Exam 2: Job-Order Costing: Calculating Unit Product Costs

Exam 1: Managerial Accounting and Cost Concepts346 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs408 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting314 Questions

Exam 4: Process Costing365 Questions

Exam 5: Cost-Volume-Profit Relationships396 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management392 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making382 Questions

Exam 8: Master Budgeting284 Questions

Exam 9: Flexible Budgets and Performance Analysis491 Questions

Exam 10: Standard Costs and Variances469 Questions

Exam 11: Responsibility Accounting Systems335 Questions

Exam 12: Strategic Performance Measurement153 Questions

Exam 13: Differential Analysis: the Key to Decision Making432 Questions

Exam 14: Capital Budgeting Decisions405 Questions

Exam 15: Statement of Cash Flows221 Questions

Exam 16: Financial Statement Analysis327 Questions

Select questions type

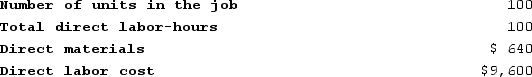

Beans Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $162,000, variable manufacturing overhead of $2.80 per direct labor-hour, and 60,000 direct labor-hours. Recently, Job K818 was completed with the following characteristics:  The unit product cost for Job K818 is closest to: (Round your intermediate calculations to 2 decimal places.)

The unit product cost for Job K818 is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.9/5  (38)

(38)

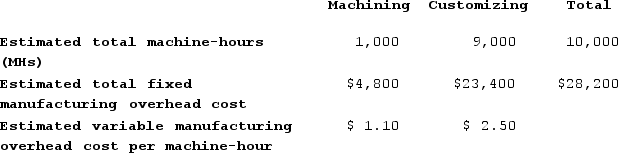

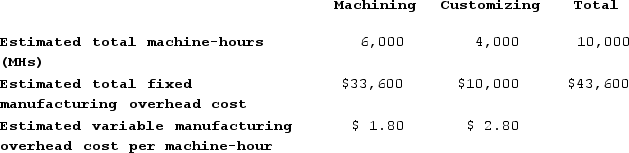

Janicki Corporation has two manufacturing departments--Machining and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job A and Job J. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job A and Job J. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job A is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job A is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

5.0/5  (39)

(39)

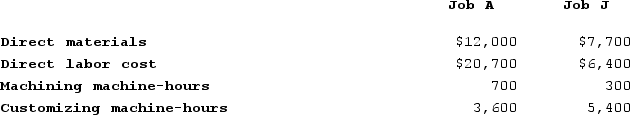

Fatzinger Corporation has two production departments, Milling and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  The predetermined overhead rate for the Assembly Department is closest to:

The predetermined overhead rate for the Assembly Department is closest to:

(Multiple Choice)

4.9/5  (32)

(32)

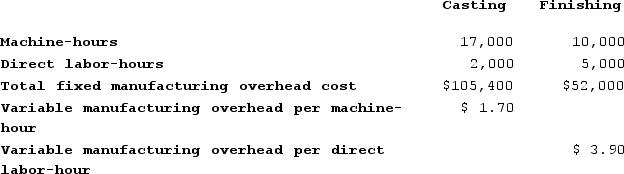

Marciante Corporation has two production departments, Casting and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  The estimated total manufacturing overhead for the Finishing Department is closest to:

The estimated total manufacturing overhead for the Finishing Department is closest to:

(Multiple Choice)

4.9/5  (42)

(42)

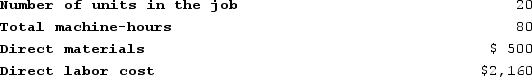

Kostelnik Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $237,000, variable manufacturing overhead of $3.90 per machine-hour, and 30,000 machine-hours. The company has provided the following data concerning Job A496 which was recently completed:  The amount of overhead applied to Job A496 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied to Job A496 is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.8/5  (38)

(38)

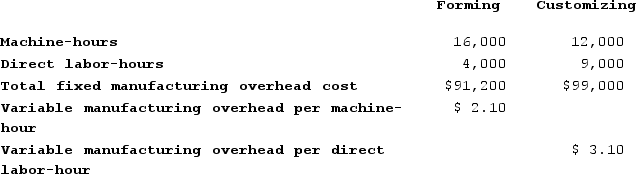

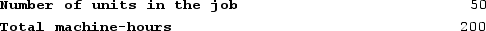

Pangle Corporation has two production departments, Forming and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

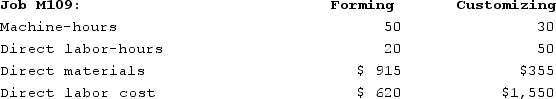

During the current month the company started and finished Job M109. The following data were recorded for this job:

During the current month the company started and finished Job M109. The following data were recorded for this job:

Required:Calculate the total job cost for Job M109.

Required:Calculate the total job cost for Job M109.

