Exam 6: Variable Costing and Segment Reporting: Tools for Management

Exam 1: Managerial Accounting and Cost Concepts346 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs408 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting314 Questions

Exam 4: Process Costing365 Questions

Exam 5: Cost-Volume-Profit Relationships396 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management392 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making382 Questions

Exam 8: Master Budgeting284 Questions

Exam 9: Flexible Budgets and Performance Analysis491 Questions

Exam 10: Standard Costs and Variances469 Questions

Exam 11: Responsibility Accounting Systems335 Questions

Exam 12: Strategic Performance Measurement153 Questions

Exam 13: Differential Analysis: the Key to Decision Making432 Questions

Exam 14: Capital Budgeting Decisions405 Questions

Exam 15: Statement of Cash Flows221 Questions

Exam 16: Financial Statement Analysis327 Questions

Select questions type

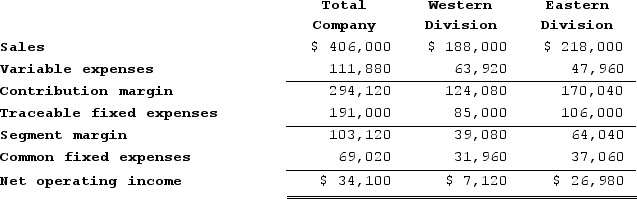

Jemmott Corporation has two divisions: Western Division and Eastern Division. The following report is for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales.The Western Division's break-even sales is closest to:

The common fixed expenses have been allocated to the divisions on the basis of sales.The Western Division's break-even sales is closest to:

(Multiple Choice)

4.8/5  (31)

(31)

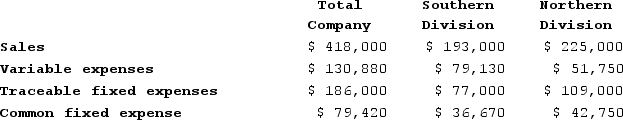

Neelon Corporation has two divisions: Southern Division and Northern Division. The following data are for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales.The company's overall break-even sales is closest to:

The common fixed expenses have been allocated to the divisions on the basis of sales.The company's overall break-even sales is closest to:

(Multiple Choice)

5.0/5  (41)

(41)

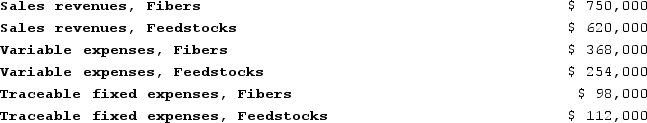

Data for September concerning Greenberger Corporation's two major business segments--Fibers and Feedstocks--appear below:

Common fixed expenses totaled $344,000 and were allocated as follows: $175,000 to the Fibers business segment and $169,000 to the Feedstocks business segment.Required: Prepare a segmented income statement in the contribution format for the company. Omit percentages; show only dollar amounts.

Common fixed expenses totaled $344,000 and were allocated as follows: $175,000 to the Fibers business segment and $169,000 to the Feedstocks business segment.Required: Prepare a segmented income statement in the contribution format for the company. Omit percentages; show only dollar amounts.

(Essay)

4.8/5  (29)

(29)

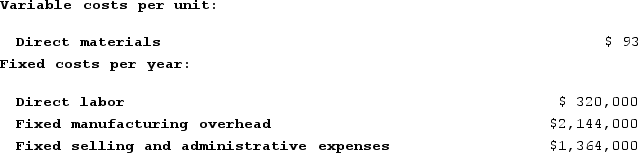

Dallavalle Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 32,000 units and sold 31,000 units. The company's only product is sold for $238 per unit.The unit product cost under super-variable costing is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 32,000 units and sold 31,000 units. The company's only product is sold for $238 per unit.The unit product cost under super-variable costing is:

(Multiple Choice)

4.9/5  (48)

(48)

Last year, Tinklenberg Corporation's variable costing net operating income was $52,400 and its inventory decreased by 1,400 units. Fixed manufacturing overhead cost was $8 per unit for both units in beginning and in ending inventory. What was the absorption costing net operating income last year?

(Multiple Choice)

4.7/5  (42)

(42)

Variable costing is more compatible with cost-volume-profit analysis than is absorption costing.

