Exam 12: Game Theory

Exam 1: Adventures in Microeconomics20 Questions

Exam 2: Supply and Demand148 Questions

Exam 3: Using Supply and Demand to Analyze Markets146 Questions

Exam 4: Consumer Behavior130 Questions

Exam 5: Individual and Market Demand146 Questions

Exam 6: Producer Behavior142 Questions

Exam 7: Costs179 Questions

Exam 8: Supply in a Competitive Market148 Questions

Exam 9: Market Power and Monopoly162 Questions

Exam 10: Market Power and Pricing Strategies165 Questions

Exam 11: Imperfect Competition172 Questions

Exam 12: Game Theory170 Questions

Exam 13: Factor Markets94 Questions

Exam 14: Investment, Time, and Insurance117 Questions

Exam 15: General Equilibrium97 Questions

Exam 16: Asymmetric Information106 Questions

Exam 17: Externalities and Public Goods114 Questions

Exam 18: Behavioral and Experimental Economics112 Questions

Select questions type

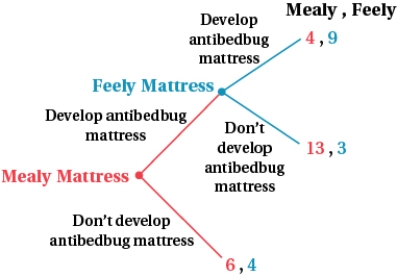

(Figure: Feely Mattress and Mealy Mattress I) In the figure, payoffs are profits in millions of dollars.  Suppose that Feely cannot develop an anti-bedbug mattress because of Mealy's patented technology. Should Mealy develop and release its anti-bedbug mattress?

Suppose that Feely cannot develop an anti-bedbug mattress because of Mealy's patented technology. Should Mealy develop and release its anti-bedbug mattress?

(Multiple Choice)

4.8/5  (35)

(35)

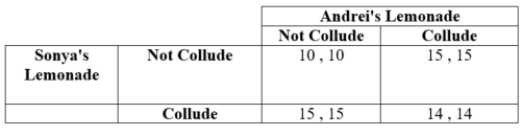

(Table: Lemonade) Andrei and Sonya operate lemonade stands in the same neighborhood.  Payoffs are in quarters . The kids have formed an agreement to restrict output. They are playing an infinitely repeated game in which output decisions must be made every period and both of them are using tit-for-tat trigger strategies. If the discount rate is d = 0.33, then the players ____.

Payoffs are in quarters . The kids have formed an agreement to restrict output. They are playing an infinitely repeated game in which output decisions must be made every period and both of them are using tit-for-tat trigger strategies. If the discount rate is d = 0.33, then the players ____.

(Multiple Choice)

4.8/5  (37)

(37)

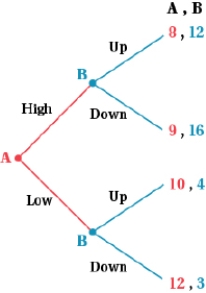

(Figure: Firms A and B III)  The Nash equilibrium of this game is:

The Nash equilibrium of this game is:

(Multiple Choice)

4.8/5  (35)

(35)

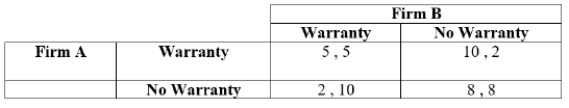

(Table: Firms A and B II) The payoffs represent profits in millions of dollars.  In this infinitely repeated game, Firm A and Firm B agree to cooperate and not offer warranty coverage. Each firm follows a grim trigger strategy. At what value of d is Firm A indifferent between keeping the agreement with Firm B and cheating on it?

In this infinitely repeated game, Firm A and Firm B agree to cooperate and not offer warranty coverage. Each firm follows a grim trigger strategy. At what value of d is Firm A indifferent between keeping the agreement with Firm B and cheating on it?

(Multiple Choice)

4.8/5  (35)

(35)

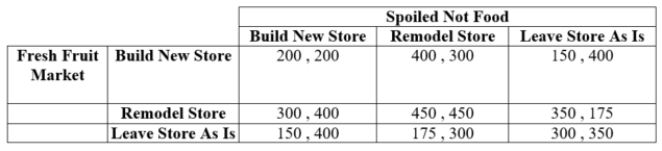

(Table: Fresh Fruit Market and Spoiled Not Food I) Payoffs are in thousands of dollars.  The Nash Equilibrium in this game is ____.

