Exam 8: Imperfect Competition

Exam 1: Introduction to Game Theory35 Questions

Exam 2: Noncooperative, One-Time, Static Games86 Questions

Exam 3: Focal-Point and Evolutionary Equilibria32 Questions

Exam 4: Infinitely-Repeated, Static Games37 Questions

Exam 5: Finitely-Repeated, Static Games40 Questions

Exam 6: Mixing Pure Strategies51 Questions

Exam 7: Static Games With Continuous Strategies24 Questions

Exam 8: Imperfect Competition52 Questions

Exam 9: Perfect Competition and Monopoly33 Questions

Exam 10: Strategic Trade Policy35 Questions

Exam 11: Dynamic Games With Complete47 Questions

Exam 12: Bargaining54 Questions

Exam 13: Pure Strategies With Uncertain Payoffs65 Questions

Exam 14: Torts and Contracts45 Questions

Exam 15: Auctions44 Questions

Exam 16: Dynamic Games With Incomplete Information34 Questions

Select questions type

If the firms in a duopoly are incapable of satisfying total market demand at any price, the Bertrand model predicts that:

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

A

According to the Bertrand model, if both firms in the industry face identical demands and marginal cost of production:

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

C

Which of the following predictions of the Bertrand model appear to be unrealistic in the real world:

Free

(Multiple Choice)

4.9/5  (41)

(41)

Correct Answer:

C

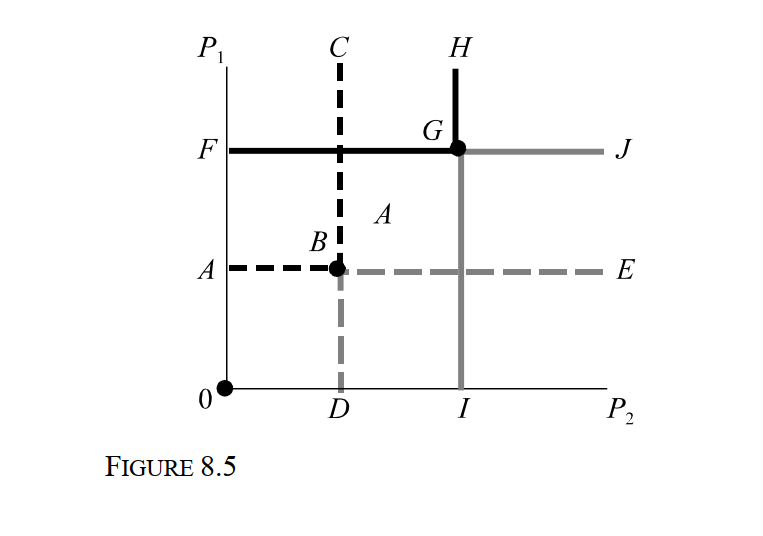

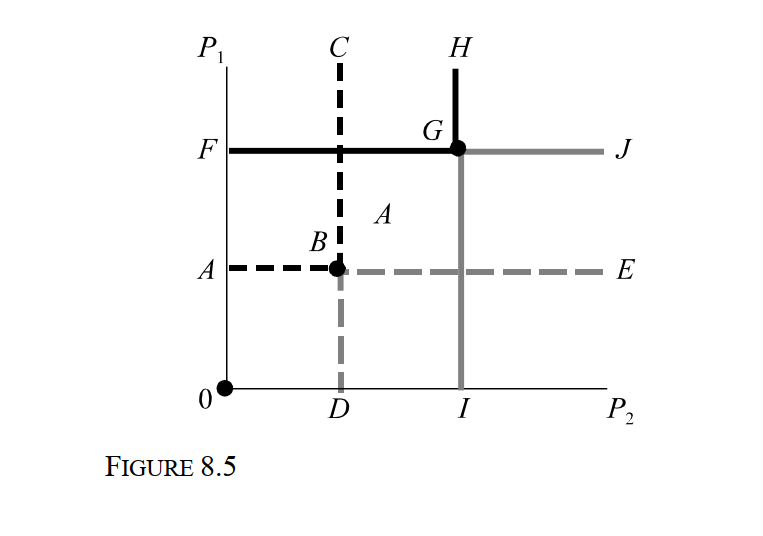

-Refer to Figure 8.5, which depicts two firms engaged in Bertrand price competition in markets X and Y. The two firms have the same marginal cost of production in each market, although marginal cost is not is not the same in both markets. The reaction functions of firms 1 and 2 in market X are ABC and DBE, respectively. The reaction functions of firms 1 and 2 in market Y are given by the line segments FGH and IGJ, respectively. The price charged by both firms market Y is:

