Exam 6: Variable Costing and Segment Reporting: Tools for Management

Exam 1: Managerial Accounting and Cost Concepts346 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs408 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting314 Questions

Exam 4: Process Costing365 Questions

Exam 5: Cost-Volume-Profit Relationships396 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management392 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making382 Questions

Exam 8: Master Budgeting284 Questions

Exam 9: Flexible Budgets and Performance Analysis491 Questions

Exam 10: Standard Costs and Variances469 Questions

Exam 11: Responsibility Accounting Systems335 Questions

Exam 12: Strategic Performance Measurement153 Questions

Exam 13: Differential Analysis: the Key to Decision Making432 Questions

Exam 14: Capital Budgeting Decisions405 Questions

Exam 15: Statement of Cash Flows221 Questions

Exam 16: Financial Statement Analysis327 Questions

Select questions type

When sales exceed production and the company uses the LIFO inventory flow assumption, the net operating income reported under variable costing generally will be:

(Multiple Choice)

4.9/5  (32)

(32)

Under the absorption costing method, a company can increase profits simply by increasing the number of units produced.

(True/False)

4.8/5  (41)

(41)

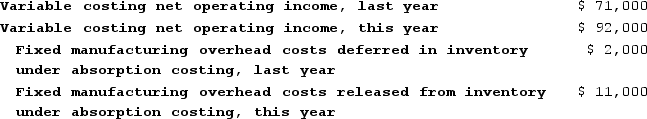

Worrel Corporation manufactures a single product. The following data pertain to the company's operations over the last two years:

Required:a. Determine the absorption costing net operating income last year.b. Determine the absorption costing net operating income this year.

Required:a. Determine the absorption costing net operating income last year.b. Determine the absorption costing net operating income this year.

(Essay)

4.8/5  (32)

(32)

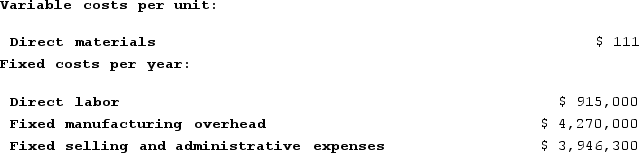

Labadie Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 61,000 units and sold 58,900 units. The company's only product is sold for $250 per unit.Assume that the company uses a variable costing system that assigns $15 of direct labor cost to each unit that is produced. The unit product cost under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 61,000 units and sold 58,900 units. The company's only product is sold for $250 per unit.Assume that the company uses a variable costing system that assigns $15 of direct labor cost to each unit that is produced. The unit product cost under this costing system is:

(Multiple Choice)

4.9/5  (44)

(44)

Baraban Corporation has provided the following data for its most recent year of operation:  The net operating income (loss) under absorption costing closest to:

The net operating income (loss) under absorption costing closest to:

(Multiple Choice)

5.0/5  (33)

(33)

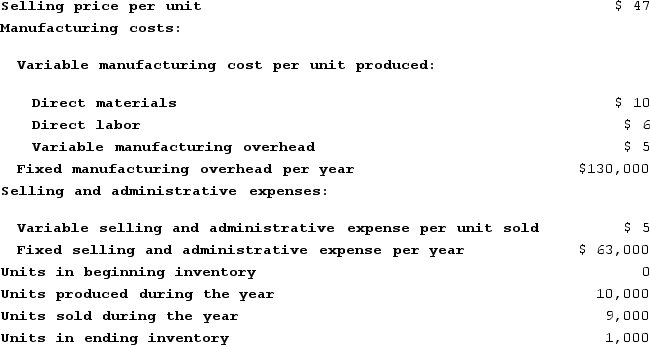

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  What is the net operating income for the month under absorption costing?

What is the net operating income for the month under absorption costing?