The Nash Equilibrium in this game is ____.

(Multiple Choice)

4.8/5  (33)

(33)

Consider the following game. Either of the two players can choose to stop the game or continue it at any point. If a player continues the game, she loses $1, and $2 is added to her opponent's payoff. The game is played for 10 rounds. Construct the decision tree for this game.

(Essay)

4.9/5  (37)

(37)

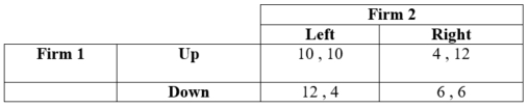

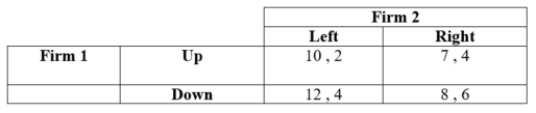

(Table: Firms 1 and 2 IV) Payoffs represent profits in millions of dollars.  If Firm 1 chooses up, the best strategy for Firm 2 is ____.

If Firm 1 chooses up, the best strategy for Firm 2 is ____.

(Multiple Choice)

4.7/5  (32)

(32)

Which of the following is (are) the elements of every game?

I. players

II. strategies

III. payoffs

IV. a pure-strategy Nash equilibrium

(Multiple Choice)

4.8/5  (28)

(28)

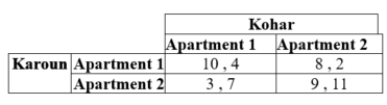

Karoun and Kohar hope to be roommates and are choosing between two apartments. Their payoffs are as given in the table.  There exists a mixed-strategy Nash equilibrium when Kohar chooses Apartment 2 with probability ____.

There exists a mixed-strategy Nash equilibrium when Kohar chooses Apartment 2 with probability ____.

(Multiple Choice)

4.9/5  (36)

(36)

Consider a game in which a person called the proposer is given $200. The proposer must choose to split the money with a person called the responder. The money must be split in one of three ways:

(1) Proposer keeps $199; responder gets $1.

(2) Proposer keeps $100; responder gets $100.

(3) Proposer keeps $50; responder gets $150.

The responder can either accept or reject the proposer's offer. If the responder rejects the offer, both players get nothing. Illustrate this game in extensive form. Using backward induction, what is the outcome of this game?

(Essay)

4.8/5  (28)

(28)

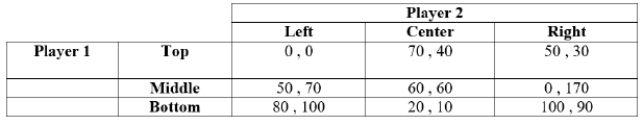

(Table: Players 1 and 2 III) Payoffs represent profits in millions of dollars.  Which of the following statements is (are) TRUE?

I. In a simultaneous game that is played only once, the Nash equilibria are (80 , 100) and (70 , 40).

II. In a sequential game in which Player 1 moves first, the Nash equilibrium is (100 , 90).

III. In a simultaneous game that is played only once, the dominated strategy for Player 1 is Middle.

Which of the following statements is (are) TRUE?

I. In a simultaneous game that is played only once, the Nash equilibria are (80 , 100) and (70 , 40).

II. In a sequential game in which Player 1 moves first, the Nash equilibrium is (100 , 90).

III. In a simultaneous game that is played only once, the dominated strategy for Player 1 is Middle.

(Multiple Choice)

4.9/5  (27)

(27)

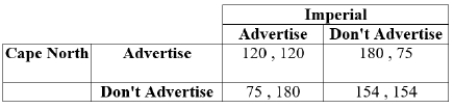

(Table: Cape North and Imperial Strategies I) The payoffs represent profits.  If Cape North and Imperial both choose their dominated strategy, Cape North will earn a profit of _____ and Imperial will earn a profit of _____.

If Cape North and Imperial both choose their dominated strategy, Cape North will earn a profit of _____ and Imperial will earn a profit of _____.

(Multiple Choice)

4.8/5  (31)

(31)

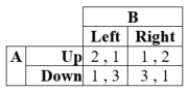

Suppose that, in a two-player game, player A can move Up or Down, and player B can choose Left or Right. Payoffs for this game are given in the table.  There exists a mixed-strategy Nash equilibrium at which Player A plays Down with probability ____.

