Exam 13: Risk and the Pricing of Options

Exam 1: Corporate Finance and the Financial Manager91 Questions

Exam 2: Introduction to Financial Statement Analysis122 Questions

Exam 3: The Valuation Principle: the Foundation of Financial Decision Making120 Questions

Exam 4: The Time Value of Money101 Questions

Exam 5: Interest Rates118 Questions

Exam 6: Bonds122 Questions

Exam 7: Valuing Stocks122 Questions

Exam 8: Investment Decision Rules137 Questions

Exam 9: Fundamentals of Capital Budgeting107 Questions

Exam 10: Risk and Return in Capital Markets101 Questions

Exam 11: Systematic Risk and the Equity Risk Premium102 Questions

Exam 12: Determining the Cost of Capital106 Questions

Exam 13: Risk and the Pricing of Options112 Questions

Exam 14: Raising Equity Capital104 Questions

Exam 15: Debt Financing109 Questions

Exam 16: Capital Structure113 Questions

Exam 17: Payout Policy101 Questions

Exam 18: Financial Modelling and Pro Forma Analysis124 Questions

Exam 19: Working Capital Management122 Questions

Exam 20: Short Term Financial Planning105 Questions

Exam 21: Risk Management108 Questions

Exam 22: International Corporate Finance108 Questions

Exam 23: Leasing86 Questions

Exam 24: Mergers and Acquisitions81 Questions

Exam 25: Corporate Governance52 Questions

Select questions type

When a stock price appreciates by a certain percentage,a call option on the same stock appreciates by a lower percentage amount.

(True/False)

4.9/5  (33)

(33)

Which of the following will increase the value of a call option?

(Multiple Choice)

4.8/5  (45)

(45)

In practice,option prices are not very sensitive to changes in the risk-free rate.

(True/False)

4.8/5  (41)

(41)

Using options to place a bet on the direction in which you believe the market is likely to move is called

(Multiple Choice)

4.8/5  (38)

(38)

Use the figure for the question(s) below.

-You have shorted a call option on WSJ stock with a strike price of $50.The option will expire in exactly six months.If the stock is trading at $60 in three months,what will you owe for each share in the contract?

-You have shorted a call option on WSJ stock with a strike price of $50.The option will expire in exactly six months.If the stock is trading at $60 in three months,what will you owe for each share in the contract?

(Multiple Choice)

4.9/5  (36)

(36)

ABX corporation stock is currently trading for $37.60.A one-year European call option on ABX is currently trading for $7.23,and a one-year European put option on ABX with the same strike price is currently trading for $0.76.If the stock pays no dividends,and the risk-free rate is 3% per year,what is the strike price of the options?

(Multiple Choice)

4.7/5  (36)

(36)

The price of a European put option on Bombardier stock with one year to expiry is trading at $2.25,and the price of a European call option is trading at $1.50.If the stock is currently trading at $4.75,and the risk-free rate is 4%,what is the exercise price of the options?

(Multiple Choice)

4.7/5  (36)

(36)

A European option with a later exercise date may trade potentially for less than an otherwise identical option with an earlier exercise date.

(True/False)

4.9/5  (37)

(37)

An investor purchases a call option and its underlying stock on the same day.If the stock appreciates by 25%,the call option will appreciate by:

(Multiple Choice)

4.9/5  (34)

(34)

Luther Industries is currently trading for $27 per share.The stock pays a quarterly dividend of $0.50 per share,with the next dividend to be paid in exactly 3 months.A one-year European put option on Luther with a strike price of $30 is currently trading for $4.60.If the risk-free interest rate is 6% per year,then the price of a one-year European call option on Luther with a strike price of $30 will be closest to:

(Multiple Choice)

4.8/5  (42)

(42)

