Exam 3: Adjusting Accounts for Financial Statements

Exam 1: Accounting in Business285 Questions

Exam 2: Accounting for Business Transactions251 Questions

Exam 3: Adjusting Accounts for Financial Statements403 Questions

Exam 4: Accounting for Merchandising Operations252 Questions

Exam 5: Inventories and Cost of Sales238 Questions

Exam 6: Cash,fraud,and Internal Controls228 Questions

Exam 7: Accounting for Receivables219 Questions

Exam 8: Accounting for Long-Term Assets258 Questions

Exam 9: Accounting for Current Liabilities219 Questions

Exam 10: Accounting for Long-Term Liabilities231 Questions

Exam 11: Corporate Reporting and Analysis247 Questions

Exam 12: Reporting Cash Flows247 Questions

Exam 13: Analysis of Financial Statements245 Questions

Exam 14: Managerial Accounting Concepts and Principles252 Questions

Exam 15: Job Order Costing and Analysis215 Questions

Exam 16: Process Costing and Analysis225 Questions

Exam 17: Activity-Based Costing and Analysis223 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis247 Questions

Exam 19: Variable Costing and Analysis202 Questions

Exam 20: Master Budgets and Performance Planning224 Questions

Exam 21: Flexible Budgets and Standard Costs223 Questions

Exam 22: Performance Measurement and Responsibility Accounting210 Questions

Exam 23: Relevant Costing for Managerial Decisions149 Questions

Exam 24: Capital Budgeting and Investment Analysis161 Questions

Exam 25: Time Value of Money84 Questions

Exam 26: Investments217 Questions

Exam 27: Lean Principles and Accounting30 Questions

Select questions type

________ refer to costs incurred in a period that are both unpaid and unrecorded.________ refer to revenues earned in a period that are both unrecorded and not yet received in cash (or other assets).

(Essay)

4.9/5  (42)

(42)

Revenue and expense accounts are permanent (real)accounts and should not be closed at the end of the accounting period.

(True/False)

4.9/5  (39)

(39)

Current liabilities are cash and other resources that are expected to be sold,collected or used within one year or the company's operating cycle whichever is longer.

(True/False)

4.8/5  (33)

(33)

The time period assumption assumes that an organization's activities may be divided into specific reporting time periods including all of the following except:

(Multiple Choice)

4.8/5  (41)

(41)

A post-closing trial balance is a list of permanent accounts and their balances from the ledger after all closing entries are journalized and posted.

(True/False)

5.0/5  (34)

(34)

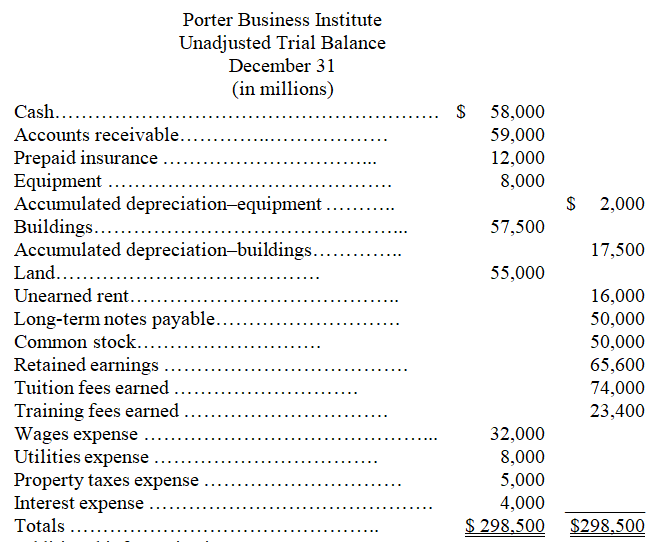

The unadjusted trial balance and the adjustment data for Porter Business Institute are given below along with adjusting entry information.What is the impact on net income if these adjustments are not recorded? Show the calculation for net income without the adjustments and net income with the adjustments.Which one gives the most accurate net income? Which accounting principles are being violated if the adjustments are not made?

Additional information items:

a.The Prepaid Insurance account consists of a payment for a 1 year policy.An analysis of the insurance invoice indicates that one half of the policy has expired by the end of the December 31 year-end.

b.A cash payment for space sublet for 8 months was received on July 1 and was credited to Unearned Rent.

c.Accrued interest expense on the note payable of $1,000 has been incurred but not paid.

Additional information items:

a.The Prepaid Insurance account consists of a payment for a 1 year policy.An analysis of the insurance invoice indicates that one half of the policy has expired by the end of the December 31 year-end.

b.A cash payment for space sublet for 8 months was received on July 1 and was credited to Unearned Rent.

c.Accrued interest expense on the note payable of $1,000 has been incurred but not paid.

(Essay)

4.9/5  (33)

(33)

A company purchased new furniture at a cost of $16,000 on January 1.The furniture is estimated to have a useful life of 6 years and a $1,000 salvage value.The company uses the straight-line method of depreciation.What is the book value of the furniture on December 31 of the first year?

(Multiple Choice)

4.8/5  (48)

(48)

If a company plans to continue business into the future,closing entries are not required.

(True/False)

4.7/5  (33)

(33)

Werner Company had $1,300 of store supplies at the beginning of the current year.During this year,Werner purchased $6,250 worth of store supplies.On December 31,$1,125 worth of store supplies remained.Calculate the amount of Werner Company's store supplies expense for the current year.

(Essay)

4.7/5  (37)

(37)

On a work sheet,the adjusted balances of revenues and expenses are sorted to the Income Statement columns of the work sheet.

(True/False)

4.7/5  (36)

(36)

Flagg records adjusting entries at its December 31 year end.At December 31,employees had earned $12,000 of unpaid and unrecorded salaries.The next payday is January 3,at which time $30,000 will be paid.

-Prepare the January 1 journal entry to reverse the effect of the December 31 salary expense accrual.

(Multiple Choice)

4.9/5  (30)

(30)

How is a classified balance sheet different from an unclassified balance sheet? List the usual order of the categories on a classified balance sheet.

(Essay)

4.9/5  (27)

(27)

Accrued revenues at the end of one accounting period often result in cash ________ in the next period.

(Short Answer)

4.8/5  (43)

(43)

________ are required at the end of the accounting period because certain internal transactions and events remain unrecorded.

(Short Answer)

4.8/5  (37)

(37)

Which of the following errors would cause the Balance Sheet and Statement of Retained Earnings columns of a work sheet to be out of balance?

(Multiple Choice)

4.8/5  (41)

(41)

Farmers' net income was $740,000 and its net sales were $8,000,000.Calculate its profit margin ratio.

(Essay)

4.8/5  (32)

(32)

The work sheet is a required report made available to external decision makers.

(True/False)

4.8/5  (35)

(35)

Revenue and expense balances are transferred from the adjusted trial balance to the income statement.

(True/False)

4.9/5  (42)

(42)

Income Summary is a temporary account only used for the closing process.

(True/False)

4.8/5  (36)

(36)

An account linked with another account that has an opposite normal balance and is subtracted from the balance of the related account is a(n):

(Multiple Choice)

4.8/5  (34)

(34)

Showing 261 - 280 of 403

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)