-Refer to Figure 8.5, which depicts two firms engaged in Bertrand price competition in markets X and Y. The two firms have the same marginal cost of production in each market, although marginal cost is not is not the same in both markets. The reaction functions of firms 1 and 2 in market X are ABC and DBE, respectively. The reaction functions of firms 1 and 2 in market Y are given by the line segments FGH and IGJ, respectively. The price charged by both firms market Y is:

(Multiple Choice)

4.9/5  (37)

(37)

Suppose that two firms in a duopoly set output according to the Cournot model. If demand is linear and the marginal cost of production for each firm is zero:

(Multiple Choice)

4.9/5  (43)

(43)

Suppose that an industry consists of two firms producing an identical product in which there is no brand loyalty by consumers. The inverse market demand for the combined output of both firms is P = 5 !0.001 (QA + QB). The marginal cost of production by firm A and firm B are $2 and $1, respectively. Total industry output is:

(Multiple Choice)

4.8/5  (35)

(35)

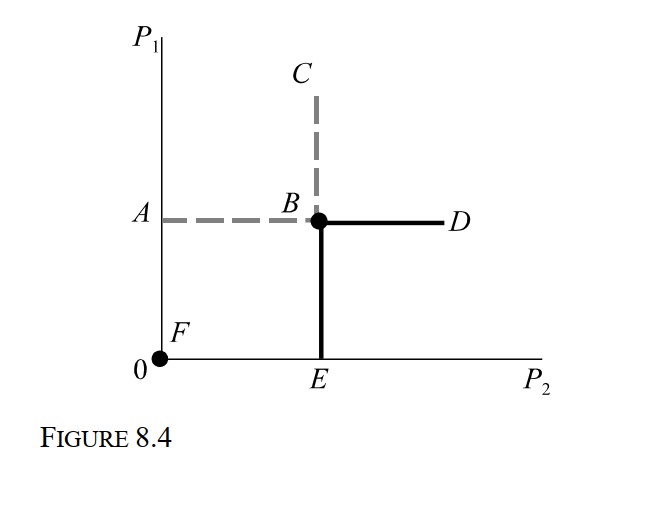

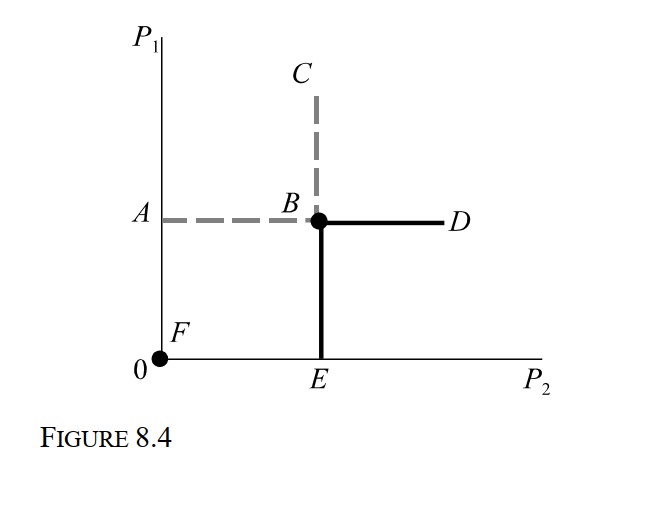

-Consider Figure 8.4 which depicts two firms producing a homogeneous product at the same constant marginal cost. The Bertrand-Nash equilibrium:

-Consider Figure 8.4 which depicts two firms producing a homogeneous product at the same constant marginal cost. The Bertrand-Nash equilibrium:

(Multiple Choice)

4.8/5  (35)

(35)