(Multiple Choice)

4.9/5  (27)

(27)

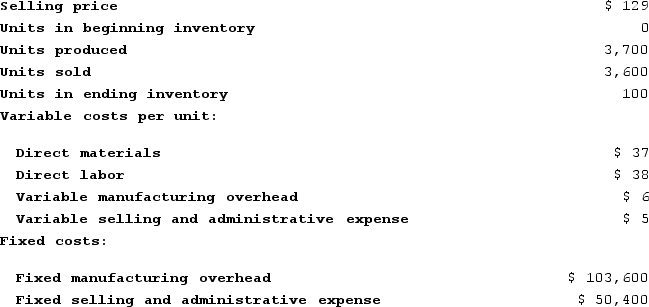

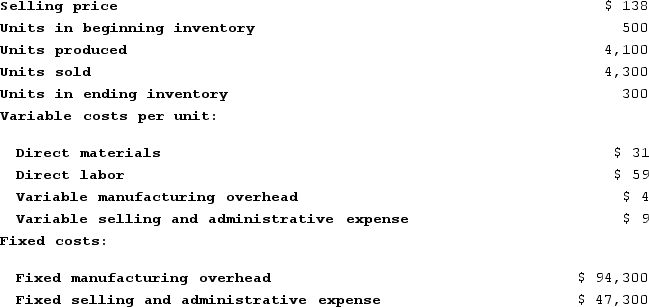

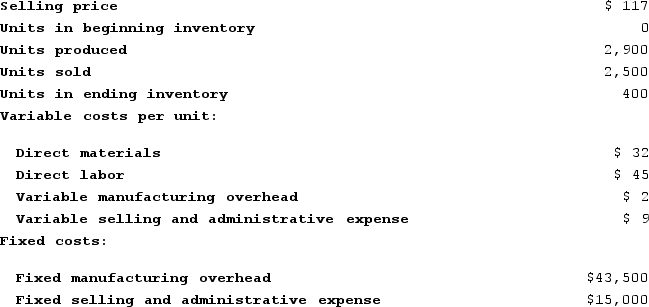

Maher Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

Required:a. What is the unit product cost for the month under variable costing?b. What is the unit product cost for the month under absorption costing?c. Prepare a contribution format income statement for the month using variable costing.d. Prepare an income statement for the month using absorption costing.e. Reconcile the variable costing and absorption costing net operating incomes for the month.

Required:a. What is the unit product cost for the month under variable costing?b. What is the unit product cost for the month under absorption costing?c. Prepare a contribution format income statement for the month using variable costing.d. Prepare an income statement for the month using absorption costing.e. Reconcile the variable costing and absorption costing net operating incomes for the month.

(Essay)

4.9/5  (34)

(34)