There exists a mixed-strategy Nash equilibrium at which Player A plays Down with probability ____.

(Multiple Choice)

4.8/5  (41)

(41)

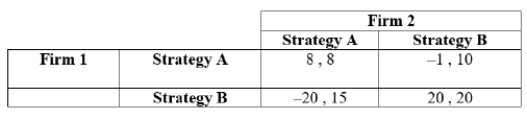

(Table: Firms 1 and 2 II) The payoffs are profits in millions of dollars.  The Nash equilibrium of this game is:

The Nash equilibrium of this game is:

(Multiple Choice)

4.9/5  (37)

(37)

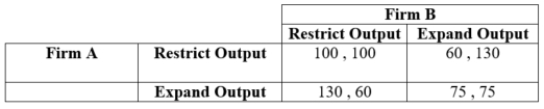

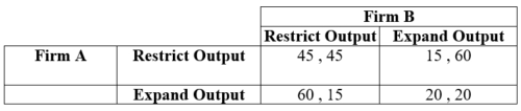

(Table: Firms A and B X) Two firms have formed an agreement to restrict output.  They are playing an infinitely repeated game in which output decisions must be made every period. Both firms are using grim trigger strategies.

They are playing an infinitely repeated game in which output decisions must be made every period. Both firms are using grim trigger strategies.

(Essay)

4.8/5  (35)

(35)

(Table: Firms A and B IX) Two firms have formed an agreement to restrict output.  They are playing an infinitely repeated game in which output decisions must be made every period. Both firms are using a grim trigger strategy. At what value of d (discount rate) would Firm A be indifferent about keeping the agreement or cheating on the agreement?

They are playing an infinitely repeated game in which output decisions must be made every period. Both firms are using a grim trigger strategy. At what value of d (discount rate) would Firm A be indifferent about keeping the agreement or cheating on the agreement?

(Essay)

4.8/5  (32)

(32)

(Table: Firms A and B I) The payoffs represent profits in thousands of dollars.  Suppose that two firms are playing an infinitely repeated game. In period 6, Firm B decides it will no longer cooperate with Firm A. If Firm A is using a grim trigger strategy, Firm A will choose:

Suppose that two firms are playing an infinitely repeated game. In period 6, Firm B decides it will no longer cooperate with Firm A. If Firm A is using a grim trigger strategy, Firm A will choose:

(Multiple Choice)

4.7/5  (22)

(22)

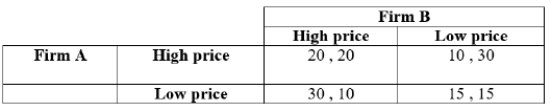

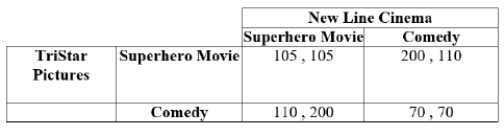

(Table: TriStar Pictures and New Line Cinema I)  Payoffs represent profits in millions of dollars. In this simultaneous game, TriStar and New Line Cinema both decide the genre of their summer movie release. TriStar prefers to release a superhero movie and New Line Cinema releases a comedy. TriStar enters into an irrevocable contract that will provide penalty payments to theater chains if it releases a summer comedy. These penalty payments serve as a credible commitment to TriStar's desire to release a superhero movie. How large do these penalty payments have to be to convince New Line Cinema that TriStar will release a superhero movie?

Payoffs represent profits in millions of dollars. In this simultaneous game, TriStar and New Line Cinema both decide the genre of their summer movie release. TriStar prefers to release a superhero movie and New Line Cinema releases a comedy. TriStar enters into an irrevocable contract that will provide penalty payments to theater chains if it releases a summer comedy. These penalty payments serve as a credible commitment to TriStar's desire to release a superhero movie. How large do these penalty payments have to be to convince New Line Cinema that TriStar will release a superhero movie?

(Multiple Choice)

4.8/5  (26)

(26)

(Table: Firms 1 and 2 III) Payoffs represent profits in millions of dollars.  Firm 2's dominant strategy is ____.

Firm 2's dominant strategy is ____.

(Multiple Choice)

4.9/5  (31)

(31)

Showing 141 - 160 of 170

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)