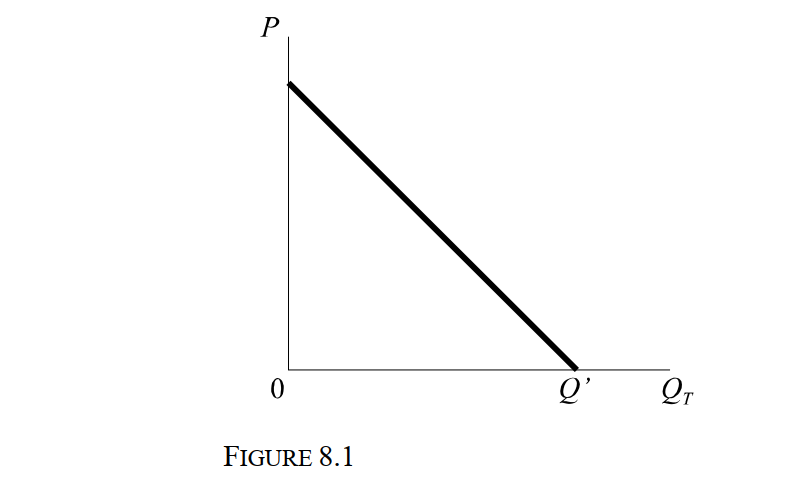

-Figure 8.1 depicts the market demand for the product produced by n firms producing an identical product in which MC = 0 for each firm. If Q' = 5,000 and there are 99 firms in the industry, total industry output according to the Cournot model is:

-Figure 8.1 depicts the market demand for the product produced by n firms producing an identical product in which MC = 0 for each firm. If Q' = 5,000 and there are 99 firms in the industry, total industry output according to the Cournot model is:

(Multiple Choice)

4.7/5  (30)

(30)

According to the Cournot model, if two firms in the industry face identical demands for their product:

(Multiple Choice)

4.8/5  (32)

(32)

-Consider Figure 8.4 which depicts two firms producing a homogeneous product at the same constant marginal cost. According to the Bertrand model, the marginal cost of production for both firms is:

-Consider Figure 8.4 which depicts two firms producing a homogeneous product at the same constant marginal cost. According to the Bertrand model, the marginal cost of production for both firms is:

(Multiple Choice)

4.7/5  (35)

(35)

Suppose that the reaction functions for two identical Cournot firms are given by the equations q1 = 50 !3q2 and q2 = 50 !3q1. If the market demand for the output of these two firms is qT = 125 !5p, the market price of this product is:

(Multiple Choice)

4.9/5  (33)

(33)

According to the Bertrand paradox, if two firms produce a homogeneous product and have identical marginal cost, each firm:

(Multiple Choice)

4.8/5  (33)

(33)

Suppose that two firms in a duopoly set output according to the Cournot model.:

(Multiple Choice)

4.7/5  (40)

(40)

Suppose that an industry consists of two firms producing an identical product in which there is no brand loyalty by consumers. The inverse market demand for the combined output of both firms is P = 5 !0.001 (QA + QB). The marginal cost of production by firm A and firm B are $2 and $1, respectively. Firm A charges a price of:

(Multiple Choice)

4.9/5  (36)

(36)

The Bertrand-Nash equilibrium in which firms with the same marginal cost first choose output levels resembles:

(Multiple Choice)

4.9/5  (40)

(40)

If the firms in a duopoly are incapable of satisfying total market demand at any price, the Bertrand model predicts that:

(Multiple Choice)

4.9/5  (29)

(29)

Suppose that an industry consists of two firms producing an identical product in which there is no brand loyalty by consumers. The inverse market demand for the combined output of both firms is P = 5 !0.001 (QA + QB). The marginal cost of production by firm A and firm B are $2 and $1, respectively. Firm B charges a price of:

(Multiple Choice)

4.8/5  (39)

(39)

-Refer to Figure 8.5, which depicts two firms engaged in Bertrand price competition in markets X and Y. The two firms have the same marginal cost of production in each market, although marginal cost is not is not the same in both markets. The reaction functions of firms 1 and 2 in market X are ABC and DBE, respectively. The reaction functions of firms 1 and 2 in market Y are given by the line segments FGH and IGJ, respectively. The price charged by both firms market X is:

-Refer to Figure 8.5, which depicts two firms engaged in Bertrand price competition in markets X and Y. The two firms have the same marginal cost of production in each market, although marginal cost is not is not the same in both markets. The reaction functions of firms 1 and 2 in market X are ABC and DBE, respectively. The reaction functions of firms 1 and 2 in market Y are given by the line segments FGH and IGJ, respectively. The price charged by both firms market X is:

(Multiple Choice)

4.9/5  (47)

(47)

Showing 1 - 20 of 52

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)