(Essay)

4.8/5  (32)

(32)

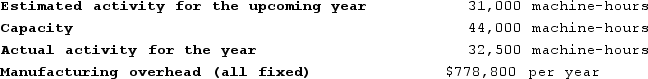

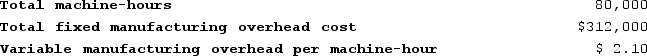

The management of Michaeli Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity rather than on the estimated amount of activity for the year. The company's controller has provided an example to illustrate how this new system would work.

Required:Determine the cost of unused capacity for the year if the predetermined overhead rate is based on activity at capacity.

Required:Determine the cost of unused capacity for the year if the predetermined overhead rate is based on activity at capacity.

(Essay)

4.8/5  (30)

(30)

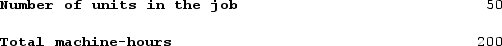

Saxon Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on 10,000 machine-hours, total fixed manufacturing overhead cost of $91,000, and a variable manufacturing overhead rate of $2.40 per machine-hour. Job K373, which was for 60 units of a custom product, was recently completed. The job cost sheet for the job contained the following data:

Required:a. Calculate the estimated total manufacturing overhead for the year.b. Calculate the predetermined overhead rate for the year.c. Calculate the amount of overhead applied to Job K373.d. Calculate the total job cost for Job K373.e. Calculate the unit product cost for Job K373

Required:a. Calculate the estimated total manufacturing overhead for the year.b. Calculate the predetermined overhead rate for the year.c. Calculate the amount of overhead applied to Job K373.d. Calculate the total job cost for Job K373.e. Calculate the unit product cost for Job K373

(Essay)

4.8/5  (27)

(27)

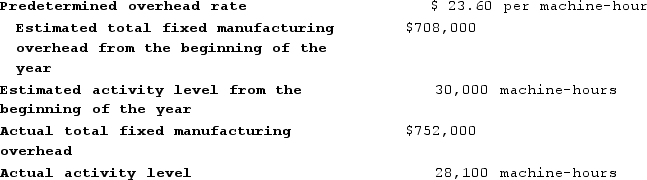

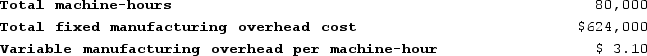

Harootunian Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job T629 was completed with the following characteristics:

Recently, Job T629 was completed with the following characteristics:

The estimated total manufacturing overhead is closest to:

The estimated total manufacturing overhead is closest to:

(Multiple Choice)

4.9/5  (38)

(38)

Kavin Corporation uses a predetermined overhead rate base on machine-hours that it recalculates at the beginning of each year. The company has provided the following data for the most recent year.  The amount of manufacturing overhead that would have been applied to all jobs during the period is closest to:

The amount of manufacturing overhead that would have been applied to all jobs during the period is closest to:

(Multiple Choice)

4.9/5  (50)

(50)

Harootunian Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job T629 was completed with the following characteristics:

Recently, Job T629 was completed with the following characteristics:

The predetermined overhead rate is closest to:

The predetermined overhead rate is closest to:

(Multiple Choice)

4.9/5  (45)

(45)

Assigning manufacturing overhead to a specific job is complicated by all of the below except:

(Multiple Choice)

4.9/5  (43)

(43)

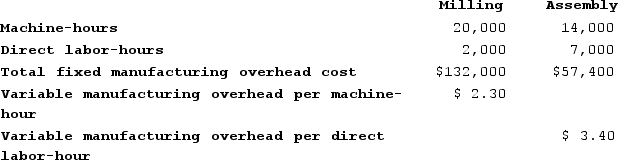

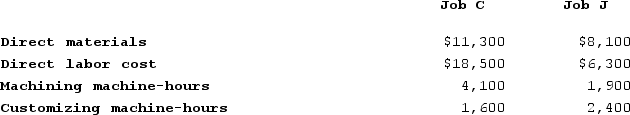

Halbur Corporation has two manufacturing departments--Machining and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job C and Job J. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job C and Job J. There were no beginning inventories. Data concerning those two jobs follow:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job J is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours. The amount of manufacturing overhead applied to Job J is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.9/5  (41)

(41)

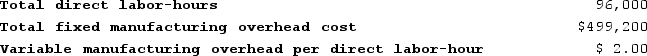

Dehner Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job P951 was completed with the following characteristics:

Recently, Job P951 was completed with the following characteristics:

The unit product cost for Job P951 is closest to: (Round your intermediate calculations to 2 decimal places.)

The unit product cost for Job P951 is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.8/5  (52)

(52)

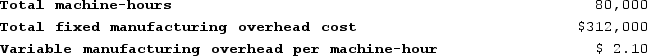

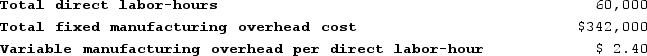

Verry Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:

Recently Job X711 was completed and required 90 direct labor-hours.Required:a. Calculate the estimated total manufacturing overhead for the year.b. Calculate the predetermined overhead rate for the year.c. Calculate the amount of overhead applied to Job X711.

