Exam 6: Variable Costing and Segment Reporting: Tools for Management

Exam 1: Managerial Accounting and Cost Concepts346 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs408 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting314 Questions

Exam 4: Process Costing365 Questions

Exam 5: Cost-Volume-Profit Relationships396 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management392 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making382 Questions

Exam 8: Master Budgeting284 Questions

Exam 9: Flexible Budgets and Performance Analysis491 Questions

Exam 10: Standard Costs and Variances469 Questions

Exam 11: Responsibility Accounting Systems335 Questions

Exam 12: Strategic Performance Measurement153 Questions

Exam 13: Differential Analysis: the Key to Decision Making432 Questions

Exam 14: Capital Budgeting Decisions405 Questions

Exam 15: Statement of Cash Flows221 Questions

Exam 16: Financial Statement Analysis327 Questions

Select questions type

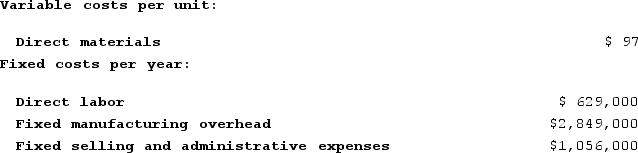

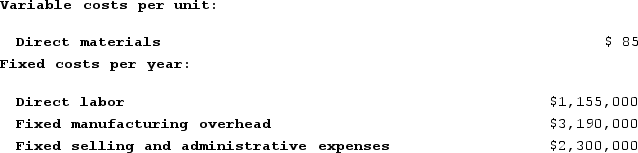

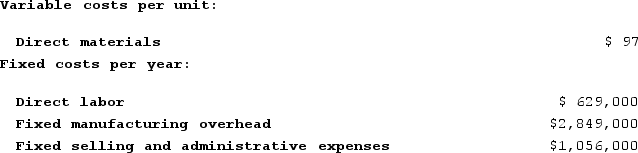

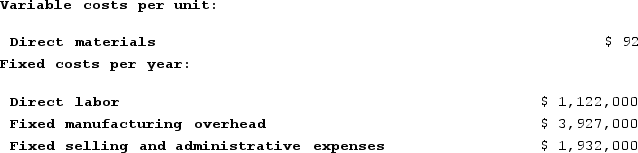

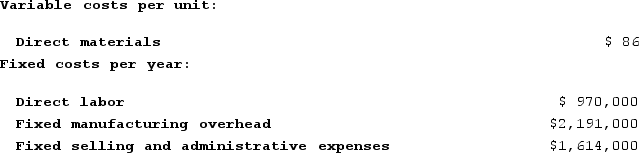

Buckbee Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 37,000 units and sold 32,000 units. The company's only product is sold for $261 per unit.The unit product cost under super-variable costing is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 37,000 units and sold 32,000 units. The company's only product is sold for $261 per unit.The unit product cost under super-variable costing is:

(Multiple Choice)

4.9/5  (41)

(41)

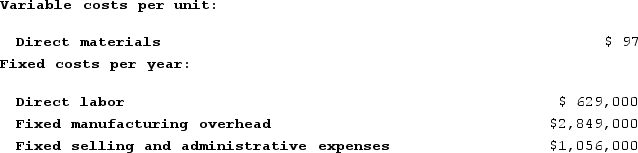

Letcher Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 44,700 units and sold 43,200 units. The company's only product is sold for $183 per unit.The company is considering using either super-variable costing or a variable costing system that assigns $21 of direct labor cost to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 44,700 units and sold 43,200 units. The company's only product is sold for $183 per unit.The company is considering using either super-variable costing or a variable costing system that assigns $21 of direct labor cost to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

(Multiple Choice)

4.7/5  (35)

(35)

