Exam 3: Using Supply and Demand to Analyze Markets

Exam 1: Adventures in Microeconomics20 Questions

Exam 2: Supply and Demand148 Questions

Exam 3: Using Supply and Demand to Analyze Markets146 Questions

Exam 4: Consumer Behavior130 Questions

Exam 5: Individual and Market Demand146 Questions

Exam 6: Producer Behavior142 Questions

Exam 7: Costs179 Questions

Exam 8: Supply in a Competitive Market148 Questions

Exam 9: Market Power and Monopoly162 Questions

Exam 10: Market Power and Pricing Strategies165 Questions

Exam 11: Imperfect Competition172 Questions

Exam 12: Game Theory170 Questions

Exam 13: Factor Markets94 Questions

Exam 14: Investment, Time, and Insurance117 Questions

Exam 15: General Equilibrium97 Questions

Exam 16: Asymmetric Information106 Questions

Exam 17: Externalities and Public Goods114 Questions

Exam 18: Behavioral and Experimental Economics112 Questions

Select questions type

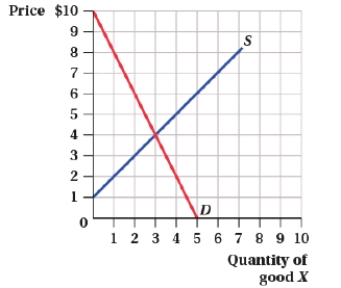

(Figure: Market for Good X I) Which of the following statements is (are) TRUE?  I. A tax on buyers of $3 per unit raises the price buyers pay to $6.

II) A tax on sellers of $3 per unit raises the price buyers pay to $6.

III) With a tax on sellers of $3 per unit, the share of the tax paid by buyers is 67%.

I. A tax on buyers of $3 per unit raises the price buyers pay to $6.

II) A tax on sellers of $3 per unit raises the price buyers pay to $6.

III) With a tax on sellers of $3 per unit, the share of the tax paid by buyers is 67%.

Free

(Multiple Choice)

4.7/5  (39)

(39)

Correct Answer:

A

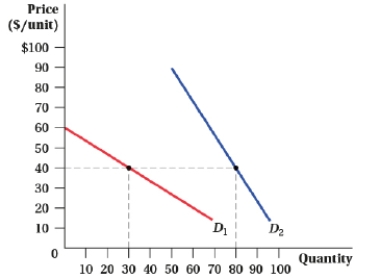

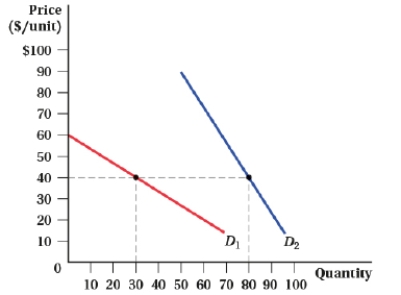

(Figure: Price and Quantity V) Answer the following questions.  a. For demand curve D1, what is the level of consumer surplus at a price of $40?

b. For demand curve D2, consumer surplus is $6,400 at a price of $40. What is the demand choke price?

a. For demand curve D1, what is the level of consumer surplus at a price of $40?

b. For demand curve D2, consumer surplus is $6,400 at a price of $40. What is the demand choke price?

Free

(Essay)

4.8/5  (27)

(27)

Correct Answer:

a. The area of the triangle between the demand curve and the market price is 0.5(60 - 40)(30 - 0) = $300.

b. The area of the triangle between the demand curve and market price is $6,400, so set 0.5 × base × height = $6,400. The height is 80 and the base equals the demand choke price - 40, so consumer surplus is 0.5(demand choke price - 40)(80) = $6,400. Demand choke price is $200.

If the legal burden of a tax is passed from sellers to buyers:

Free

(Multiple Choice)

5.0/5  (35)

(35)

Correct Answer:

D

Suppose the demand and supply curves for shampoo are given by

QD = 18 - 5P

QS = -3 + 2P

Where QD is the quantity of shampoo demanded (in thousands of bottles), QS is the quantity supplied, and P is the price of shampoo (in dollars per bottle). The consumer surplus at the equilibrium price is ____.

(Multiple Choice)

4.7/5  (37)

(37)

The supply and demand for organic peanut butter are QD = 70 - 5P and QS = 5P, where P is price per jar and Q is in hundreds of jars per day. The government decides to impose either a $1 supply subsidy or a price floor equal to $7.50. The producer surplus associated with the price floor would be _____.

(Essay)

4.9/5  (27)

(27)

The demand for a good is given by QD = 750 - 0.4P. What is consumer surplus at a price of $80?

(Multiple Choice)

4.8/5  (31)

(31)

The market for cookies is represented by the following supply and demand conditions:

QD = 1,000 - 200P and QS = 400P - 200, where P is price per box of cookies and Q measures boxes per day.

a. Solve for the equilibrium price and quantity and then use supply and demand curves to illustrate your answer.

b. Suppose the government places a quota of 500 boxes per day on cookies. Solve for the equilibrium price and quantity and then use supply and demand curves to illustrate your answer.

c. Calculate consumer surplus before and after the quota.

d. Calculate producer surplus before and after the quota.

e. Calculate the deadweight loss from the quota.

