Exam 4: Supply and Demand: Applications and Extensions

Exam 1: The Economic Approach210 Questions

Exam 2: Some Tools of the Economist257 Questions

Exam 3: Demand, Supply, and the Market Process585 Questions

Exam 4: Supply and Demand: Applications and Extensions331 Questions

Exam 5: Difficult Cases for the Market, and the Role of Government168 Questions

Exam 6: The Economics of Political Action360 Questions

Exam 7: Consumer Choice and Elasticity223 Questions

Exam 8: Costs and the Supply of Goods231 Questions

Exam 9: Price Takers and the Competitive Process497 Questions

Exam 10: Price-Searcher Markets With Low Entry Barriers216 Questions

Exam 11: Price-Searcher Markets With High Entry Barriers254 Questions

Exam 12: The Supply of and Demand for Productive Resources200 Questions

Exam 13: Earnings, Productivity, and the Job Market109 Questions

Exam 14: Investment, the Capital Market, and the Wealth of Nations129 Questions

Exam 15: Income Inequality and Poverty136 Questions

Exam 16: Applying the Basics: Special Topics in Economics709 Questions

Select questions type

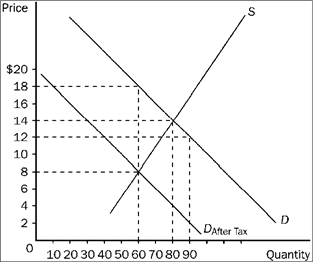

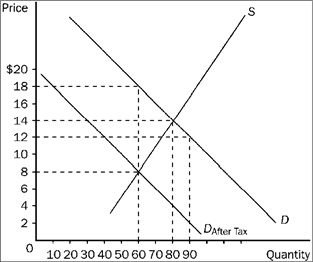

Figure 4-21  Refer to Figure 4-21. The price paid by buyers after the tax is imposed is

Refer to Figure 4-21. The price paid by buyers after the tax is imposed is

(Multiple Choice)

4.9/5  (44)

(44)

A tax is levied on products A and B, both of which have the same price elasticity of supply. The demand for A is more inelastic than is the demand for B. Other things constant, how will this affect the incidence of an excise tax on these products?

(Multiple Choice)

4.9/5  (38)

(38)

A $10 per unit government subsidy paid directly to sellers of heaters will result in

(Multiple Choice)

4.7/5  (29)

(29)

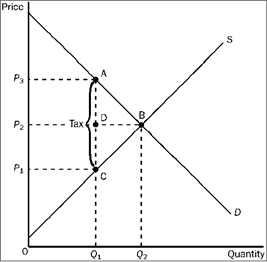

Figure 4-24  Refer to Figure 4-24. The per unit burden of the tax on buyers is

Refer to Figure 4-24. The per unit burden of the tax on buyers is

(Multiple Choice)

4.9/5  (37)

(37)

Use the figure below to answer the following question(s).

Figure 4-10

Figure 4-10 shows the market for a good before and after an excise tax is imposed. What does the triangular area C represent?

Figure 4-10 shows the market for a good before and after an excise tax is imposed. What does the triangular area C represent?

(Multiple Choice)

4.8/5  (37)

(37)

If there was an increase in the excise tax imposed on beer suppliers, what would be the effect on the equilibrium price and quantity of beer?

(Multiple Choice)

4.8/5  (33)

(33)

When a government subsidy is granted to the buyers of a product, sellers can end up capturing some of the benefit because

(Multiple Choice)

4.9/5  (37)

(37)

Many economists believe a general sales tax (particularly on items such as food) takes a larger proportion of income from low-income households than from high-income households. If this is true, a general sales tax is a

(Multiple Choice)

4.8/5  (39)

(39)

Figure 4-21  Refer to Figure 4-21. How much tax revenue does this tax produce for the government?

Refer to Figure 4-21. How much tax revenue does this tax produce for the government?

(Multiple Choice)

4.9/5  (34)

(34)

Use the figure below to answer the following question(s).

Figure 4-11

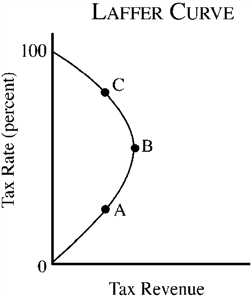

Refer to Figure 4-11. On the Laffer curve shown, tax revenue could be increased by

Refer to Figure 4-11. On the Laffer curve shown, tax revenue could be increased by

(Multiple Choice)

4.8/5  (41)

(41)

In the supply and demand model, a subsidy granted to sellers is illustrated by

(Multiple Choice)

4.9/5  (40)

(40)

About 35,000 general aviation multiengine airplanes are licensed to operate in the United States. If an additional $1,000-per-year tax was levied on each plane to raise general revenue, economic thinking suggests the

(Multiple Choice)

4.9/5  (44)

(44)

If Lex's income increases from $30,000 to $40,000 and his tax liability increases from $6,000 to $10,000, which of the following is true?

(Multiple Choice)

4.8/5  (37)

(37)

A payment the government makes to either the buyer or seller, usually on a per-unit basis, when a good or service is purchased or sold is called a

(Multiple Choice)

4.7/5  (39)

(39)

Lowincomesville, North Carolina, is a poor town. The mayor has decided to impose a law to cut all rental rates on apartments in half and to fix them at this level. Will this help the poor? Why or why not? Be sure to distinguish between the short run and the long run.

(Essay)

4.9/5  (36)

(36)

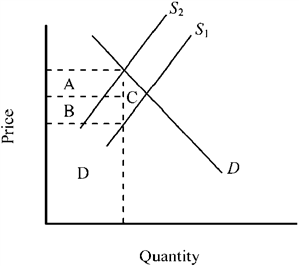

Use the figure below to answer the following question(s).

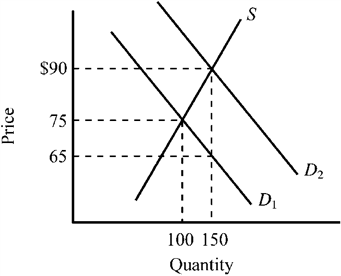

Figure 4-13

Refer to Figure 4-13. The supply curve S and the demand curve D1 indicate initial conditions in the market for flu shots. A new government program is implemented that grants buyers a $25 subsidy when they buy a flu shot, shifting the demand curve from D1 to D2. Which of the following is true for this subsidy given the information provided in the figure?

Refer to Figure 4-13. The supply curve S and the demand curve D1 indicate initial conditions in the market for flu shots. A new government program is implemented that grants buyers a $25 subsidy when they buy a flu shot, shifting the demand curve from D1 to D2. Which of the following is true for this subsidy given the information provided in the figure?

(Multiple Choice)

4.8/5  (35)

(35)

A subsidy on a product will generate more actual benefit for producers (and less for consumers) when

(Multiple Choice)

4.8/5  (36)

(36)

Showing 281 - 300 of 331

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)