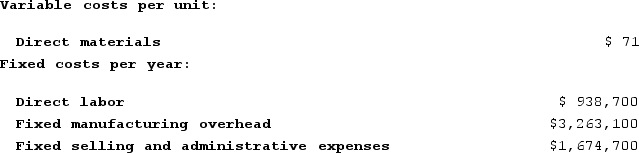

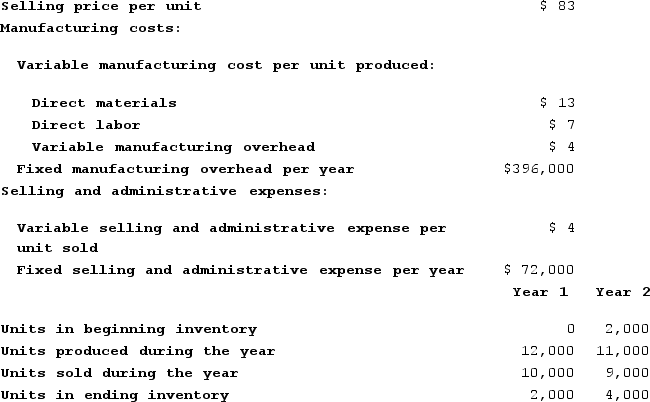

Badoni Corporation has provided the following data for its two most recent years of operation:  The net operating income (loss) under variable costing in Year 2 is closest to:

The net operating income (loss) under variable costing in Year 2 is closest to:

(Multiple Choice)

4.9/5  (38)

(38)

Mandato Corporation has provided the following data for its two most recent years of operation:  The net operating income (loss) under variable costing in Year 1 is closest to:

The net operating income (loss) under variable costing in Year 1 is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

Leheny Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 55,000 units and sold 50,000 units. The company's only product is sold for $238 per unit.The net operating income for the year under super-variable costing is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 55,000 units and sold 50,000 units. The company's only product is sold for $238 per unit.The net operating income for the year under super-variable costing is:

(Multiple Choice)

4.7/5  (34)

(34)

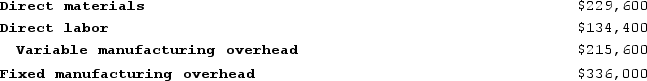

Krepps Corporation produces a single product. Last year, Krepps manufactured 28,000 units and sold 22,500 units. Production costs for the year were as follows:  Sales totaled $1,046,250 for the year, variable selling and administrative expenses totaled $117,000, and fixed selling and administrative expenses totaled $201,600. There was no beginning inventory. Assume that direct labor is a variable cost.Under variable costing, the company's net operating income for the year would be:

Sales totaled $1,046,250 for the year, variable selling and administrative expenses totaled $117,000, and fixed selling and administrative expenses totaled $201,600. There was no beginning inventory. Assume that direct labor is a variable cost.Under variable costing, the company's net operating income for the year would be:

(Multiple Choice)

4.7/5  (44)

(44)

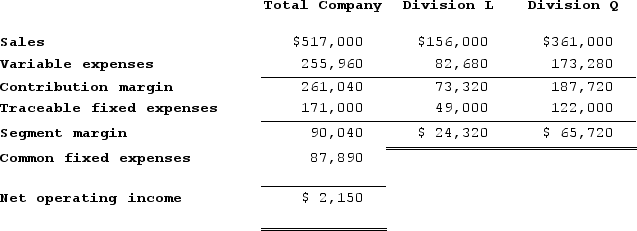

Delisa Corporation has two divisions: Division L and Division Q. Data from the most recent month appear below:  The break-even in sales dollars for Division Q is closest to:

The break-even in sales dollars for Division Q is closest to:

(Multiple Choice)

4.9/5  (40)

(40)

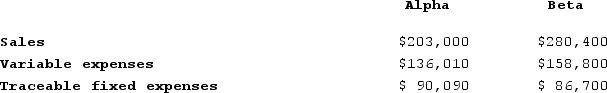

Combe Corporation has two divisions: Alpha and Beta. Data from the most recent month appear below:  The company's common fixed expenses total $94,500. The break-even in sales dollars for Alpha Division is closest to:

The company's common fixed expenses total $94,500. The break-even in sales dollars for Alpha Division is closest to:

(Multiple Choice)

4.9/5  (34)

(34)

Buckbee Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 37,000 units and sold 32,000 units. The company's only product is sold for $261 per unit.The net operating income for the year under super-variable costing is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 37,000 units and sold 32,000 units. The company's only product is sold for $261 per unit.The net operating income for the year under super-variable costing is:

(Multiple Choice)

4.9/5  (26)

(26)

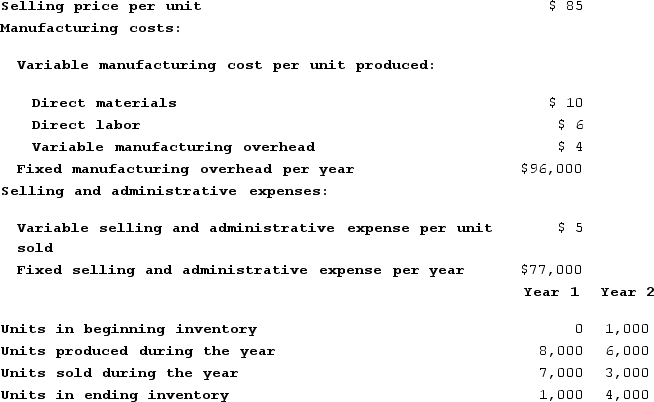

Kaaua Corporation has provided the following data for its two most recent years of operation:  Which of the following statements is true for Year 2?

Which of the following statements is true for Year 2?

(Multiple Choice)

4.9/5  (34)

(34)

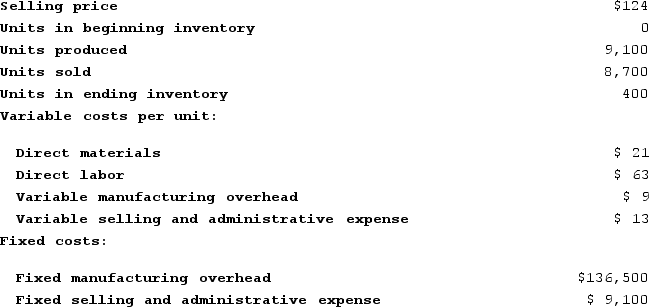

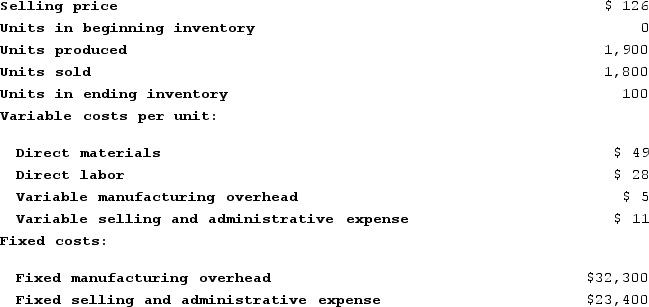

Farris Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  What is the net operating income (loss) for the month under variable costing?

What is the net operating income (loss) for the month under variable costing?

(Multiple Choice)

4.9/5  (47)

(47)

Silver Corporation produces a single product. Last year, the company's variable production costs totaled $7,500 and its fixed manufacturing overhead costs totaled $4,500. The company produced 3,000 units during the year and sold 2,400 units. There were no units in the beginning inventory. Which of the following statements is true?

(Multiple Choice)

4.8/5  (36)

(36)

Under variable costing, fixed manufacturing overhead is treated as a product cost.

(True/False)

4.8/5  (31)

(31)

Marcelin Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 51,000 units and sold 46,000 units. The company's only product is sold for $276 per unit.The unit product cost under super-variable costing is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 51,000 units and sold 46,000 units. The company's only product is sold for $276 per unit.The unit product cost under super-variable costing is:

(Multiple Choice)

4.9/5  (38)

(38)

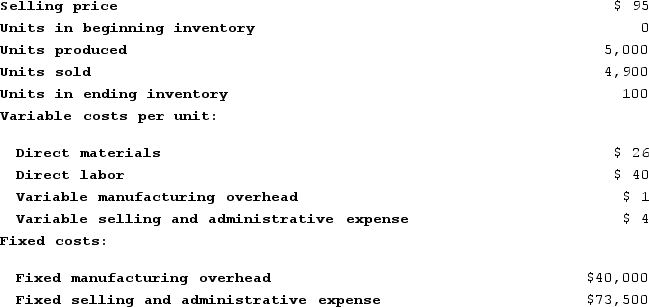

Hadley Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  What is the net operating income for the month under variable costing?

