Exam 15: Public Choice, Taxes, and the Distribution of Income

Exam 1: Economics: Foundations and Models145 Questions

Exam 2: Trade-Offs, Comparative Advantage, and the Market System151 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply159 Questions

Exam 4: Economic Efficiency, Government Price Setting, and Taxes127 Questions

Exam 5: Externalities, Environmental Policy, and Public Goods141 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply149 Questions

Exam 7: Comparative Advantage and the Gains From International Trade125 Questions

Exam 8: Consumer Choice and Behavioral Economics154 Questions

Exam 9: Technology, Production, and Costs169 Questions

Exam 10: Firms in Perfectly Competitive Markets153 Questions

Exam 11: Monopolistic Competition140 Questions

Exam 12: Oligopoly: Firms in Less Competitive Markets130 Questions

Exam 13: Monopoly and Antitrust Policy146 Questions

Exam 14: The Markets for Labour and Other Factors of Production149 Questions

Exam 15: Public Choice, Taxes, and the Distribution of Income134 Questions

Exam 16: Pricing Strategy132 Questions

Exam 17: Firms, the Stock Market, and Corporate Governance137 Questions

Select questions type

Suppose the equilibrium price and quantity of a 12-pack of pop are $5.00 and 10,000 12-packs, respectively, and the government decides to impose a $1.00 tax on every 12-pack of carbonated soft drinks in an effort to fight obesity.Draw two supply and demand graphs, one showing the excess burden of the tax when supply is less elastic and the other showing the excess burden of the tax when supply is more elastic.Identify the excess burden of the tax on each graph.On which graph is the excess burden the greatest?

(Essay)

4.9/5  (37)

(37)

If the government wants to minimize the welfare loss of a tax, it should tax goods with more inelastic demands or supplies.

(True/False)

4.8/5  (30)

(30)

Explain the effect of price elasticities of supply and demand on tax incidence.

(Essay)

4.9/5  (42)

(42)

The government of Silverado raises revenue to operate the city's hospital, open to all residents, through a general income tax paid by its residents.This method of raising revenue is consistent with the benefits-received principle.

(True/False)

4.9/5  (42)

(42)

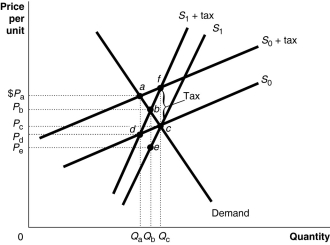

Figure 15.2

Figure 15.2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 15.2.If the government imposes an excise tax of $1.00 on every unit sold,

Figure 15.2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 15.2.If the government imposes an excise tax of $1.00 on every unit sold,

(Multiple Choice)

4.9/5  (39)

(39)

If you pay $2,000 in taxes on an income of $20,000, and a tax of $3,500 on an income of $30,000, then over this range of income the tax is

(Multiple Choice)

4.9/5  (38)

(38)

Local governments in Canada receive most of their revenue from

(Multiple Choice)

5.0/5  (36)

(36)

Exempting food purchases from sales tax is consistent with the ability-to-pay principle, although not necessarily consistent with vertical equity.

(True/False)

4.8/5  (35)

(35)

The "ability-to-pay" principle of taxation is the normative idea that

(Multiple Choice)

4.8/5  (34)

(34)

A focus on relative poverty, rather than absolute poverty could lead to

(Multiple Choice)

4.9/5  (41)

(41)

Provincial governments get most of their operating funds from

(Multiple Choice)

4.8/5  (43)

(43)

If, as your taxable income decreases, you pay a smaller percentage of your taxable income in taxes, then the tax is

(Multiple Choice)

4.7/5  (42)

(42)

The government of Notrealia raises revenue through a general income tax paid by all its residents to operate the city's marina.The marina is used by private boat owners.This method of raising revenue to operate the marina is

(Multiple Choice)

4.9/5  (36)

(36)

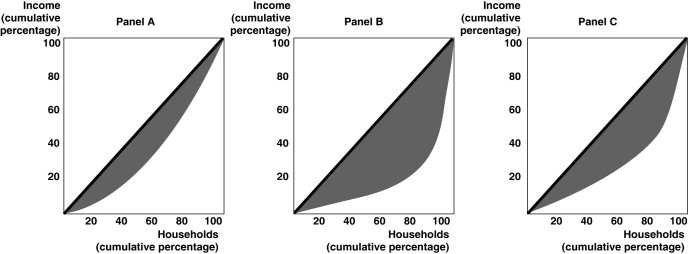

Figure 15.3

-Refer to Figure 15.3.Rank the above panels in terms of most unequal income distribution to least unequal income distribution.

-Refer to Figure 15.3.Rank the above panels in terms of most unequal income distribution to least unequal income distribution.

(Multiple Choice)

4.7/5  (34)

(34)

Table 15.2

Highway Improvements Employment Insurance Benefits Social Safetynet Reform Bart 1st 3rd 2nd Lisa 2nd lst 3rd Maggie 3rd 2nd 1st

-Refer to Table 15.2.The table above outlines the rankings of three members of Parliament on three spending alternatives.Assume that Parliament can spend additional revenue on only one of the three spending alternatives and that Bart, Lisa, and Maggie, all members of Parliament, participate in a series of votes in which they are to determine which of the spending alternatives should receive funding.Three votes will be taken: (1)Highway Improvements and Employment Insurance Benefits (2)Highway Improvements and Social Safetynet Reform and (3)Employment Insurance Benefits and Social Safetynet Reform.

Show the results of each vote and determine whether the voting paradox will occur as a result of these votes.

(Essay)

4.8/5  (38)

(38)

Showing 101 - 120 of 134

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)