Exam 4: Supply and Demand: Applications and Extensions

Exam 1: The Economic Approach210 Questions

Exam 2: Some Tools of the Economist257 Questions

Exam 3: Demand, Supply, and the Market Process585 Questions

Exam 4: Supply and Demand: Applications and Extensions331 Questions

Exam 5: Difficult Cases for the Market, and the Role of Government168 Questions

Exam 6: The Economics of Political Action360 Questions

Exam 7: Consumer Choice and Elasticity223 Questions

Exam 8: Costs and the Supply of Goods231 Questions

Exam 9: Price Takers and the Competitive Process497 Questions

Exam 10: Price-Searcher Markets With Low Entry Barriers216 Questions

Exam 11: Price-Searcher Markets With High Entry Barriers254 Questions

Exam 12: The Supply of and Demand for Productive Resources200 Questions

Exam 13: Earnings, Productivity, and the Job Market109 Questions

Exam 14: Investment, the Capital Market, and the Wealth of Nations129 Questions

Exam 15: Income Inequality and Poverty136 Questions

Exam 16: Applying the Basics: Special Topics in Economics709 Questions

Select questions type

Because illegal drug markets operate outside the legal system,

(Multiple Choice)

4.9/5  (39)

(39)

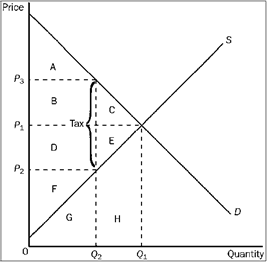

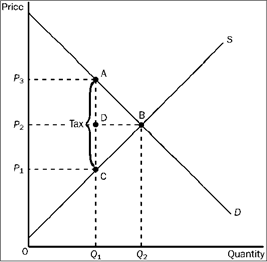

Figure 4-25  Refer to Figure 4-25. The price that sellers receive after the tax is imposed is

Refer to Figure 4-25. The price that sellers receive after the tax is imposed is

(Multiple Choice)

4.9/5  (33)

(33)

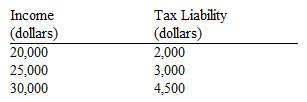

Use the table below to choose the correct answer.

The marginal tax rate on income in the $20,000 to $25,000 range is

The marginal tax rate on income in the $20,000 to $25,000 range is

(Multiple Choice)

4.7/5  (35)

(35)

When the top marginal tax rates were lowered substantially during the 1980s, the inflation-adjusted income tax revenue collected from the top 1 percent of all income earners

(Multiple Choice)

4.9/5  (37)

(37)

Figure 4-24  Refer to Figure 4-24. The price that sellers receive after the tax is imposed is

Refer to Figure 4-24. The price that sellers receive after the tax is imposed is

(Multiple Choice)

4.9/5  (30)

(30)

Suppose that the federal government levies a 50 cent excise tax on gasoline and that the demand for gasoline is highly inelastic while the supply is highly elastic. Under these circumstances, the burden of the tax

(Multiple Choice)

4.8/5  (35)

(35)

Other things constant, how will a decrease in the wages of teenagers affect the market for fast food hamburgers?

(Multiple Choice)

4.7/5  (42)

(42)

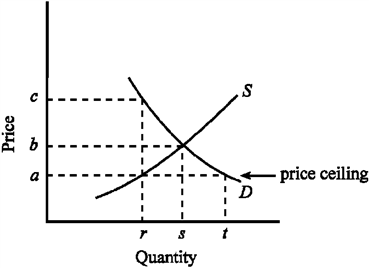

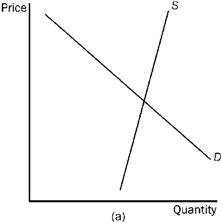

Use the figure below to answer the following question(s).

Figure 4-4

Given the demand and supply conditions shown in Figure 4-4, if the government imposes a price ceiling of a , which of the following would be true?

Given the demand and supply conditions shown in Figure 4-4, if the government imposes a price ceiling of a , which of the following would be true?

(Multiple Choice)

4.9/5  (37)

(37)

Data from the effects of the substantial tax rate reductions in the 1980s

(Multiple Choice)

4.8/5  (27)

(27)

Figure 4-24  Refer to Figure 4-24. The amount of deadweight loss associated with the tax is equal to

Refer to Figure 4-24. The amount of deadweight loss associated with the tax is equal to

(Multiple Choice)

4.8/5  (37)

(37)

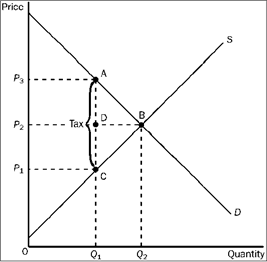

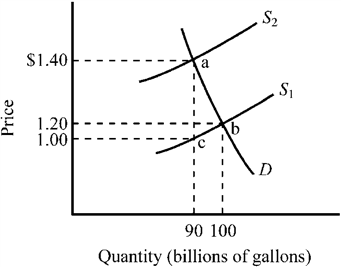

Use the figure below to answer the following question(s).

Figure 4-9

Refer to Figure 4-9. The market for gasoline was initially in equilibrium at point b . If a $.40 excise tax was imposed,

Refer to Figure 4-9. The market for gasoline was initially in equilibrium at point b . If a $.40 excise tax was imposed,

(Multiple Choice)

4.9/5  (37)

(37)

If the federal government began granting a subsidy of 10 cents per apple to apple growers and as a result the price of apples to consumers falls by 8 cents,

(Multiple Choice)

4.8/5  (39)

(39)

If drugs such as marijuana and cocaine were legalized, it would be likely that

(Multiple Choice)

4.8/5  (39)

(39)

An increase in the number of students attending college would tend to

(Multiple Choice)

4.8/5  (41)

(41)

If the demand for a good is very price elastic, the imposition of a tax on that good

(Multiple Choice)

5.0/5  (32)

(32)

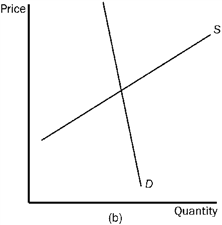

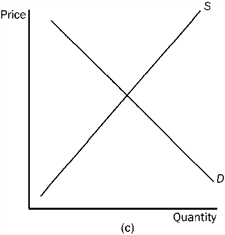

Figure 4-23

Refer to Figure 4-23. In which market will the tax burden be most equally divided between the buyer and the seller?

Refer to Figure 4-23. In which market will the tax burden be most equally divided between the buyer and the seller?

(Multiple Choice)

4.8/5  (38)

(38)

Showing 301 - 320 of 331

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)