Exam 17: Activity-Based Costing

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

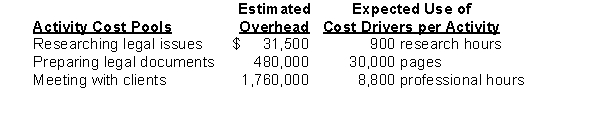

Horton, Reiser, and Associates, a law firm, employs ABC. The following budgeted data for each of the activity cost pools is provided for the year 2016.  During 2016 the firm worked 660 research hours, 10,000 professional hours, and prepared 25,000 document pages.

Instructions

Compute the total overhead applied during 2016.

During 2016 the firm worked 660 research hours, 10,000 professional hours, and prepared 25,000 document pages.

Instructions

Compute the total overhead applied during 2016.

(Essay)

4.9/5  (38)

(38)

Each of the following is a limitation of activity-based costing except that

(Multiple Choice)

4.8/5  (38)

(38)

The presence of any of the following factors would suggest a switch to ABC except when

(Multiple Choice)

4.9/5  (37)

(37)

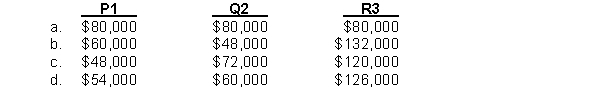

Peters, Inc. produces 3 products: P1, Q2, and R3. P1 requires 400 purchase orders, Q2 requires 600 purchase orders, and R3 requires 1,000 purchase orders. Peters has identified an ordering and receiving activity cost pool with allocated overhead of $240,000 for which the cost driver is purchase orders. Direct labor hours used on each product are 50,000 for P1, 40,000 for Q2, and 110,000 for R3. How much ordering and receiving overhead is assigned to each product?

(Short Answer)

4.7/5  (35)

(35)

Which of the following is a limitation of activity-based costing?

(Multiple Choice)

4.9/5  (41)

(41)

In traditional costing systems, direct labor cost is often used for the assignment of all ____________________.

(Short Answer)

4.9/5  (46)

(46)

In activity-based costing, overhead costs are allocated to ____________________, then assigned to products.

(Short Answer)

4.8/5  (35)

(35)

Merando Manufacturing Company manufactures small tools. Classify each of the following activity costs of the tool company as:

Correct Answer:

Premises:

Responses:

(Matching)

4.8/5  (34)

(34)

The first step in activity-based costing is to assign overhead costs to products, using cost drivers.

(True/False)

4.9/5  (41)

(41)

Noland Company manufactures two models of its banjo, the Basic and the Luxury. The Basic model requires 10,000 direct labor hours and the Luxury requires 30,000 direct labor hours. The company produces 3,400 units of the Basic model and 600 units of the Luxury model each year. The company inspects one Basic for every 100 produced, and inspects one Luxury for every 10 produced. The company expects to incur $112,800 of total inspecting costs this year. How much of the inspecting costs should be allocated to the Basic model using ABC costing?

(Multiple Choice)

4.8/5  (24)

(24)

The presence of any of the following factors would suggest a switch to ABC except when

(Multiple Choice)

4.7/5  (38)

(38)

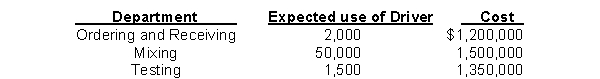

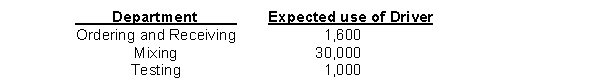

A company incurs $4,050,000 of overhead each year in three departments: Ordering and Receiving, Mixing, and Testing. The company prepares 2,000 purchase orders, works 50,000 mixing hours, and performs 1,500 tests per year in producing 200,000 drums of Goo and 600,000 drums of Slime. The following data are available:  Production information for Slime is as follows:

Production information for Slime is as follows:  Compute the amount of overhead assigned to Slime.

Compute the amount of overhead assigned to Slime.

(Multiple Choice)

4.8/5  (27)

(27)

Some ______________________ increase the perceived worth of a product or service to customers.

(Short Answer)

4.8/5  (38)

(38)

Which would be an appropriate cost driver for the machining activity cost pool?

(Multiple Choice)

4.8/5  (38)

(38)

ABC is generally more costly to implement than traditional costing.

(True/False)

4.8/5  (44)

(44)

Showing 81 - 100 of 185

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)