Exam 3: Adjusting Accounts for Financial Statements

Exam 1: Accounting in Business285 Questions

Exam 2: Accounting for Business Transactions251 Questions

Exam 3: Adjusting Accounts for Financial Statements403 Questions

Exam 4: Accounting for Merchandising Operations252 Questions

Exam 5: Inventories and Cost of Sales238 Questions

Exam 6: Cash,fraud,and Internal Controls228 Questions

Exam 7: Accounting for Receivables219 Questions

Exam 8: Accounting for Long-Term Assets258 Questions

Exam 9: Accounting for Current Liabilities219 Questions

Exam 10: Accounting for Long-Term Liabilities231 Questions

Exam 11: Corporate Reporting and Analysis247 Questions

Exam 12: Reporting Cash Flows247 Questions

Exam 13: Analysis of Financial Statements245 Questions

Exam 14: Managerial Accounting Concepts and Principles252 Questions

Exam 15: Job Order Costing and Analysis215 Questions

Exam 16: Process Costing and Analysis225 Questions

Exam 17: Activity-Based Costing and Analysis223 Questions

Exam 18: Cost Behavior and Cost-Volume-Profit Analysis247 Questions

Exam 19: Variable Costing and Analysis202 Questions

Exam 20: Master Budgets and Performance Planning224 Questions

Exam 21: Flexible Budgets and Standard Costs223 Questions

Exam 22: Performance Measurement and Responsibility Accounting210 Questions

Exam 23: Relevant Costing for Managerial Decisions149 Questions

Exam 24: Capital Budgeting and Investment Analysis161 Questions

Exam 25: Time Value of Money84 Questions

Exam 26: Investments217 Questions

Exam 27: Lean Principles and Accounting30 Questions

Select questions type

An adjusting entry that increases a revenue and decreases a liability is known as a(n):

(Multiple Choice)

4.8/5  (34)

(34)

Explain the purpose of adjusting entries at the end of a period and provide an example of an adjusting entry.

(Essay)

4.7/5  (38)

(38)

A company shows a $600 balance in Prepaid Rent in the Unadjusted Trial Balance columns of the work sheet.The Adjustments columns show expired rent of $200.This adjusting entry results in:

(Multiple Choice)

5.0/5  (31)

(31)

Carroll Co.is a multi-million dollar business.The business results for the year have been impacted significantly by a slowing economy.The company wants to increase its net income.It has incurred $2,900,000 in unpaid salaries at the end of the year and wants to leave those amounts unrecorded at the end of the year.(a)How would this omission affect the financial statements of Carroll? (b)Which accrual basis of accounting principles does this omission violate? (c)Would this be considered an ethical problem?

(Essay)

4.7/5  (41)

(41)

On April 1,Otisco,Inc.paid Garcia Publishing Company $1,548 for 36-month subscriptions to several different magazines.Otisco debited the prepayment to a Prepaid Subscriptions account,and the subscriptions started immediately.

-What is the amount of revenue that should be recorded by Otisco Publishing Company for the first year of the subscription assuming the company uses a calendar-year reporting period?

(Multiple Choice)

5.0/5  (39)

(39)

The expense recognition (matching)principle does not aim to record expenses in the same accounting period as the revenue earned as a result of these expenses.

(True/False)

4.8/5  (41)

(41)

The accrual basis of accounting requires adjustments to recognize revenues in the periods they are earned and to match expenses with revenues.

(True/False)

4.9/5  (30)

(30)

If the Balance Sheet and Statement of Retained Earnings columns of a work sheet fail to balance when the net income is added to the Balance Sheet and Statement of Retained Earnings Credit column,the cause could be:

(Multiple Choice)

4.7/5  (35)

(35)

A physical count of supplies on hand at the end of May for Masters,Inc.indicated $1,250 of supplies on hand.The general ledger balance before any adjustment is $2,100.What is the adjusting entry for office supplies that should be recorded on May 31?

(Multiple Choice)

4.8/5  (33)

(33)

The assets section of a classified balance sheet usually includes the subgroups:

(Multiple Choice)

4.9/5  (36)

(36)

A classified balance sheet differs from an unclassified balance sheet in that:

(Multiple Choice)

4.9/5  (34)

(34)

A company had no supplies available at the beginning of August.A company purchased $6,000 worth of supplies in August and recorded the purchase in the Supplies account.On August 31,the fiscal year-end,the physical count of supplies indicates the cost of unused supplies is $3,200.The adjusting entry would include a $2,800 debit to Supplies.

(True/False)

4.8/5  (29)

(29)

On the work sheet,net income is entered in the Income Statement Credit column as well as the Balance Sheet or Statement of Retained Earnings Credit column.

(True/False)

5.0/5  (35)

(35)

The trial balance prepared after all closing entries have been journalized and posted is called the:

(Multiple Choice)

4.9/5  (43)

(43)

The Unadjusted Trial Balance columns of a company's work sheet shows the Store Supplies account with a balance of $750.The Adjustments columns shows a credit of $425 for supplies used during the period.The amount shown as Store Supplies in the Balance Sheet columns of the work sheet is:

(Multiple Choice)

4.9/5  (36)

(36)

Adjusting entries result in a better matching of revenues and expenses for the period.

(True/False)

4.9/5  (43)

(43)

A company paid $9,000 for a twelve-month insurance policy on February 1.The policy coverage began on February 1.On February 28,$750 of insurance expense must be recorded.

(True/False)

4.9/5  (39)

(39)

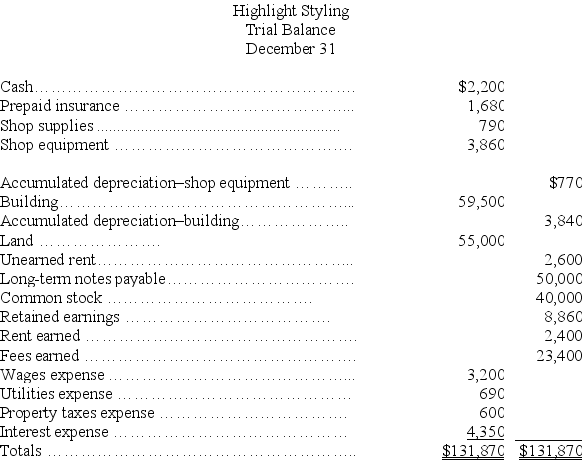

Based on the unadjusted trial balance for Highlight Styling and the adjusting information given below,prepare the adjusting journal entries for Highlight Styling.

Highlight Stylings' for the current year follows:

Additional information:

a.An insurance policy examination showed $1,040 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,020.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was still unearned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Additional information:

a.An insurance policy examination showed $1,040 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,020.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was still unearned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

(Essay)

4.8/5  (40)

(40)

Showing 221 - 240 of 403

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)