Exam 11: Cash Flow Estimation and Risk Analysis

Exam 1: An Overview of Financial Management and the Financial Environment46 Questions

Exam 2: Financial Statements, cash Flow, and Taxes77 Questions

Exam 3: Analysis of Financial Statements104 Questions

Exam 4: Time Value of Money168 Questions

Exam 5: Bonds, bond Valuation, and Interest Rates100 Questions

Exam 6: Risk and Return146 Questions

Exam 7: Valuation of Stocks and Corporations80 Questions

Exam 8: Financial Options and Applications in Corporate Finance28 Questions

Exam 9: The Cost of Capital92 Questions

Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows108 Questions

Exam 11: Cash Flow Estimation and Risk Analysis78 Questions

Exam 12: Corporate Valuation and Financial Planning41 Questions

Exam 13: Agency Conflicts and Corporate Governance6 Questions

Exam 15: Capital Structure Decisions59 Questions

Exam 16: Supply Chains and Working Capital Management135 Questions

Exam 17: Multinational Financial Management49 Questions

Exam 18: Public and Private Financing: Initial Offerings, seasoned Offerings, and Investment Banks22 Questions

Exam 18: Extension 18 A: Rights Offerings4 Questions

Exam 19: Lease Financing23 Questions

Exam 20: Hybrid Financing: Preferred Stock, warrants, and Convertibles26 Questions

Exam 21: Dynamic Capital Structures22 Questions

Exam 22: Mergers and Corporate Control46 Questions

Exam 23: Enterprise Risk Management14 Questions

Exam 24: Bankruptcy, reorganization, and Liquidation12 Questions

Exam 25: Portfolio Theory and Asset Pricing Models35 Questions

Exam 26: Real Options11 Questions

Exam 27: Providing and Obtaining Credit29 Questions

Exam 28: Advanced Issues in Cash Management and Inventory Control17 Questions

Exam 29: Pension Plan Management10 Questions

Exam 30: Financial Management in Not For Profit Businesses10 Questions

Select questions type

Accelerated depreciation has an advantage for profitable firms in that it moves some cash flows forward,thus increasing their present value.On the other hand,using accelerated depreciation generally lowers the reported current year's profits because of the higher depreciation expenses.However,the reported profits problem can be solved by using different depreciation methods for tax and stockholder reporting purposes.

(True/False)

4.8/5  (35)

(35)

VR Corporation has the opportunity to invest in a new project,the details of which are shown below.What is the Year 1 cash flow for the project? Sales revenues, each year \ 42,500 Depreciation \ 10,000 Other operating costs \ 17,000 Interest expense \ 4,000 Tax rate 35,0\%

(Multiple Choice)

4.8/5  (33)

(33)

McPherson Company must purchase a new milling machine.The purchase price is $50,000,including installation.The machine has a tax life of 5 years,and it can be depreciated according to the following rates.The firm expects to operate the machine for 4 years and then to sell it for $12,500.If the marginal tax rate is 40%,what will the after-tax salvage value be when the machine is sold at the end of Year 4? Year Depreciation Rate 1 0.20 2 0.32 3 0.19 4 0.12 5 0.11 6 0.06

(Multiple Choice)

4.8/5  (33)

(33)

If a firm's projects differ in risk,then one way of handling this problem is to evaluate each project with the appropriate risk-adjusted discount rate.

(True/False)

4.8/5  (34)

(34)

Fitzgerald Computers is considering a new project whose data are shown below.The required equipment has a 3-year tax life,after which it will be worthless,and it will be depreciated by the straight-line method over 3 years.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's Year 1 cash flow? Equipment cost (depreciable basis) \ 65,000 Straight-line depreciation rate 33.333\% Sales revenues, each year \ 60,000 Operating costs (excl. deprec.) \ 25,000 Tax rate 35,0\%

(Multiple Choice)

4.9/5  (34)

(34)