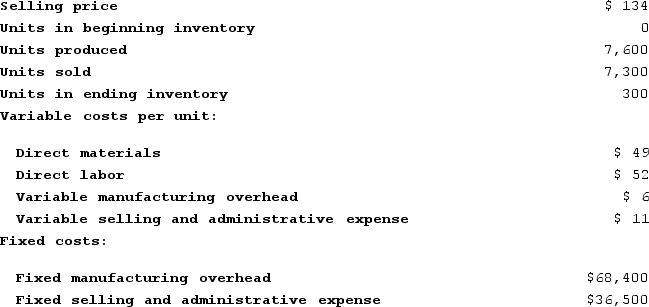

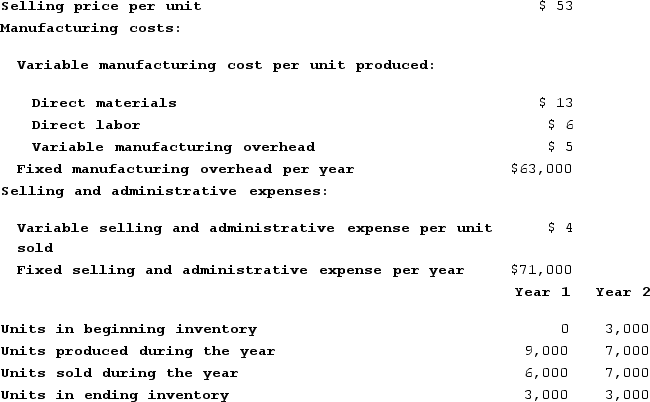

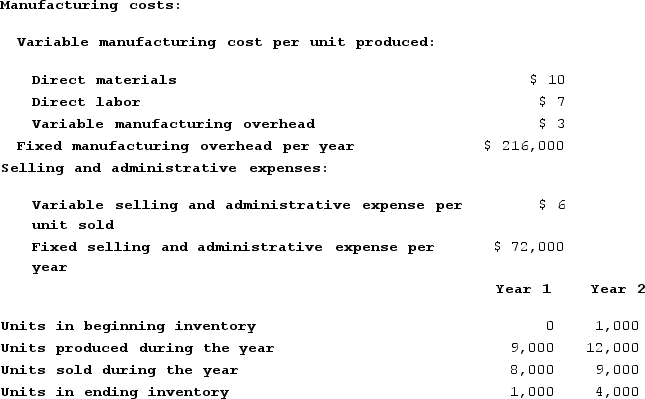

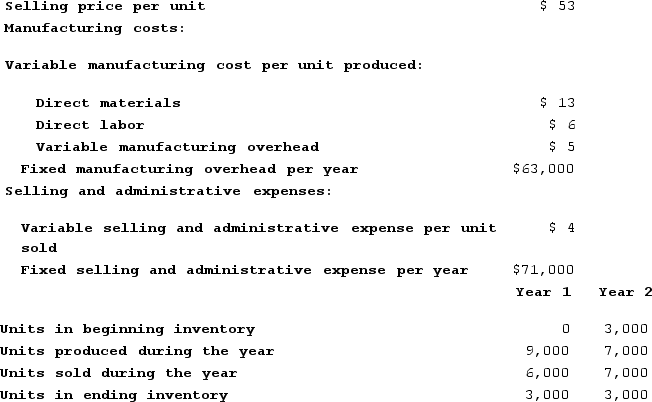

Bryans Corporation has provided the following data for its two most recent years of operation:  The net operating income (loss) under variable costing in Year 1 is closest to:

The net operating income (loss) under variable costing in Year 1 is closest to:

(Multiple Choice)

4.8/5  (37)

(37)

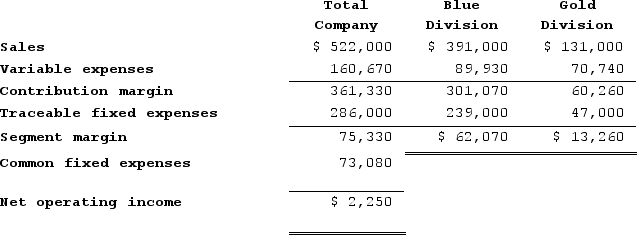

Wyrich Corporation has two divisions: Blue Division and Gold Division. The following report is for the most recent operating period:  The Gold Division's break-even sales is closest to:

The Gold Division's break-even sales is closest to:

(Multiple Choice)

4.8/5  (33)

(33)

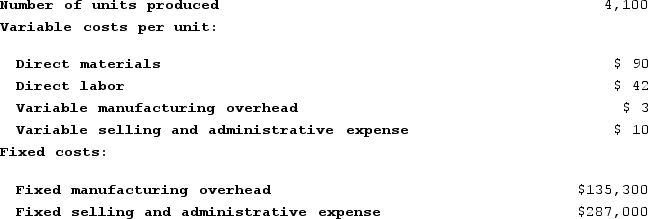

Beamish Incorporated, which produces a single product, has provided the following data for its most recent month of operations:  There were no beginning or ending inventories. The absorption costing unit product cost was:

There were no beginning or ending inventories. The absorption costing unit product cost was:

(Multiple Choice)

4.7/5  (39)

(39)

Lefelmann Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.Required:a. What is the unit product cost for the month under variable costing?b. What is the unit product cost for the month under absorption costing?c. Prepare a contribution format income statement for the month using variable costing.d. Prepare an income statement for the month using absorption costing.e. Reconcile the variable costing and absorption costing net operating incomes for the month.

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.Required:a. What is the unit product cost for the month under variable costing?b. What is the unit product cost for the month under absorption costing?c. Prepare a contribution format income statement for the month using variable costing.d. Prepare an income statement for the month using absorption costing.e. Reconcile the variable costing and absorption costing net operating incomes for the month.

