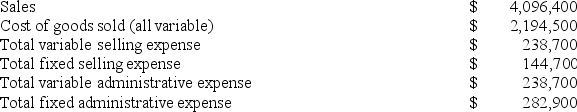

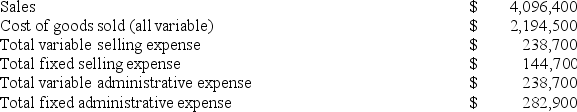

Bolka Corporation, a merchandising company, reported the following results for October:  The gross margin for October is:

The gross margin for October is:

(Multiple Choice)

4.8/5  (41)

(41)

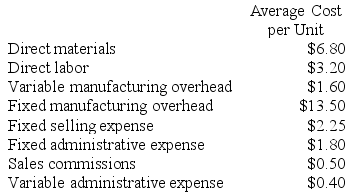

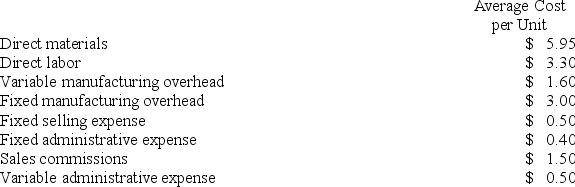

Balerio Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows:

Required:

a. For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units?

b. If 10,000 units are sold, what is the variable cost per unit sold?

c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold?

d. If the selling price is $18.20 per unit, what is the contribution margin per unit sold?

e. What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units?

Required:

a. For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units?

b. If 10,000 units are sold, what is the variable cost per unit sold?

c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold?

d. If the selling price is $18.20 per unit, what is the contribution margin per unit sold?

e. What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units?

(Essay)

4.8/5  (40)

(40)

Bolka Corporation, a merchandising company, reported the following results for October:  The contribution margin for October is:

The contribution margin for October is:

(Multiple Choice)

4.8/5  (39)

(39)

Batterson Corporation leases its corporate headquarters building. This lease cost is fixed with respect to the company's sales volume. In a recent month in which the sales volume was 28,000 units, the lease cost was $697,200. To the nearest whole cent, what should be the average lease cost per unit at a sales volume of 26,400 units in a month? (Assume that this sales volume is within the relevant range.)

(Multiple Choice)

4.8/5  (38)

(38)

In the standard cost formula Y = a + bX, what does the "X" represent?

(Multiple Choice)

4.8/5  (35)

(35)

Varela Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows:  For financial reporting purposes, the total amount of product costs incurred to make 4,000 units is closest to:

For financial reporting purposes, the total amount of product costs incurred to make 4,000 units is closest to:

(Multiple Choice)

4.8/5  (40)

(40)

Which costs will change with a decrease in activity within the relevant range?

(Multiple Choice)

4.7/5  (43)

(43)

At a sales volume of 20,000 units, Choice Corporation's sales commissions (a cost that is variable with respect to sales volume) total $132,000. To the nearest whole cent, what should be the average sales commission per unit at a sales volume of 18,500 units? (Assume that this sales volume is within the relevant range.)

(Multiple Choice)

5.0/5  (39)

(39)

Dizzy Amusement Park is open from 8:00 am till midnight every day of the year. Dizzy charges its patrons a daily entrance fee of $30 per person which gives them unlimited access to all of the park's 35 rides. For liability insurance, Dizzy pays a set monthly fee plus a small additional amount for every patron entering the park. The cost of liability insurance would best be described as a:

(Multiple Choice)

4.9/5  (40)

(40)

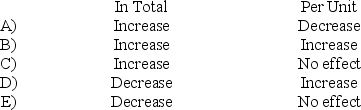

As the level of activity increases, how will a mixed cost in total and per unit behave?

(Multiple Choice)

4.8/5  (45)

(45)

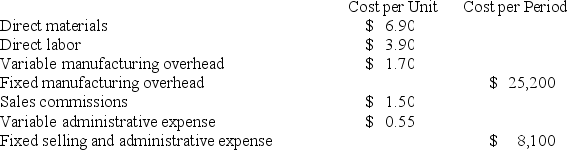

Sparacino Corporation has provided the following information:  If 5,000 units are produced, the total amount of manufacturing overhead cost is closest to:

If 5,000 units are produced, the total amount of manufacturing overhead cost is closest to:

(Multiple Choice)

4.9/5  (39)

(39)

Conversion cost is the sum of direct labor cost and manufacturing overhead cost.

(True/False)

4.8/5  (37)

(37)

Boersma Sales, Inc., a merchandising company, reported sales of 7,100 units in September at a selling price of $682 per unit. Cost of goods sold, which is a variable cost, was $317 per unit. Variable selling expenses were $44 per unit and variable administrative expenses were $22 per unit. The total fixed selling expenses were $157,200 and the total administrative expenses were $338,000. The gross margin for September was:

(Multiple Choice)

4.8/5  (37)

(37)

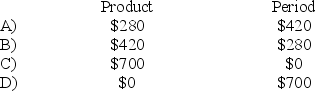

A manufacturing company prepays its insurance coverage for a three-year period. The premium for the three years is $2,100 and is paid at the beginning of the first year. Sixty percent of the premium applies to manufacturing operations and forty percent applies to selling and administrative activities. What amounts should be considered product and period costs respectively for the first year of coverage?

(Multiple Choice)

4.7/5  (36)

(36)

Showing 221 - 240 of 299

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)