Exam 2: Accounting for Transactions

Exam 1: Introducing Financial Accounting259 Questions

Exam 2: Accounting for Transactions219 Questions

Exam 3: Preparing Financial Statements235 Questions

Exam 4: Accounting for Merchandising Operations200 Questions

Exam 5: Accounting for Inventories191 Questions

Exam 6: Accounting for Cash and Internal Controls203 Questions

Exam 7: Accounting for Receivables170 Questions

Exam 8: Accounting for Long-Term Assets202 Questions

Exam 9: Accounting for Current Liabilities195 Questions

Exam 10: Accounting for Long-Term Liabilities189 Questions

Exam 11: Accounting for Equity198 Questions

Exam 12: Accounting for Cash Flows175 Questions

Exam 13: Interpreting Financial Statements187 Questions

Exam 14: Time Value of Money57 Questions

Exam 15: Investments and International Operations178 Questions

Exam 16: Accounting for Partnerships122 Questions

Exam 17: Accounting With Special Journals164 Questions

Select questions type

Hamilton Industries has total liabilities of $105 million and total assets of $350 million. Its debt ratio is 333.3%.

(True/False)

4.9/5  (51)

(51)

Which of the following statements is false with regard to the debt ratio?

(Multiple Choice)

4.9/5  (38)

(38)

Wisconsin Rentals purchased office supplies on credit. The journal entry made by Wisconsin Rentals to record this transaction will include a:

(Multiple Choice)

4.7/5  (38)

(38)

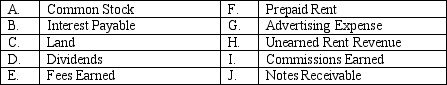

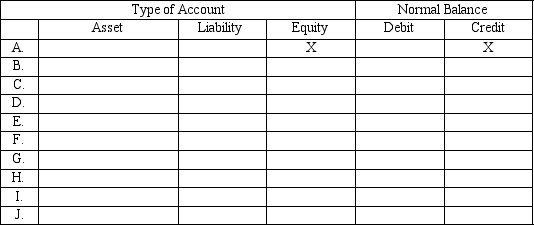

The following is a list of accounts and identification letters A through J for Shannon Management Co.:

Use the form below to identify the type of account and its normal balance. The first item is filled in as an example.

Use the form below to identify the type of account and its normal balance. The first item is filled in as an example.

(Essay)

4.8/5  (33)

(33)

Stride Rite has total assets of $425 million. Its total liabilities are $110 million. Its equity is $315 million. Calculate the debt ratio.

(Multiple Choice)

4.9/5  (34)

(34)

Robert Haddon contributed $70,000 in cash and some land worth $130,000 to open a new business, RH Consulting. Which of the following general journal entries will RH Consulting make to record this transaction?

(Multiple Choice)

4.9/5  (40)

(40)

If the Debit and Credit column totals of a trial balance are equal, then:

(Multiple Choice)

4.8/5  (39)

(39)

IFRS requires that companies report four financial statements with explanatory notes: balance sheet; income statement; statement of changes in equity, and statement of cash flows.

(True/False)

4.9/5  (35)

(35)

A trial balance that is in balance is proof that no errors were made in journalizing the transactions, posting to the ledger, and preparing the trial balance.

(True/False)

4.8/5  (33)

(33)

Match the following definitions and terms by placing the number that identifies the best definition in the blank space next to the term.

Correct Answer:

Premises:

Responses:

(Matching)

4.7/5  (37)

(37)

After preparing an (unadjusted) trial balance at year-end,

G. Chu of Chu Design Company discovered the following errors:

1. Cash payment of the $225 telephone bill for December was recorded twice.

2. Cash payment of a note payable was recorded as a debit to Cash and a debit to Notes

Payable for $1,000.

3. A $900 cash dividend was recorded to the correct accounts as $90.

4. An additional investment of $5,000 cash by the owner was recorded as a debit to Common

Stock and a credit to Cash.

5. A credit purchase of office equipment for $1,800 was recorded as a debit to the Office

Equipment account with no offsetting credit entry.

Using the form below, indicate whether the error would cause the trial balance to be out of balance by placing an X in either the yes or no column.

Error Yes No 1. 2. 3. 4. 5.

(Essay)

4.9/5  (29)

(29)

The third step in the analyzing and recording process is to post the information to _________________________.

(Short Answer)

4.7/5  (31)

(31)

Which of the following items would appear on the balance sheet? Common stock……$120,000 Accounts payable…...$25,000

Cash……………….$116,640 Accounts receivable..$22,450

Supplies………… $ 1,500 Office equipment…...$23,300

Prepaid rent……....$ 3,200 Unearned revenue….$ 4,152

Service revenue..... $ 20,000 Utilities expense…....$ 422

Retained earnings...$ 30,000 Shaving equipment…$31,640

(Multiple Choice)

4.9/5  (38)

(38)

A simple account form widely used in accounting to illustrate how debits and credits work is called a:

(Multiple Choice)

4.9/5  (32)

(32)

Josephine's Bakery had the following assets and liabilities at the beginning and end of the current year:

Assets Liabilities Beginning of the year \ 114,000 \ 68,000 End of the year 135,000 73,000 If the owners made no investments and dividends of $5,000 were paid during the year, what was the amount of net income earned by Josephine's Bakery during the current year?

(Essay)

4.9/5  (38)

(38)

Of the following errors, which one will cause the trial balance to be out of balance?

(Multiple Choice)

4.8/5  (47)

(47)

A $130 credit to Office Equipment was credited to Fees Earned by mistake. By what amounts are the accounts under- or overstated as a result of this error?

(Multiple Choice)

4.9/5  (25)

(25)

Double-entry accounting requires that the impact of each transaction be recorded in at least two accounts.

(True/False)

4.9/5  (33)

(33)

Given the trial balance amounts below, compute net income. Common stock……. $120,000 Accounts payable…...$25,000

Cash……………….. $116,640 Accounts receivable.. $22,450

Supplies………........ $ 1,500 Office equipment…... $23,300

Prepaid rent………. $ 3,200 Unearned revenue…. $ 4,152

Service revenue…... $ 20,000 Utilities expense….... $ 422

Beginning Shaving equipment… $31,640

Retained earnings. $ 30,000

(Multiple Choice)

4.9/5  (44)

(44)

Showing 41 - 60 of 219

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)