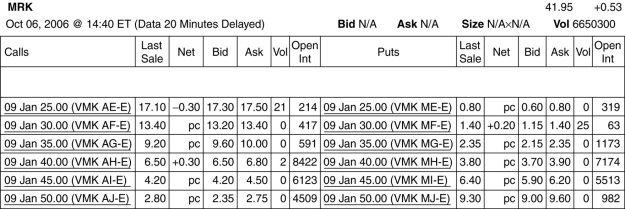

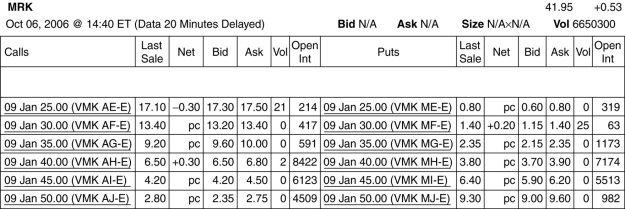

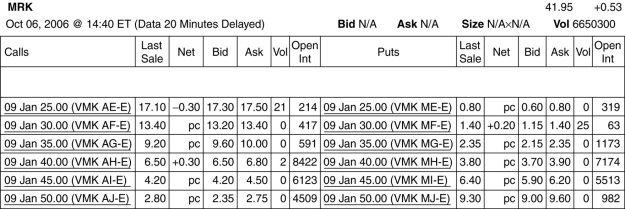

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

-How many of the December 2010 put options are in-the-money?

-How many of the December 2010 put options are in-the-money?

(Multiple Choice)

4.9/5  (29)

(29)

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

-How many of the January 2009 call options are in-the-money?

-How many of the January 2009 call options are in-the-money?

(Multiple Choice)

4.9/5  (38)

(38)

The price of a call option on Microsoft stock with a maturity of six months and a strike price of $40 is $3.50,and the price of the stock is $38.50.The price of a put option on the same stock with the same strike price and time to maturity is $1.25.Calculate the risk-free rate.

(Multiple Choice)

4.9/5  (43)

(43)

The value of an otherwise identical American call option is ________ if the exercise date is ________.

(Multiple Choice)

4.7/5  (36)

(36)

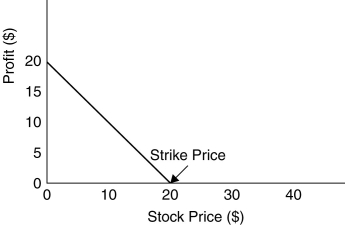

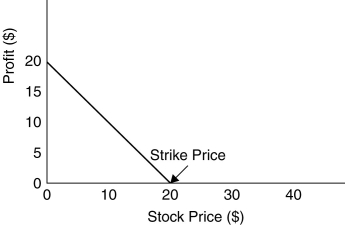

Use the figure for the question(s) below.

-This graph depicts the payoffs of a

-This graph depicts the payoffs of a

(Multiple Choice)

4.9/5  (33)

(33)

A share of stock can be thought of as a put option on the firm's assets with a strike price equal to the face value of debt.

(True/False)

4.8/5  (39)

(39)

Suppose a stock is currently trading for $23,and in one period it will either increase to $30 or decrease to $20.If the one-period risk-free rate is 5%,what is the price of a European put option that expires in one period and has an exercise price of $25?

(Multiple Choice)

4.8/5  (34)

(34)

The price of a European call option on Lululemon stock with an exercise price of $34.50 and one year to expiry is trading at $2.52.The current price of the stock is $34,and the risk-free rate is 4%.With no arbitrage,what must be the price of a European put on Lululemon with an exercise price of $34.50?

(Multiple Choice)

4.8/5  (34)

(34)

A put option gives the owner the right to ________ an asset at a fixed price at some future date.

(Multiple Choice)

4.8/5  (41)

(41)

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

-How many of the January 2009 call options are out-of-the-money?

-How many of the January 2009 call options are out-of-the-money?

(Multiple Choice)

4.8/5  (41)

(41)

Showing 61 - 80 of 112

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)