Exam 1: CPA Auditing and Attestation Exam

Exam 1: CPA Auditing and Attestation Exam1 k+ Questions

Select questions type

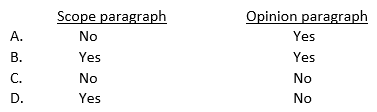

When disclaiming an opinion due to a client-imposed scope limitation, an auditor should indicate in a separate paragraph why the audit did not comply with generally accepted auditing standards. The auditor should also omit the:

(Multiple Choice)

4.8/5  (35)

(35)

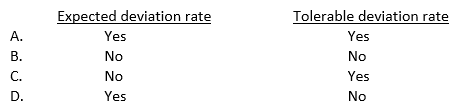

Which of the following factors is (are) considered in determining the sample size for a test of controls?

(Multiple Choice)

4.9/5  (34)

(34)

During the annual audit of Ajax Corp., a publicly held company, Jones, CPA, a continuing auditor, determined that illegal political contributions had been made during each of the past seven years, including the year under audit. Jones notified the board of directors about the illegal contributions, but they refused to take any action because the amounts involved were immaterial to the financial statements. Jones should reconsider the intended degree of reliance to be placed on the:

(Multiple Choice)

4.8/5  (38)

(38)

Cooper, CPA, believes there is substantial doubt about the ability of Zero Corp. to continue as a going concern for a reasonable period of time. In evaluating Zero's plans for dealing with the adverse effects of future conditions and events, Cooper most likely would consider, as a mitigating factor, Zero's plans to:

(Multiple Choice)

4.9/5  (42)

(42)

An entity engaged a CPA to determine whether the client's web sites meet defined criteria for standard business practices and controls over transaction integrity and information protection. In performing this engagement, the CPA should comply with the provisions of:

(Multiple Choice)

4.7/5  (38)

(38)

This question consists of an item pertaining to possible deficiencies in an accountant's review report. Jordan & Stone, CPAs, audited the financial statements of Tech Co., a nonissuer, for the year ended December 31, 20X1, and expressed an unqualified opinion. For the year ended December 31, 20X2, Tech issued comparative financial statements. Jordan & Stone reviewed Tech's 20X2 financial statements and Kent, an assistant on the engagement, drafted the accountants' review report below. Land, the engagement supervisor, decided not to reissue the prior year's auditors' report, but instructed Kent to include a separate paragraph in the current year's review report describing the responsibility assumed for the prior year's audited financial statements. This is an appropriate reporting procedure. Land reviewed Kent's draft and indicated in the Supervisor's Review Notes below that there were several deficiencies in Kent's draft. Accountant's Review Report We have reviewed and audited the accompanying balance sheets of Tech Co. as of December 31, 20X2 and 20X1, and the related statements of income, retained earnings, and cash flows for the years then ended, in accordance with Statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants and generally accepted auditing standards. All information included in these financial statements is the representation of the management of Tech Co. A review consists principally of inquiries of company personnel and analytical procedures applied to financial data. It is substantially less in scope than an audit in accordance with generally accepted auditing standards, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Based on our review, we are not aware of any material modifications that should be made to the accompanying financial statements. Because of the inherent limitations of a review engagement, this report is intended for the information of management and should not be used for any other purpose. The financial statements for the year ended December 31, 20X1, were audited by us and our report was dated March 2, 20X2. We have no responsibility for updating that report for events and circumstances occurring after that date. Jordan and Stone, CPAs March 1, 20X3 Supervisor's Review Notes There should be no restriction on the use of the accountant's review report in the third paragraph.

(Multiple Choice)

4.9/5  (30)

(30)

Which of the following internal control procedures most likely addresses the completeness assertion for inventory?

(Multiple Choice)

4.7/5  (38)

(38)

A letter issued on significant deficiencies relating to an entity's internal control observed during an audit of the financial statements of a nonissuer should include a:

(Multiple Choice)

5.0/5  (30)

(30)

In determining the number of documents to select for a test to obtain assurance that all sales returns have been properly authorized, an auditor should consider the tolerable rate of deviation from the control activity. The auditor should also consider the:

(Multiple Choice)

4.8/5  (46)

(46)

Holding other planning considerations equal, a decrease in the amount of misstatements in a class of transactions that an auditor could tolerate most likely would cause the auditor to:

(Multiple Choice)

4.9/5  (33)

(33)

When audited financial statements are presented in a client's document containing other information, the auditor should:

(Multiple Choice)

4.9/5  (32)

(32)

An entity's internal control requires for every check request that there be an approved voucher, supported by a prenumbered purchase order and a prenumbered receiving report. To determine whether checks are being issued for unauthorized expenditures, an auditor most likely would select items for testing from the population of all:

(Multiple Choice)

4.7/5  (41)

(41)

Which of the following statements is correct about the auditor's use of the work of a specialist?

(Multiple Choice)

4.9/5  (39)

(39)

Field is an employee of Gold Enterprises. Hardy, CPA, is asked to express an opinion on Field's profit participation in Gold's net income. Hardy may accept this engagement only if:

(Multiple Choice)

4.8/5  (34)

(34)

To determine whether accounts payable are complete, an auditor performs a test to verify that all merchandise received is recorded. The population of documents for this test consists of all:

(Multiple Choice)

4.8/5  (35)

(35)

The ultimate purpose of assessing control risk is to contribute to the auditor's evaluation of the risk that:

(Multiple Choice)

4.9/5  (42)

(42)

Which of the following statements concerning audit evidence is correct?

(Multiple Choice)

4.8/5  (49)

(49)

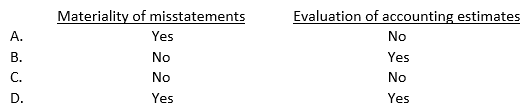

For which of the following judgments may an independent auditor share responsibility with an entity's internal auditor who is assessed to be both competent and objective?

(Multiple Choice)

4.8/5  (27)

(27)

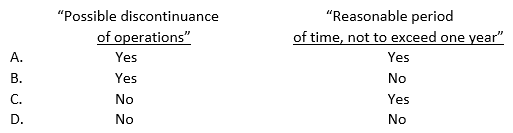

Kane, CPA, concludes that there is substantial doubt about Lima Co.'s ability to continue as a going concern for a reasonable period of time. If Lima's financial statements adequately disclose its financial difficulties, Kane's auditor's report is required to include an explanatory paragraph that specifically uses the phrase(s):

(Multiple Choice)

4.8/5  (27)

(27)

Showing 861 - 880 of 1050

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)