(Essay)

4.8/5  (32)

(32)

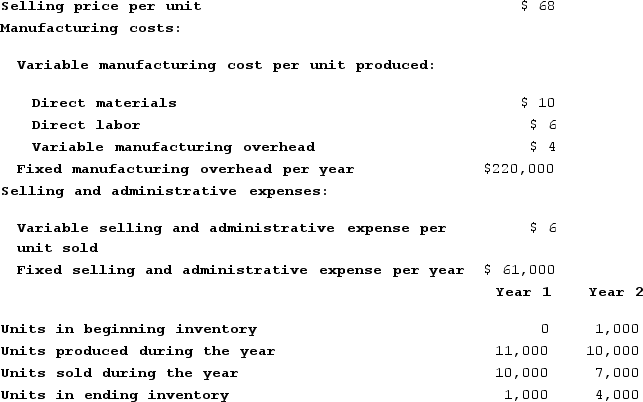

Else Corporation has provided the following data for its two most recent years of operation:

Required:

a.Assume the company uses absorption costing. Compute the unit product cost in each year.

b. Assume the company uses variable costing. Compute the unit product cost in each year.

Required:

a.Assume the company uses absorption costing. Compute the unit product cost in each year.

b. Assume the company uses variable costing. Compute the unit product cost in each year.

(Essay)

4.7/5  (43)

(43)

Under absorption costing, a portion of fixed manufacturing overhead cost is released from inventory when production volume exceeds sales volume.

(True/False)

4.8/5  (28)

(28)

Tustin Corporation has provided the following data for its two most recent years of operation:  The unit product cost under variable costing in Year 1 is closest to:

The unit product cost under variable costing in Year 1 is closest to:

(Multiple Choice)

4.8/5  (33)

(33)

Younie Corporation has two divisions: the South Division and the West Division. The corporation's net operating income is $26,900. The South Division's divisional segment margin is $42,800 and the West Division's divisional segment margin is $29,900. What is the amount of the common fixed expense not traceable to the individual divisions?

(Multiple Choice)

4.8/5  (42)

(42)

Tubaugh Corporation has two major business segments--East and West. In December, the East business segment had sales revenues of $690,000, variable expenses of $352,000, and traceable fixed expenses of $104,000. During the same month, the West business segment had sales revenues of $140,000, variable expenses of $56,000, and traceable fixed expenses of $24,000. The common fixed expenses totaled $162,000 and were allocated as follows: $89,000 to the East business segment and $73,000 to the West business segment.A properly constructed segmented income statement in a contribution format would show that the segment margin of the East business segment is:

(Multiple Choice)

4.9/5  (38)

(38)

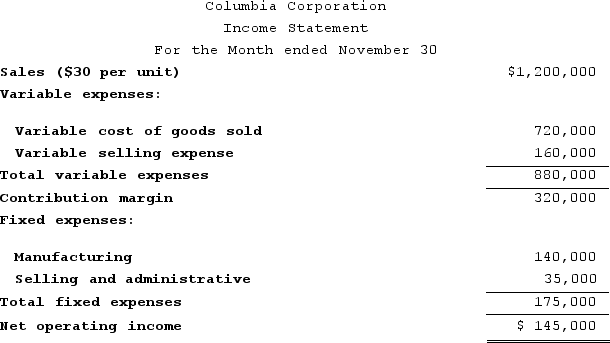

Columbia Corporation produces a single product. The company's variable costing income statement for November appears below:  During November, 35,000 units were manufactured and 8,000 units were in beginning inventory. Variable production costs per unit, total fixed manufacturing expenses, and the number of units produced were the same in prior months.The value of the company's inventory on November 30 under absorption costing would be:

During November, 35,000 units were manufactured and 8,000 units were in beginning inventory. Variable production costs per unit, total fixed manufacturing expenses, and the number of units produced were the same in prior months.The value of the company's inventory on November 30 under absorption costing would be:

(Multiple Choice)

4.9/5  (38)

(38)

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  The total gross margin for the month under absorption costing is:

The total gross margin for the month under absorption costing is:

(Multiple Choice)

4.9/5  (42)

(42)

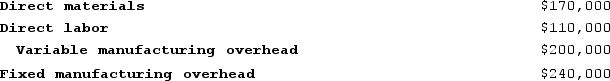

Krepps Corporation produces a single product. Last year, Krepps manufactured 20,000 units and sold 15,000 units. Production costs for the year were as follows:  Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.The contribution margin per unit was:

Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.The contribution margin per unit was:

(Multiple Choice)

4.7/5  (40)

(40)

Bryans Corporation has provided the following data for its two most recent years of operation:  The unit product cost under absorption costing in Year 1 is closest to:

The unit product cost under absorption costing in Year 1 is closest to:

(Multiple Choice)

4.9/5  (44)

(44)

Showing 21 - 40 of 392

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)