Exam 17: Activity-Based Costing

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

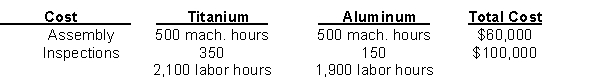

Reynoso Corporation manufactures titanium and aluminum tennis racquets. Reynoso's total overhead costs consist of assembly costs and inspection costs. The following information is available:  Reynoso is considering switching from one overhead rate based on labor hours to activity-based costing.

Using activity-based costing, how much assembly cost is assigned to titanium racquets?

Reynoso is considering switching from one overhead rate based on labor hours to activity-based costing.

Using activity-based costing, how much assembly cost is assigned to titanium racquets?

(Multiple Choice)

5.0/5  (41)

(41)

Nott Company manufactures two products, pillows and comforters. The company has estimated its overhead in the order-processing department to be $600,000. The company produces 50,000 pillows and 80,000 comforters each year. Pillow production requires 25,000 machine hours, comforter production requires 50,000 machine hours. The company places raw materials orders 10 times per month, 2 times for raw materials for pillows and the remainder for raw materials for comforters. How much of the order processing overhead should be allocated to comforters?

(Multiple Choice)

4.9/5  (36)

(36)

Not all activities labeled non-value-added are totally wasteful, nor can they be totally eliminated.

(True/False)

4.9/5  (35)

(35)

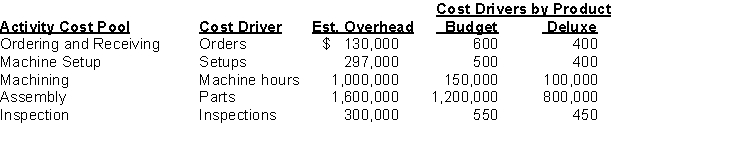

Randel Manufacturing has five activity cost pools and two products (a budget tape vacuum and a deluxe tape vacuum). Information is presented below:  Instructions

Compute the overhead cost per unit for each product. Production is 700,000 units of Budget and 200,000 units of Deluxe. Round your answer to the nearest cent.

Instructions

Compute the overhead cost per unit for each product. Production is 700,000 units of Budget and 200,000 units of Deluxe. Round your answer to the nearest cent.

(Essay)

4.9/5  (33)

(33)

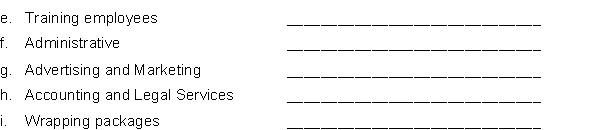

Nancy Lake owns a small department store in a metropolitan area. For twenty years, the accountant has applied overhead to the various departments-Women's Apparel, Men's Apparel, Cosmetics, Housewares, Shoes, and Electronics-based on the basis of employee hours worked. Nancy Lake's daughter, who is an accounting student at a local university, has suggested her mother should consider using activity-based costing (ABC). In an attempt to implement ABC, Nancy Lake and her daughter have identified the following activities.

Instructions

Determine a cost driver for each of the activities listed below.

(Essay)

4.9/5  (36)

(36)

In traditional costing systems, overhead is generally applied based on

(Multiple Choice)

4.9/5  (39)

(39)

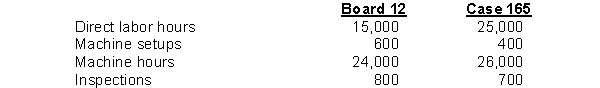

Zimmerman Company manufactures two products, Board 12 and Case 165. Zimmerman's overhead costs consist of setting up machines, $2,400,000; machining, $5,400,000; and inspecting, $1,800,000. Information on the two products is:  Overhead applied to Board 12 using activity-based costing is

Overhead applied to Board 12 using activity-based costing is

(Multiple Choice)

4.8/5  (38)

(38)

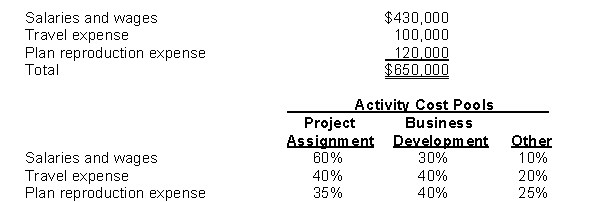

Jayson Woods, PSC is an architectural firm that uses activity-based costing. The three activity cost pools used by Jayson Woods are: Salaries and Wages, Travel Expense, and Plan Reproduction Expense. The firm has provided the following information concerning activity and costs:  Instructions

Calculate the total cost to be allocated to the (a) Project Assignment, (b) Business Development, and (c) Other activity cost pools.

Instructions

Calculate the total cost to be allocated to the (a) Project Assignment, (b) Business Development, and (c) Other activity cost pools.

(Essay)

4.9/5  (45)

(45)

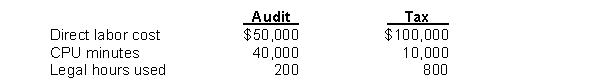

Gant Accounting performs two types of services, Audit and Tax. Gant's overhead costs consist of computer support, $300,000; and legal support, $150,000. Information on the two services is:  Overhead applied to tax services using activity-based costing is

Overhead applied to tax services using activity-based costing is

(Multiple Choice)

4.8/5  (40)

(40)

Two of the activity cost pools for Molina Company are (a) machining ($325,000) and (b) inspections ($42,000). Possible cost drivers are direct labor hours (2,550), machine hours (12,500), square footage (2,000), and number of inspections (200).

Instructions

Compute the overhead rate for each activity.

(Essay)

4.8/5  (39)

(39)

Which would be an appropriate cost driver for the purchasing activity cost pool?

(Multiple Choice)

4.8/5  (37)

(37)

Predetermined overhead rates in traditional costing are often based on

(Multiple Choice)

4.9/5  (28)

(28)

The general approach to identifying activities, activity cost pools, and cost drivers is used by a service company in the same manner as a manufacturing company.

(True/False)

4.9/5  (41)

(41)

Showing 21 - 40 of 185

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)