(True/False)

4.8/5  (37)

(37)

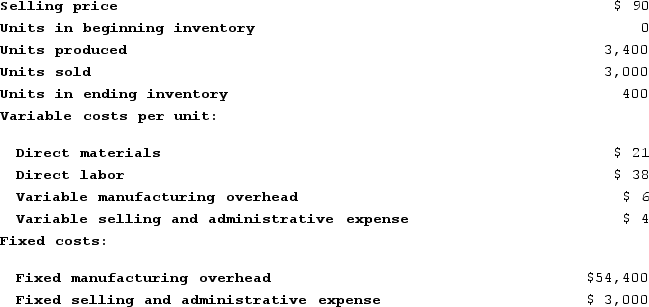

Murphy Incorporated, which produces a single product, has provided the following data for its most recent month of operation:

The company had no beginning or ending inventories.Required:a. Compute the unit product cost under absorption costing.b. Compute the unit product cost under variable costing.

The company had no beginning or ending inventories.Required:a. Compute the unit product cost under absorption costing.b. Compute the unit product cost under variable costing.

(Essay)

4.7/5  (31)

(31)

Aaron Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  The total gross margin for the month under the absorption costing approach is:

The total gross margin for the month under the absorption costing approach is:

(Multiple Choice)

4.8/5  (32)

(32)

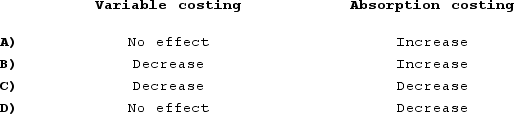

In its first year of operations, Bronfren Corporation produced 800,000 sets and sold 780,000 sets of artificial tan lines. What would have happened to net operating income in this first year under the following costing methods if Bronfren had produced 20,000 fewer sets? (Assume that Bronfren has both variable and fixed production costs.)

(Multiple Choice)

4.9/5  (39)

(39)

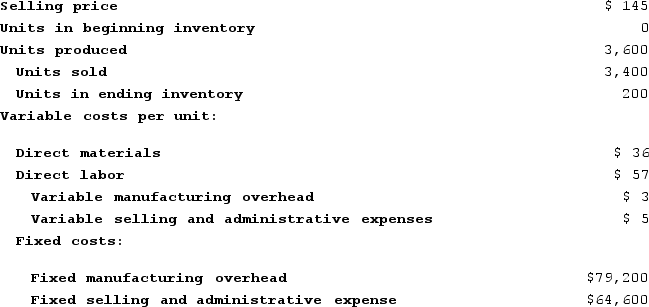

Nelter Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.Required: a. Prepare a contribution format income statement for the month using variable costing.b. Prepare an income statement for the month using absorption costing.

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.Required: a. Prepare a contribution format income statement for the month using variable costing.b. Prepare an income statement for the month using absorption costing.

(Essay)

4.8/5  (41)

(41)

Aaron Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  What is the unit product cost for the month under absorption costing?

What is the unit product cost for the month under absorption costing?

(Multiple Choice)

4.9/5  (27)

(27)

Under variable costing, only variable production costs are treated as product costs.

(True/False)

4.9/5  (30)

(30)

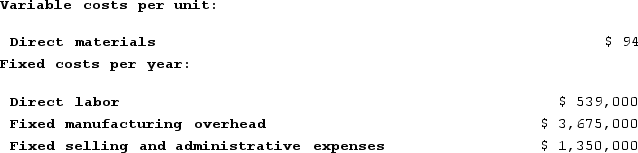

Tremble Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.Assume that the company uses an absorption costing system that assigns $11 of direct labor cost and $75 of fixed manufacturing overhead to each unit that is produced. The unit product cost under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 49,000 units and sold 45,000 units. The company's only product is sold for $233 per unit.Assume that the company uses an absorption costing system that assigns $11 of direct labor cost and $75 of fixed manufacturing overhead to each unit that is produced. The unit product cost under this costing system is:

(Multiple Choice)

4.8/5  (40)

(40)

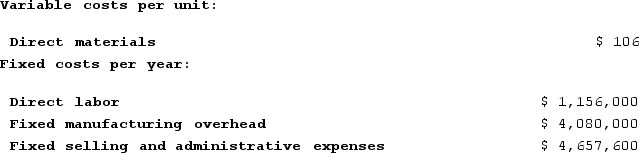

Tremble Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 68,000 units and sold 65,600 units. The company's only product is sold for $278 per unit.Assume that the company uses an absorption costing system that assigns $17 of direct labor cost and $60 of fixed manufacturing overhead to each unit that is produced. The unit product cost under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 68,000 units and sold 65,600 units. The company's only product is sold for $278 per unit.Assume that the company uses an absorption costing system that assigns $17 of direct labor cost and $60 of fixed manufacturing overhead to each unit that is produced. The unit product cost under this costing system is:

(Multiple Choice)

4.9/5  (43)

(43)

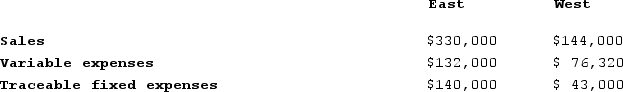

Fernstrom Corporation has two divisions: East and West. Data from the most recent month appear below:  The company's common fixed expenses total $52,140. If the company operates at exactly the break-even sales of the East Division and West Division, what would be the company's overall net operating income?