Sylvester Media is analyzing an average-risk project,and the following data have been developed.Unit sales will be constant,but the sales price should increase with inflation.Fixed costs will also be constant,but variable costs should rise with inflation.The project should last for 3 years,it will be depreciated on a straight-line basis,and there will be no salvage value.This is just one of many projects for the firm,so any losses can be used to offset gains on other firm projects.The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate,but the CFO thinks an adjustment is required.What is the difference in the expected NPV if the inflation adjustment is made vs.if it is not made? WACC 10.0\% Net investment cost (depreciable basis) \ 200,000 Units sold 50,000 Average price per unit, Year 1 \ 25.00 Fixed op. cost excl. deprec. (constant) \ 150,000 Variable op. cost/unit, Year 1 \ 20.20 Annual depreciation rate 33.333\% Expected inflation 4.00\% Tax rate 35.0\%

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following procedures best accounts for the relative risk of a proposed project?

(Multiple Choice)

4.9/5  (39)

(39)

Because of improvements in forecasting techniques,estimating the cash flows associated with a project has become the easiest step in the capital budgeting process.

(True/False)

4.8/5  (44)

(44)

Since the focus of capital budgeting is on cash flows rather than on net income,changes in noncash balance sheet accounts such as inventory are not included in a capital budgeting analysis.

(True/False)

4.9/5  (40)

(40)

The coefficient of variation,calculated as the standard deviation of expected returns divided by the expected return,is a standardized measure of the risk per unit of expected return.

(True/False)

4.9/5  (35)

(35)

Whitestone Products is considering a new project whose data are shown below.The required equipment has a 3-year tax life,and the accelerated rates for such property are 33.33%,44.45%,14.81%,and 7.41% for Years 1 through 4.Revenues and other operating costs are expected to be constant over the project's 10-year expected operating life.What is the project's Year 4 cash flow? Equipment cost (depreciable basis)

Sales revenues, each year

Operating costs (excl. deprec.)

Tax rate

(Multiple Choice)

4.8/5  (36)

(36)

Erickson Inc.is considering a capital budgeting project that has an expected return of 25% and a standard deviation of 30%.What is the project's coefficient of variation?

(Multiple Choice)

4.7/5  (40)

(40)

The two cardinal rules that financial analysts should follow to avoid capital budgeting errors are: (1)in the NPV equation,the numerator should use income calculated in accordance with generally accepted accounting principles,and (2)all incremental cash flows should be considered when making accept/reject decisions.

(True/False)

4.8/5  (43)

(43)

Collins Inc.is investigating whether to develop a new product.In evaluating whether to go ahead with the project,which of the following items should NOT be explicitly considered when cash flows are estimated?

(Multiple Choice)

4.8/5  (36)

(36)

Garden-Grow Products is considering a new investment whose data are shown below.The equipment would be depreciated on a straight-line basis over the project's 3-year life,would have a zero salvage value,and would require some additional working capital that would be recovered at the end of the project's life.Revenues and other operating costs are expected to be constant over the project's life.What is the project's NPV? (Hint: Cash flows are constant in Years 1 to 3.) WACC 10.0\% Net investment in fixed assets (basis) \ 75,000 Required new working capital \ 15,000 Straight-line deprec. rate 33.333\% Sales revenues, each year \ 75,000 Operating costs (excl. deprec.), each year \ 25,000 Tax rate 35.0\%

(Multiple Choice)

4.9/5  (33)

(33)

The primary advantage to using accelerated rather than straight-line depreciation is that with accelerated depreciation the present value of the tax savings provided by depreciation will be higher,other things held constant.

(True/False)

4.9/5  (38)

(38)

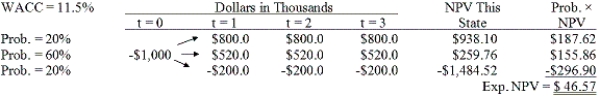

Brandt Enterprises is considering a new project that has a cost of $1,000,000,and the CFO set up the following simple decision tree to show its three most likely scenarios.The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so,but to obtain this abandonment option,it would have to make a payment to those parties.How much is the option to abandon worth to the firm?

(Multiple Choice)

4.9/5  (31)

(31)

Opportunity costs include those cash inflows that could be generated from assets the firm already owns if those assets are not used for the project being evaluated.

(True/False)

4.8/5  (42)

(42)

Showing 41 - 60 of 78

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)