Exam 18: Cost-Volume-Profit

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

Vintage Wines has fixed costs of $20,000 per year. Its warehouse sells wine with variable costs of 80% of its unit selling price. How much in sales does Vintage need to break even per year?

(Multiple Choice)

4.9/5  (42)

(42)

The graph of variable costs that behave in a curvilinear fashion will

(Multiple Choice)

4.7/5  (36)

(36)

Variable costs for Abbey, Inc. are 25% of sales. Its selling price is $100 per unit. If Abbey sells one unit more than break-even units, how much will profit increase?

(Multiple Choice)

4.9/5  (36)

(36)

Dunbar Manufacturing's variable costs are 30% of sales. The company is contemplating an advertising campaign that will cost $55,000. If sales are expected to increase $100,000, by how much will the company's net income increase?

(Multiple Choice)

4.8/5  (27)

(27)

The break-even point is where total sales equal total fixed costs.

(True/False)

4.8/5  (31)

(31)

Henning Co. estimates that variable costs will be 70% of sales and fixed costs will total $2,160,000. The selling price of the product is $10, and 750,000 units will be sold.

Instructions

Using the mathematical equation,

(a) Compute the break-even point in units and dollars.

(b) Compute the margin of safety in dollars and as a ratio.

(c) Compute net income.

(Essay)

4.7/5  (36)

(36)

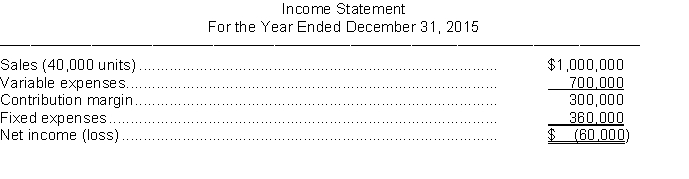

The income statement for Bradford Machine Company for 2015 appears below.

BRADFORD MACHINE COMPANY  Instructions

Answer the following independent questions and show computations using the contribution margin technique to support your answers:

1. What was the company's break-even point in sales dollars in 2015?

2. How many additional units would the company have had to sell in 2016 in order to earn net income of $45,000?

3. If the company is able to reduce variable costs by $2.50 per unit in 2016 and other costs and unit revenues remain unchanged, how many units will the company have to sell in order to earn a net income of $45,000?

Instructions

Answer the following independent questions and show computations using the contribution margin technique to support your answers:

1. What was the company's break-even point in sales dollars in 2015?

2. How many additional units would the company have had to sell in 2016 in order to earn net income of $45,000?

3. If the company is able to reduce variable costs by $2.50 per unit in 2016 and other costs and unit revenues remain unchanged, how many units will the company have to sell in order to earn a net income of $45,000?

(Essay)

4.9/5  (38)

(38)

Greg's Golf Carts produces two models: Model 24 has sales of 500 units with a contribution margin of $40 each; Model 26 has sales of 350 units with a contribution margin of $50 each. If sales of Model 26 increase by 100 units, how much will profit change?

(Multiple Choice)

4.8/5  (44)

(44)

A _________________ cost remains constant per unit at every level of activity.

(Short Answer)

4.8/5  (39)

(39)

Murphy Company produces flash drives for computers, which it sells for $20 each. Each flash drive costs $6 of variable costs to make. During April, 700 drives were sold. Fixed costs for April were $4 per unit for a total of $2,800 for the month. How much does Murphy's operating income increase for each $1,000 increase in revenue per month?

(Multiple Choice)

4.9/5  (40)

(40)

A cost which remains constant per unit at various levels of activity is a

(Multiple Choice)

4.9/5  (38)

(38)

Hanson, Inc. requires its marketing managers to submit estimated cost-volume-profit data on all requests for new products, or expansions of a product line.

Nancy Stephens is a new manager. Her calculations show a fixed cost for a new project at $100,000 and a variable cost of $5. Since the selling price is only $15 for the proposed product, 10,000 units would need to be sold to break even. That is approximately twice the volume estimate for the first year. She shares her dismay with Patti Patterson, another manager.

Patti strongly advises her to revise her estimates. She points out that several of the costs that had been classified as fixed costs could be considered variable, since they are step costs and mixed costs. When the data has been revised classifying those costs as variable costs, the project appears viable.

Required:

1. Who are the stakeholders in this decision?

2. Is it ethical for Nancy to revise the costs as indicated? Briefly explain.

3. What should Nancy do?

(Essay)

4.7/5  (34)

(34)

Bolton Industries had actual sales of $1,000,000 when break-even sales were $600,000. What is the margin of safety ratio?

(Multiple Choice)

4.8/5  (36)

(36)

Boswell company reported the following information for the current year: Sales (50,000 units) $1,000,000, direct materials and direct labor $500,000, other variable costs $50,000, and fixed costs $360,000. What is Boswell's contribution margin ratio?

(Multiple Choice)

4.9/5  (39)

(39)

The range over which a company expects to operate is referred to as the _____________ range.

(Short Answer)

4.9/5  (35)

(35)

Fixed costs are $900,000 and the variable costs are 75% of the unit selling price. What is the break-even point in dollars?

(Multiple Choice)

4.7/5  (44)

(44)

Contribution margin is the amount of revenues remaining after deducting cost of goods sold.

(True/False)

4.9/5  (39)

(39)

When applying the high-low method, the variable cost element of a mixed cost is calculated before the fixed cost element.

(True/False)

4.8/5  (31)

(31)

Showing 141 - 160 of 210

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)