What is the net operating income for the month under variable costing?

(Multiple Choice)

4.8/5  (46)

(46)

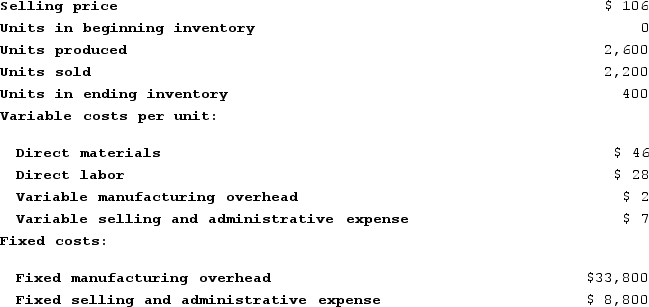

Davison Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  What is the total period cost for the month under the absorption costing?

What is the total period cost for the month under the absorption costing?

(Multiple Choice)

4.8/5  (36)

(36)

Gabuat Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  The total gross margin for the month under the absorption costing approach is:

The total gross margin for the month under the absorption costing approach is:

(Multiple Choice)

4.8/5  (40)

(40)

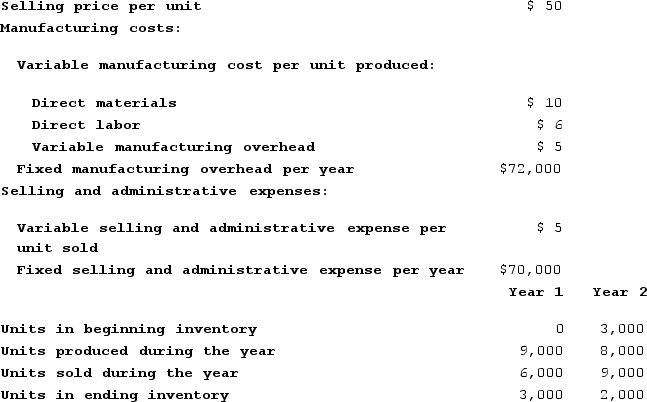

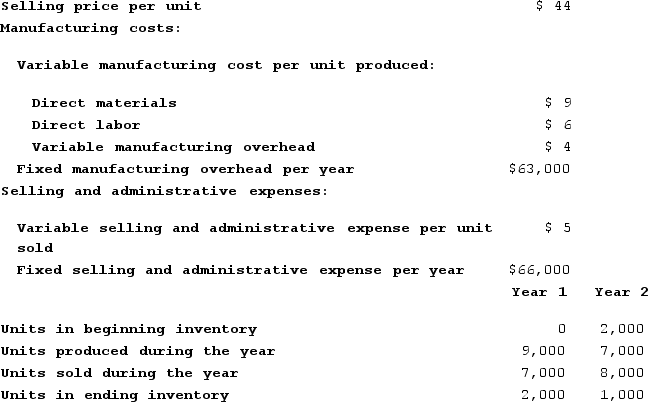

Plummer Corporation has provided the following data for its two most recent years of operation:  The net operating income (loss) under absorption costing in Year 2 is closest to:

The net operating income (loss) under absorption costing in Year 2 is closest to:

(Multiple Choice)

4.8/5  (33)

(33)

Buckbee Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 42,000 units and sold 38,000 units. The company's only product is sold for $230 per unit.The net operating income for the year under super-variable costing is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 42,000 units and sold 38,000 units. The company's only product is sold for $230 per unit.The net operating income for the year under super-variable costing is:

(Multiple Choice)

4.8/5  (38)

(38)

Buckbee Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 37,000 units and sold 32,000 units. The company's only product is sold for $261 per unit.Assume that the company uses a variable costing system that assigns $17 of direct labor cost to each unit that is produced. The unit product cost under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 37,000 units and sold 32,000 units. The company's only product is sold for $261 per unit.Assume that the company uses a variable costing system that assigns $17 of direct labor cost to each unit that is produced. The unit product cost under this costing system is:

(Multiple Choice)

4.8/5  (38)

(38)

Showing 201 - 220 of 392

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)