The company's common fixed expenses total $52,140. If the company operates at exactly the break-even sales of the East Division and West Division, what would be the company's overall net operating income?

(Multiple Choice)

4.9/5  (35)

(35)

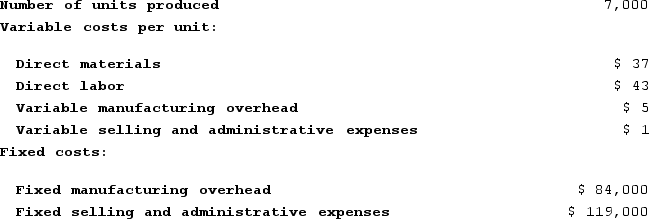

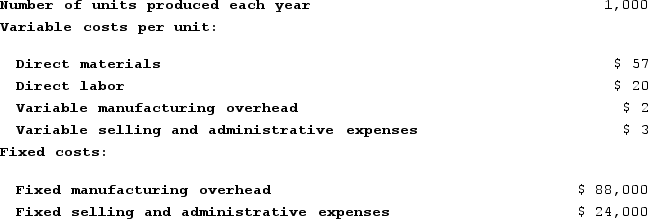

Davitt Corporation produces a single product and has the following cost structure:

Required:Compute the unit product cost under variable costing.

Required:Compute the unit product cost under variable costing.

(Essay)

4.7/5  (42)

(42)

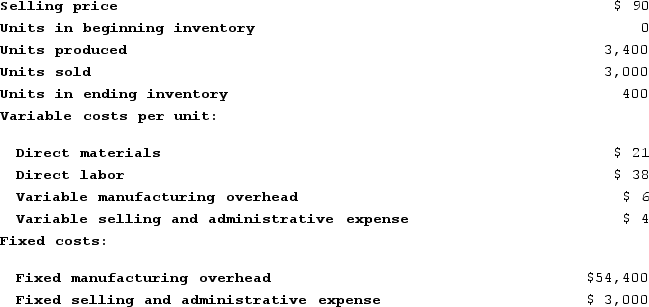

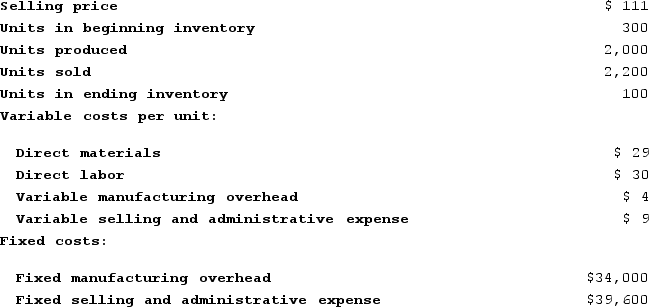

Clemeson Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  The total gross margin for the month under the absorption costing approach is:

The total gross margin for the month under the absorption costing approach is:

(Multiple Choice)

4.8/5  (37)

(37)

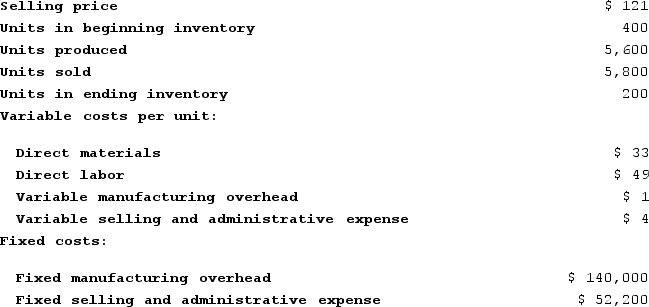

Janos Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.What is the net operating income for the month under variable costing?

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.What is the net operating income for the month under variable costing?

(Multiple Choice)

4.9/5  (29)

(29)

When using data from a segmented income statement, the dollar sales for a segment to break even is equal to:

(Multiple Choice)

4.7/5  (31)

(31)

Corbett Corporation manufactures a single product. Last year, variable costing net operating income was $72,000. The fixed manufacturing overhead costs deferred in inventory under absorption costing amounted to $29,000.Required:Determine the absorption costing net operating income last year.

(Essay)

4.8/5  (36)

(36)

Showing 181 - 200 of 392

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)