(Essay)

4.8/5  (42)

(42)

In the market for cotton, the quantity demanded and quantity supplied are expressed mathematically as QD = 400 - 250P and QS = 250P - 100, where P is the price per pound of cotton and Q measures pounds of cotton. Suppose the government sets a price ceiling of $0.50 per pound of cotton. The consumer surplus with the price ceiling is:

(Multiple Choice)

4.9/5  (40)

(40)

At the equilibrium price of $10, the elasticity of demand and supply are -0.9 and 1.10. If the government institutes a tax of $1 per unit, sellers will receive _____ and consumers will pay _____.

(Multiple Choice)

4.9/5  (29)

(29)

Suppose the demand and supply curves for shampoo are given by

QD = 18 - 5P

QS = -3 + 2P

Where QD is the quantity of shampoo demanded (in thousands of bottles), QS is the quantity supplied, and P is the price of shampoo (in dollars per bottle). The equilibrium price in this market is ____ and the equilibrium quantity is ____.

(Multiple Choice)

4.8/5  (31)

(31)

(Figure: Price and Quantity V) For demand curve D1, the level of consumer surplus at a price of $40 is:

(Multiple Choice)

4.9/5  (42)

(42)

Suppose the demand and supply curves for shampoo are given by

QD = 18 - 5P

QS = -3 + 2P

where QD is the quantity of shampoo demanded (in thousands of bottles), QS is the quantity supplied, and P is the price of shampoo (in dollars per bottle). Calculate producer surplus at the equilibrium price using calculus.

(Essay)

4.9/5  (35)

(35)

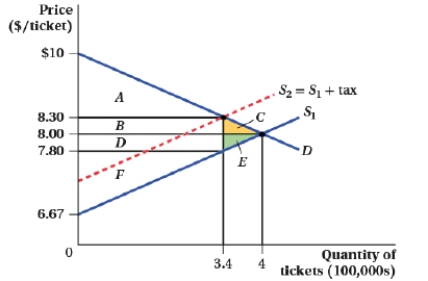

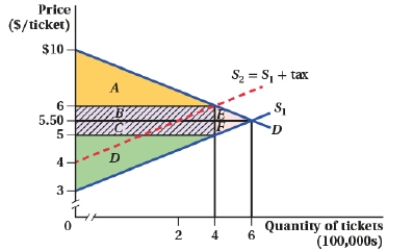

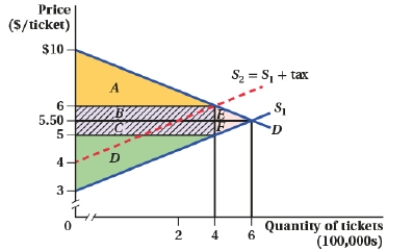

(Figure: Market for Tickets I) Which of the following statements is (are) TRUE?  I. Consumer surplus after the tax is area A + B.

II) Producer surplus before the tax is D + E + F.

III) Consumer surplus before the tax is A + C + E.

IV) The size of the tax is $0.50, raising $170,000 in tax revenue.

I. Consumer surplus after the tax is area A + B.

II) Producer surplus before the tax is D + E + F.

III) Consumer surplus before the tax is A + C + E.

IV) The size of the tax is $0.50, raising $170,000 in tax revenue.

(Multiple Choice)

4.9/5  (38)

(38)

The demand curve for pizza on the college campus is represented by QD = 1,000 - 40P. At a price of $14, the total consumer surplus for the college campus would be $_____.

(Essay)

4.9/5  (41)

(41)

Suppose that the demand curve for an advanced technology product for businesses is given by P =10,000 - 4Q3 and supply is P = 2,000 + 4Q3. The consumer surplus at the equilibrium price is ____.

(Multiple Choice)

4.9/5  (33)

(33)

(Figure: Market for Tickets II) The government tax revenue is:

(Multiple Choice)

4.8/5  (32)

(32)

(Figure: Market for Tickets II) Before the tax, producer surplus is ____ and after the tax, producer surplus is ____.

(Multiple Choice)

4.8/5  (40)

(40)

To calculate consumer surplus for the case when a quota is in place:

(Multiple Choice)

4.7/5  (26)

(26)

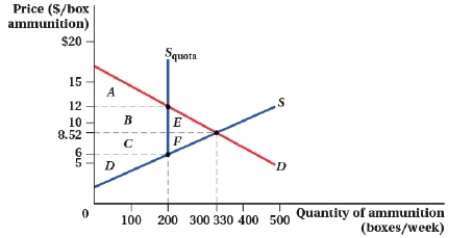

(Figure: Market for Ammunition I) Assuming the government imposes the quota of 200 boxes/week, the consumer surplus is:

(Multiple Choice)

4.8/5  (34)

(34)

Showing 1 - 20 of 146

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)