Exam 3: The Mechanics of Double-Entry Bookkeeping

Exam 1: An Introduction to the Role of Accounting in the Business World73 Questions

Exam 2: Concepts and Elements Underlying Accounting109 Questions

Exam 3: The Mechanics of Double-Entry Bookkeeping86 Questions

Exam 4: Cash, Short-Term Investments and Accounts Receivable64 Questions

Exam 5: Inventory86 Questions

Exam 6: Long-Term Assets: Property, Plant Equipment and Intangibles93 Questions

Exam 7: Liabilities119 Questions

Exam 8: Stockholders Equity106 Questions

Exam 9: The Corporate Income Statement and Financial Analysis113 Questions

Exam 10: Statement of Cash Flows85 Questions

Exam 11: Managerial Accounting116 Questions

Exam 12: Cost-Volume-Profit Analysis77 Questions

Exam 13: The Master Budget96 Questions

Exam 14: Activity-Based Management and Performance Measurementreward114 Questions

Select questions type

The set of accounting procedures that must be completed for a business each accounting period is the

(Multiple Choice)

4.8/5  (32)

(32)

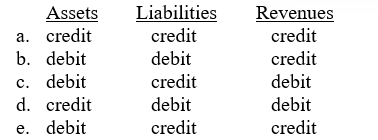

Which of the following reflects the normal balances of the listed types of accounts?

(Short Answer)

4.8/5  (33)

(33)

A journal entry must have one debit and one credit and the amounts of the debit and credits must be equal.

(True/False)

4.8/5  (37)

(37)

An account whose period-ending balance is transferred or closed to Income Summary is a(an)

(Multiple Choice)

4.8/5  (45)

(45)

A machine costing $33,000 with an estimated salvage value of $3,000 is to be depreciated on a straight-line basis over five years. The machine was purchased on April 1, 2009. What year-end depreciation adjusting entry should be made on December 31, 2010?

(Multiple Choice)

4.9/5  (44)

(44)

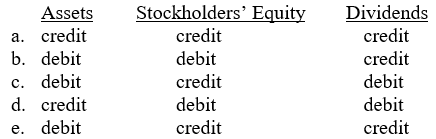

Which of the following reflects the normal balances of the listed types of accounts?

(Short Answer)

4.8/5  (40)

(40)

During 2010, Zambezi Rowing Co. generated $500,000 in revenue. In its closing entry for revenue, Zambezi will debit

(Multiple Choice)

4.8/5  (41)

(41)

Companies should prepare trial balances before posting journal entries to general ledger accounts.

(True/False)

4.9/5  (37)

(37)

The accounting cycle in an organization begins with the incurrence of an economic transaction.

(True/False)

4.9/5  (40)

(40)

On September 1, 2010, Huntley Co. paid $18,000 to renew its insurance policy for the next 12-month period. What amount should be recorded as prepaid insurance in Huntley's December 31, 2010, balance sheet?

(Multiple Choice)

4.7/5  (33)

(33)

Expenses normally have ___ balances and cause stockholders' equity to ____.

(Multiple Choice)

4.8/5  (37)

(37)

GnP Consulting engaged in the following transactions during February 2010.

Feb) 1 Callie Gordon and Bill Paxell each invested $15,000 to start the business. For the investment, each received 5,000 shares of $1 par value common stock.

Feb) 1 GnP rented office space for $1,500 per month. Three months of rent were paid at this time.

Feb) 1 Furniture for the office was rented for $800 per month. This amount was paid in cash and recorded as an expense at this time.

Feb) 1 Computer equipment costing $3,000 was purchased on account. It is estimated that the equipment will last for 24 months and have a $600 salvage value at that time.

Feb) 3 GnP purchased $750 of office supplies on account.

Feb) 5 A client paid GnP $480 for some consulting services.

Feb) 7 Consulting services worth $575 were performed for a client. The client will pay GnP on Feb. 28.

Feb) 10 Entertainment expenses costing $125 were incurred on account.

Feb) 13 Wages of $700 were paid to the receptionist.

Feb) 20 A payment of $1,000 was made on the computer equipment purchased on Feb. 1.

Feb) 28 The computer equipment was depreciated for February.

Feb) 28 Office rent expense for February was recorded.

Feb) 28 A count of office supplies indicated that $680 of supplies were still on hand.

Feb) 28 The receptionist was owed, but had not been paid, wages of $715 for the last part of the month.

Feb) 28 The utility bill of $438 for February was received. GnP will pay this bill on its due date of March 8.

Feb) 28 Received the amount due from the February 7th client.

Feb) 28 GnP declared a $250 dividend. This amount will be paid on March 15.

Required:

Prepare general journal entries for these transactions. Next to each account title, indicate whether that account will increase (+) or decrease (-) as a result of the transaction.

(Essay)

4.8/5  (31)

(31)

An accrued item is one for which cash has been paid or received in advance of the expense or revenue.

(True/False)

4.9/5  (35)

(35)

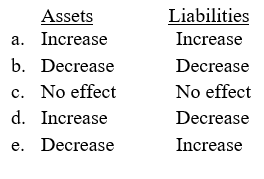

Q Co. paid $1,000 owed to a supplies vendor. The effect of this transaction on assets and liabilities is

(Short Answer)

4.7/5  (36)

(36)

On October 1, 2011, Railways Corp. signed a $10,000, 5%, 5-year note payable. The note and the interest will be paid when the note comes due. Assuming Railways has a calendar year-end, how much interest expense should Railways record on this note payable in 2011?

(Multiple Choice)

4.8/5  (38)

(38)

Companies should prepare adjusting journal entries before financial statements.

(True/False)

4.9/5  (28)

(28)

Showing 41 - 60 of 86

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)