Exam 15: Translating Foreign Currency Statements: The Current Rate Method

Exam 1: Wholly Owned Subsidiaries: at Date of Creation87 Questions

Exam 2: Wholly Owned Subsidiaries: Postcreation Periods110 Questions

Exam 3: Partially Owned Created Subsidiaries & Variable Interest Entities138 Questions

Exam 4: Introduction to Business Combinations105 Questions

Exam 5: The Purchase Method: at Date of Acquisition-100 Ownership135 Questions

Exam 6: The Purchase Method: Postacquisition Periods and Partial Ownerships74 Questions

Exam 7: New Basis of Accounting52 Questions

Exam 8: Introduction to Intercompany Transactions42 Questions

Exam 9: Intercompany Inventory Transfers66 Questions

Exam 10: Intercompany Fixed Asset Transfers & Bond Holdings31 Questions

Exam 12: Reporting Segment and Related Information90 Questions

Exam 13: International Accounting Standards & Translating Foreign Currency Transactions103 Questions

Exam 14: Using Derivatives to Manage Foreign Currency Exposures256 Questions

Exam 15: Translating Foreign Currency Statements: The Current Rate Method99 Questions

Exam 16: Translating Foreign Currency Statements: The Temporal Method and the Functional Currency Concept231 Questions

Exam 17: Interim Period Reporting49 Questions

Exam 18: Securities and Exchange Commission Reporting55 Questions

Exam 19: Bankruptcy Reorganizations and Liquidations51 Questions

Exam 20: Partnerships: Formation and Operation45 Questions

Exam 21: Partnerships: Changes in Ownership37 Questions

Exam 22: Partnerships: Liquidations35 Questions

Exam 23: Estates and Trusts40 Questions

Exam 24: Governmental Accounting: Basic Principles and the General Fund138 Questions

Exam 25: Governmental Accounting: The Special-Purpose Funds and Special General Ledger232 Questions

Exam 26: Not-For-Profit Organizations: Introduction and Private Npos218 Questions

Select questions type

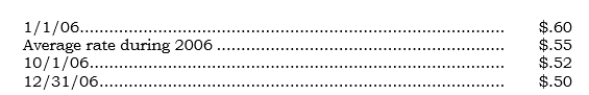

____ Pamex's 100%-owned Swiss subsidiary, Samex, had stockholders' equity of 900,000 euros on 1/1/06. For 2006, Samex reported net income of 300,000 euros. On 10/1/06, Samex declared and paid a cash dividend of 100,000 euros. The euro is the functional currency. Direct exchange rate information follows:

What is the effect of the 2006 exchange rate change?

What is the effect of the 2006 exchange rate change?

(Multiple Choice)

4.8/5  (40)

(40)

Under FAS 52, the AOCI-Cumulative Translation Adjustment account balance is reported in earnings when the foreign unit is ______________________________ or ____________________________.

(Short Answer)

4.9/5  (41)

(41)

_____ Which of the following statements holds true for the foreign currency unit of measure approach?

(Multiple Choice)

4.8/5  (33)

(33)

Under the foreign currency unit of measure approach, the temporal method is used to translate all assets and liabilities.

(True/False)

4.9/5  (38)

(38)

When a foreign subsidiary has its foreign currency as its functional currency, the parent would hedge the _______________________________________ to prevent reporting an adverse impact on stockholders' equity as a result of an adverse exchange rate change.

(Short Answer)

4.9/5  (41)

(41)

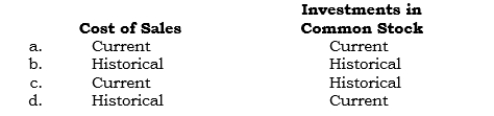

_____ Which exchange rates are used to express the following accounts in dollars when the current rate method is used? (Assume that valuation in the local currency is at market value, which conforms to the rules of FAS 115, "Accounting for Certain Investments in Debt and Equity Securities.")

