Exam 4: Supply and Demand: Applications and Extensions

Exam 1: The Economic Approach210 Questions

Exam 2: Some Tools of the Economist257 Questions

Exam 3: Demand, Supply, and the Market Process585 Questions

Exam 4: Supply and Demand: Applications and Extensions331 Questions

Exam 5: Difficult Cases for the Market, and the Role of Government168 Questions

Exam 6: The Economics of Political Action360 Questions

Exam 7: Consumer Choice and Elasticity223 Questions

Exam 8: Costs and the Supply of Goods231 Questions

Exam 9: Price Takers and the Competitive Process497 Questions

Exam 10: Price-Searcher Markets With Low Entry Barriers216 Questions

Exam 11: Price-Searcher Markets With High Entry Barriers254 Questions

Exam 12: The Supply of and Demand for Productive Resources200 Questions

Exam 13: Earnings, Productivity, and the Job Market109 Questions

Exam 14: Investment, the Capital Market, and the Wealth of Nations129 Questions

Exam 15: Income Inequality and Poverty136 Questions

Exam 16: Applying the Basics: Special Topics in Economics709 Questions

Select questions type

Suppose a property tax of $300 per month is legally (statutorily) imposed on the owners of rental housing. Which of the following is likely to occur?

(Multiple Choice)

4.9/5  (43)

(43)

Government programs such as Medicare substantially subsidize health care purchases by some consumers in the U.S. economy. Who benefits from these subsidies? How do they affect the price of health care? If you are not a recipient of this program, are you made better or worse off by the subsidy? Explain.

(Essay)

4.8/5  (34)

(34)

Which of the following statements regarding black markets is true?

(Multiple Choice)

4.8/5  (40)

(40)

If the supply of health care services is highly inelastic, programs that subsidize the cost of purchasing medical services will

(Multiple Choice)

4.7/5  (34)

(34)

The deadweight loss resulting from levying a tax on an economic activity is

(Multiple Choice)

4.8/5  (39)

(39)

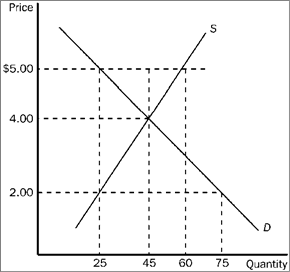

Figure 4-25  Refer to Figure 4-25. The equilibrium price before the tax is imposed is

Refer to Figure 4-25. The equilibrium price before the tax is imposed is

(Multiple Choice)

4.7/5  (41)

(41)

If Heather's tax liability increases from $10,000 to $13,500 when her income increases from $30,000 to $40,000, her marginal tax rate is

(Multiple Choice)

4.8/5  (33)

(33)

When a government subsidy is granted to the buyers of a product, sellers can end up capturing some of the benefit because

(Multiple Choice)

4.8/5  (40)

(40)

Suppose the market equilibrium price of wheat is $5 per bushel, and the government sets a price floor of $7 per bushel to aid growers. What is the most likely result of this action?

(Multiple Choice)

4.9/5  (26)

(26)

The imposition of price ceilings on a market often results in

(Multiple Choice)

5.0/5  (40)

(40)

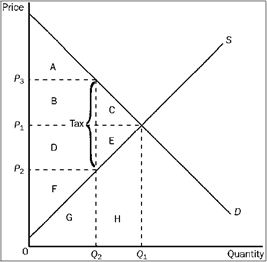

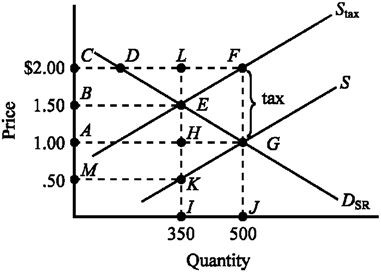

Figure 4-24  Refer to Figure 4-24. The amount of the tax on each unit of the good is

Refer to Figure 4-24. The amount of the tax on each unit of the good is

(Multiple Choice)

4.8/5  (44)

(44)

A price ceiling set below an equilibrium price tends to cause persistent imbalances in the market because

(Multiple Choice)

4.8/5  (43)

(43)

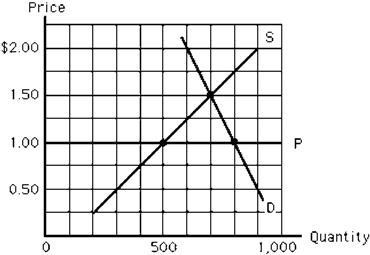

Figure 4-14  Figure 4-14 depicts the milk market. The horizontal line, P, represents a price ceiling imposed by the government. Which of the following is true?

Figure 4-14 depicts the milk market. The horizontal line, P, represents a price ceiling imposed by the government. Which of the following is true?

(Multiple Choice)

4.9/5  (37)

(37)

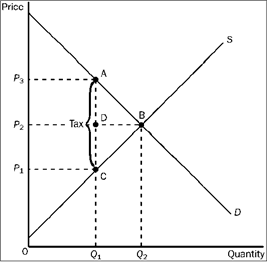

Figure 4-22  Refer to Figure 4-22. Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. Now,

Refer to Figure 4-22. Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. Now,

(Multiple Choice)

4.7/5  (37)

(37)

If a local government enacts rent control legislation that sets the price of rental housing below equilibrium, which of the following will most likely happen in the local rental housing market?

(Multiple Choice)

4.9/5  (37)

(37)

Figure 4-18  Refer to Figure 4-18. If the government imposes a price ceiling of $2.00 in this market, the result is a

Refer to Figure 4-18. If the government imposes a price ceiling of $2.00 in this market, the result is a

(Multiple Choice)

4.9/5  (38)

(38)

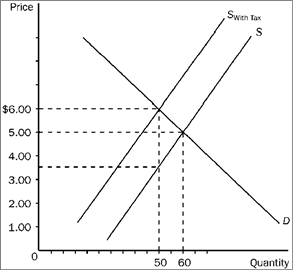

Use the figure below illustrating the impact of an excise tax to answer the following question(s).

Figure 4-6

Refer to Figure 4-6. The amount of the excise tax I is

Refer to Figure 4-6. The amount of the excise tax I is

(Multiple Choice)

4.8/5  (27)

(27)

In a market economy, which of the following will most likely cause a prolonged milk shortage?

(Multiple Choice)

4.8/5  (39)

(39)

A tax for which the average tax rate remains constant at all levels of income is defined as a

(Multiple Choice)

4.7/5  (28)

(28)

Showing 81 - 100 of 331

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)