Recently Job X711 was completed and required 90 direct labor-hours.Required:a. Calculate the estimated total manufacturing overhead for the year.b. Calculate the predetermined overhead rate for the year.c. Calculate the amount of overhead applied to Job X711.

(Essay)

4.8/5  (38)

(38)

Sivret Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:  Recently, Job M598 was completed with the following characteristics:

Recently, Job M598 was completed with the following characteristics:

The amount of overhead applied to Job M598 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied to Job M598 is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.9/5  (40)

(40)

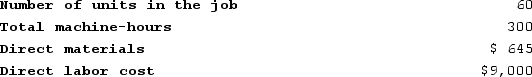

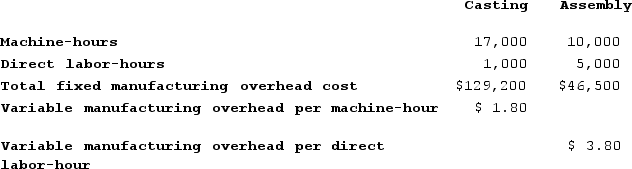

Tiff Corporation has two production departments, Casting and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Casting Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:  During the current month the company started and finished Job P131. The following data were recorded for this job:

During the current month the company started and finished Job P131. The following data were recorded for this job:

The amount of overhead applied in the Assembly Department to Job P131 is closest to: (Round your intermediate calculations to 2 decimal places.)

The amount of overhead applied in the Assembly Department to Job P131 is closest to: (Round your intermediate calculations to 2 decimal places.)

(Multiple Choice)

4.8/5  (31)

(31)

The management of Plitt Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity. The company's controller has provided an example to illustrate how this new system would work. In this example, the allocation base is machine-hours and the estimated amount of the allocation base for the upcoming year is 69,000 machine-hours. Capacity is 82,000 machine-hours and the actual level of activity for the year is assumed to be 72,400 machine-hours. All of the manufacturing overhead is fixed and both the estimated amount at the beginning of the year and the actual amount at the end of the year are assumed to be $4,130,340 per year. It is assumed that a number of jobs were worked on during the year, one of which was Job Q20L which required 470 machine-hours.If the company bases its predetermined overhead rate on capacity, what would be the cost of unused capacity reported on the income statement prepared for internal management purposes?

(Multiple Choice)

4.8/5  (35)

(35)

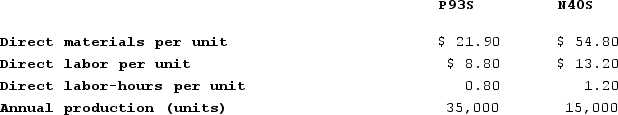

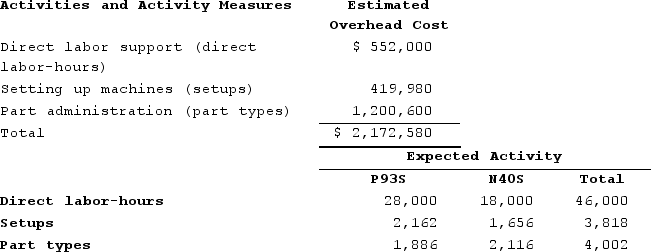

Coudriet Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs). The company has two products, P93S and N40S, about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $2,172,580 and the company's estimated total direct labor-hours for the year is 46,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $2,172,580 and the company's estimated total direct labor-hours for the year is 46,000.The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The unit product cost of product N40S under the activity-based costing system is closest to:

The unit product cost of product N40S under the activity-based costing system is closest to:

(Multiple Choice)

4.9/5  (42)

(42)

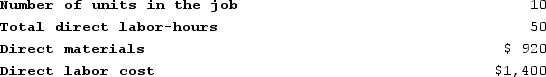

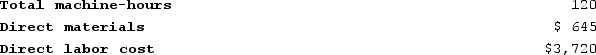

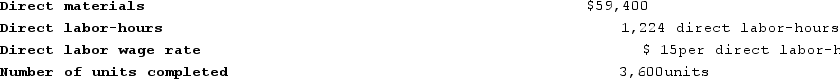

Job 652 was recently completed. The following data have been recorded on its job cost sheet:

The company applies manufacturing overhead on the basis of direct labor-hours. The predetermined overhead rate is $35 per direct labor-hour.Required:Compute the unit product cost that would appear on the job cost sheet for this job.

The company applies manufacturing overhead on the basis of direct labor-hours. The predetermined overhead rate is $35 per direct labor-hour.Required:Compute the unit product cost that would appear on the job cost sheet for this job.

(Essay)

4.9/5  (32)

(32)

Showing 41 - 60 of 408

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)