Exam 9: Plant Assets, Natural Resources, and Intangible Assets

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

On March 1, 2015, Landon Company acquired real estate on which it planned to construct a small office building. The company paid $90,000 in cash. An old warehouse on the property was razed at a cost of $7,600; the salvaged materials were sold for $1,700. Additional expenditures before construction began included $1,100 attorney's fee for work concerning the land purchase, $4,000 real estate broker's fee, $7,800 architect's fee, and $14,000 to put in driveways and a parking lot.

Instructions

Determine the amount to be reported as the cost of the land.

(Essay)

5.0/5  (35)

(35)

If a plant asset is sold at a gain, the gain on disposal should reduce the cost of goods sold section of the income statement.

(True/False)

4.9/5  (42)

(42)

The Accumulated Depletion account is deducted from the cost of the natural resource in the balance sheet.

(True/False)

4.7/5  (35)

(35)

Alvarado Company purchased a new machine for $400,000. It is estimated that the machine will have a $40,000 salvage value at the end of its 5-year useful service life. The double-declining-balance method of depreciation will be used.

Instructions

Prepare a depreciation schedule which shows the annual depreciation expense on the machine for its 5-year life.

(Essay)

5.0/5  (42)

(42)

The ________________ method of computing depreciation expense results in an equal amount of periodic depreciation throughout the service life of the plant asset.

(Short Answer)

4.9/5  (48)

(48)

When estimating the useful life of an asset, accountants do not consider

(Multiple Choice)

5.0/5  (33)

(33)

In recording the purchase of a business, goodwill should be recorded for the excess of ______________ over the _______________ of the net assets acquired.

(Short Answer)

4.8/5  (40)

(40)

The Accumulated Depreciation account represents a cash fund available to replace plant assets.

(True/False)

4.7/5  (39)

(39)

If disposal of a plant asset occurs at any time during the year, ___________________ for the fraction of the year to the date of disposal must be recorded.

(Short Answer)

4.8/5  (29)

(29)

An asset was purchased for $250,000. It had an estimated salvage value of $50,000 and an estimated useful life of 10 years. After 5 years of use, the estimated salvage value is revised to $40,000 but the estimated useful life is unchanged. Assuming straight-line depreciation, depreciation expense in year 6 would be

(Multiple Choice)

4.8/5  (28)

(28)

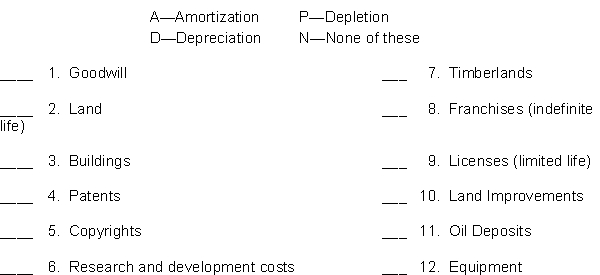

268For each item listed below, enter a code letter in the blank space to indicate the allocation terminology for the item. Use the following codes for your answer:

(Short Answer)

4.8/5  (37)

(37)

On July 1, 2018, Melton Inc. invested $560,000 in a mine estimated to have 800,000 tons of ore of uniform grade. During the last 6 months of 2018, 100,000 tons of ore were mined and sold.

Instructions

(a) Prepare the journal entry to record depletion expense.

(b) Assume that the 100,000 tons of ore were mined, but only 85,000 units were sold. How are the costs applicable to the 15,000 unsold units reported?

(Essay)

4.7/5  (40)

(40)

Expenditures that maintain the operating efficiency and expected productive life of a plant asset are generally

(Multiple Choice)

4.9/5  (38)

(38)

Drago Company purchased equipment on January 1, 2018, at a total invoice cost of $1,200,000. The equipment has an estimated salvage value of $30,000 and an estimated useful life of 5 years. What is the amount of accumulated depreciation at December 31, 2019, if the straight-line method of depreciation is used?

(Multiple Choice)

4.9/5  (46)

(46)

A computer company has $2,800,000 in research and development costs. Before accounting for these costs, the net income of the company is $2,000,000. What is the amount of net income or loss after these R & D costs are accounted for?

(Multiple Choice)

4.9/5  (39)

(39)

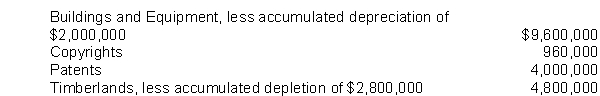

A company has the following assets:  The total amount reported under Property, Plant, and Equipment would be

The total amount reported under Property, Plant, and Equipment would be

(Multiple Choice)

4.7/5  (39)

(39)

During 2018, Rathke Corporation reported net sales of $3,000,000, net income of $1,200,000, and depreciation expense of $100,000. Rathke also reported beginning total assets of $1,000,000, ending total assets of $1,500,000, plant assets of $800,000, and accumulated depreciation of $500,000. Rathke's asset turnover is

(Multiple Choice)

4.7/5  (39)

(39)

Showing 41 - 60 of 291

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)