Exam 9: Plant Assets, Natural Resources, and Intangible Assets

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

Under the double-declining-balance method, the depreciation rate used each year remains constant.

(True/False)

4.9/5  (34)

(34)

Each of the following is used in computing revised annual depreciation for a change in estimate except

(Multiple Choice)

4.8/5  (37)

(37)

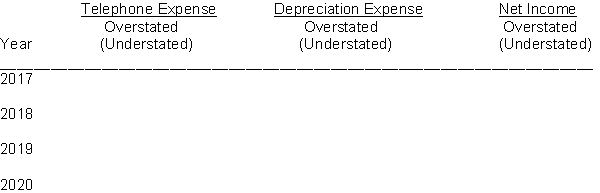

On January 1, 2016 Grier Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2017 more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Telephone Expense. Grier Company uses the straight-line method of depreciation.

Instructions

Prepare a schedule showing the effects of the error on Telephone Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2017 through the useful life of the new equipment.

(Essay)

4.7/5  (46)

(46)

Salem Company hired Kirk Construction to construct an office building for £6,400,000 on land costing £1,600,000, which Salem Company owned. The building was complete and ready to be used on January 1, 2018 and it has a useful life of 40 years. The price of the building included land improvements costing £480,000 and personal property costing £600,000. The useful lives of the land improvements and the personal property are 10 years and 5 years, respectively. Salem Company uses component depreciation, and the company uses straight-line depreciation for other similar assets. What total amount of depreciation expense would Salem Company report on its income statement for the year ended December 31, 2018?

(Multiple Choice)

4.8/5  (42)

(42)

Research and development costs which result in a successful product which is patentable are charged to the Patent account.

(True/False)

4.9/5  (32)

(32)

A plant asset was purchased on January 1 for $100,000 with an estimated salvage value of $20,000 at the end of its useful life. The current year's Depreciation Expense is $10,000 calculated on the straight-line basis and the balance of the Accumulated Depreciation account at the end of the year is $50,000. The remaining useful life of the plant asset is

(Multiple Choice)

4.8/5  (36)

(36)

To determine a new depreciation amount after a change in estimate of a plant asset's useful life, the asset's remaining depreciable cost is divided by its remaining useful life.

(True/False)

4.9/5  (49)

(49)

Accountants do not attempt to measure the change in a plant asset's fair value during ownership because

(Multiple Choice)

4.8/5  (42)

(42)

The declining-balance method of depreciation is called an accelerated depreciation method because it depreciates an asset in a shorter period of time than the asset's useful life.

(True/False)

4.9/5  (30)

(30)

The December 31, 2017 balance sheet of Jensen Company showed Equipment of $76,000 and Accumulated Depreciation of $18,000. On January 1, 2018, the company decided that the equipment has a remaining useful life of 6 years with a $4,000 salvage value.

Instructions

Compute the (a) depreciable cost of the equipment and (b) revised annual depreciation.

(Essay)

4.8/5  (37)

(37)

If a plant asset is retired before it is fully depreciated and no salvage value is received,

(Multiple Choice)

4.9/5  (39)

(39)

Natural resources are long-lived productive assets that are extracted in operations and are replaceable only by an act of nature.

(True/False)

4.8/5  (32)

(32)

On January 1, 2018, Petersen Enterprises purchased natural resources for $1,800,000. The company expects the resources to produce 12,000,000 units of product. (1) What is the depletion cost per unit? (2) If the company mined and sold 20,000 units in January, what is depletion expense for the month?

(Essay)

4.8/5  (37)

(37)

Goodwill is not recognized in accounting unless it is acquired from purchasing another business enterprise.

(True/False)

4.9/5  (32)

(32)

Fleming Company purchased a machine on January 1, 2018. In addition to the purchase price paid, the following additional costs were incurred: (a) sales tax paid on the purchase price, (b) transportation and insurance costs while the machinery was in transit from the seller, (c) personnel training costs for initial operation of the machinery, (d) annual city operating license, (e) major overhaul to extend the life of the machinery, (f) lubrication of the machinery gearing before the machinery was placed into service, (g) lubrication of the machinery gearing after the machinery was placed into service, and (h) installation costs necessary to secure the machinery to the building flooring.

Instructions

Indicate whether the items (a) through (h) are capital or revenue expenditures in the spaces provided: C = Capital, R = Revenue.

(a)_____________ (b)______________ (c)______________ (d)______________

(e)_____________ (f)______________ (g)______________ (h)______________

(Essay)

4.8/5  (36)

(36)

On January 2, 2015, Olathe Company purchased a patent for $240,000. The patent has an

8-year estimated useful life and a legal life of 20 years.

Instructions

Prepare the journal entry to record patent amortization.

(Essay)

4.7/5  (32)

(32)

A plant asset acquired on October 1, 2018, at a cost of $400,000 has an estimated useful life of 10 years. The salvage value is estimated to be $40,000 at the end of the asset's useful life.

Instructions

Determine the depreciation expense for the first two years using:

(a) the straight-line method.

(b) the double-declining-balance method.

(Essay)

4.8/5  (38)

(38)

Iverson Company purchased a delivery truck for $45,000 on January 1, 2018. The truck was assigned an estimated useful life of 100,000 miles and has a residual value of $10,000. The truck was driven 18,000 miles in 2018 and 22,000 miles in 2019. Compute depreciation expense using the units-of-activity method for the years 2018 and 2019.

(Essay)

4.9/5  (37)

(37)

Showing 21 - 40 of 291

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)