(Short Answer)

4.8/5  (38)

(38)

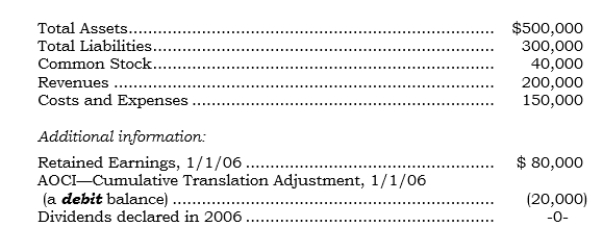

_____ Following are certain items (accounts or account totals) that have been translated into U.S. dollars at or for the year ending 12/31/06 for a Mexican subsidiary having the peso as its functional currency:

What is the total ending Retained Earnings balance at 12/31/06?

What is the total ending Retained Earnings balance at 12/31/06?

(Multiple Choice)

4.9/5  (33)

(33)

Under FAS 52, the AOCI-Cumulative Translation Adjustment account is closed out directly to retained earnings when the foreign unit is sold or liquidated.

(True/False)

4.8/5  (40)

(40)

_____ Which of the following accounts is not a monetary item?

(Multiple Choice)

4.9/5  (25)

(25)

_____ Which of the following statements is false for the foreign currency unit of measure approach?

(Multiple Choice)

4.8/5  (40)

(40)

_____ Pakex's French subsidiary, Sakex, sold inventory on credit to a British customer on 12/22/06. The sale was denominated in pounds, and the customer paid in full in March 2007. From the sales date to 12/31/06, the pound strengthened relative to the franc (which is Sakex's functional currency). Sakex's gain should be reported as

(Multiple Choice)

4.8/5  (31)

(31)

_____ On 12/31/06, a Danish subsidiary accrued a litigation liability of 100,000 krones ($40,000 when translated at the current rate at 12/31/06), even though the probability of payment is remote. The outcome is not expected to be determined until 2007. The worksheet entry required at 12/31/07 (not 12/31/06) will result in which of the following (assuming no change in the exchange rate during 2007)?

(Multiple Choice)

4.7/5  (35)

(35)

Under the foreign currency unit of measure approach, the relationships in the foreign currency statements are maintained in translation.

(True/False)

4.8/5  (35)

(35)

_____ Which of the following is not an allowable reason for eliminating the balance in the AOCI-Cumulative Translation Adjustment account?

(Multiple Choice)

4.7/5  (43)

(43)

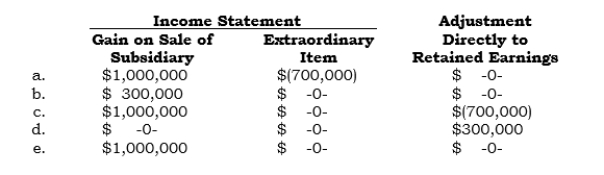

_____ On 4/1/07, Pakco sold its foreign subsidiary for $5,000,000. On this date, the carrying value of the Investment in Subsidiary account was $4,000,000, and the AOCI-Cumulative Translation Adjustment account had a debit balance of $700,000. In the 2007 financial statements, what should Pakco report?

(Short Answer)

4.8/5  (42)

(42)

Under the foreign currency unit of measure approach, the current rate method is used to translate all assets, liabilities, and equity accounts.

(True/False)

4.7/5  (32)

(32)

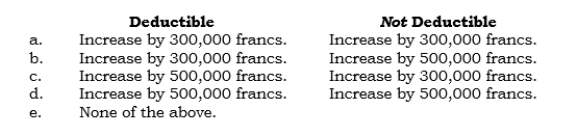

_____ A Swiss subsidiary follows the practice of recording a liability for potential future losses at its manufacturing location (which is not insured). The offsetting debit to income is in accordance with Swiss GAAP and is deductible under Swiss tax laws. The liability account had a balance of 500,000 francs at the beginning of 2006. During 2006, 100,000 francs were added to the account, and 40,000 francs were charged against the liability account as a result of fire damage from an accident. The Swiss income tax rate is 40%. What adjustment is required to the subsidiary's beginning Retained Earnings, assuming that under Swiss income tax law, additions to the liability account are either deductible or not deductible?

(Short Answer)

4.8/5  (44)

(44)

When the current rate method is used, any exchange rate change adjustment to a parent's Dividend Receivable from its foreign subsidiary is reported currently in earnings.

(True/False)

4.9/5  (26)

(26)

_____ Under FAS 52, how is the effect of an exchange rate change reported when the current rate method of translation is used?

(Multiple Choice)

4.8/5  (32)

(32)

Showing 21 - 40 of 99

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)