Exam 18: Public Choice, Taxes, and the Distribution of Income

Exam 1: Economics: Foundations and Models234 Questions

Exam 2: Trade-Offs, Comparative Advantage, and the Market System258 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply242 Questions

Exam 4: Economic Efficiency, Government Price Setting, and Taxes208 Questions

Exam 5: Externalities, Environmental Policy, and Public Goods263 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply295 Questions

Exam 7: The Economics of Health Care171 Questions

Exam 8: Firms, the Stock Market, and Corporate Governance264 Questions

Exam 9: Comparative Advantage and the Gains From International Trade188 Questions

Exam 10: Consumer Choice and Behavioral Economics300 Questions

Exam 11: Technology, Production, and Costs328 Questions

Exam 12: Firms in Perfectly Competitive Markets296 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a More Realistic Setting274 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets259 Questions

Exam 15: Monopoly and Antitrust Policy279 Questions

Exam 16: Pricing Strategy261 Questions

Exam 17: The Markets for Labor and Other Factors of Production281 Questions

Exam 18: Public Choice, Taxes, and the Distribution of Income258 Questions

Select questions type

When the demand for a product is more elastic than the supply

(Multiple Choice)

4.9/5  (44)

(44)

Income inequality in the United States has increased somewhat over the past 25 years.Two factors that appear to have contributed to this are

(Multiple Choice)

4.7/5  (35)

(35)

A key insight of the public choice model is that public policymakers are likely to pursue the public's interest, even if their self-interests conflict with the public interest.

(True/False)

4.7/5  (28)

(28)

A tax is efficient if it imposes a small excess burden relative to the tax revenue it raises.

(True/False)

4.8/5  (46)

(46)

Many state governments use lotteries to raise revenue.If a lottery is viewed as a tax, is it most likely a progressive tax or a regressive tax? What information would you need to determine whether the burden of a lottery is progressive or regressive?

(Essay)

4.8/5  (39)

(39)

The public choice model can be used to examine voting models that contrast the manner in which collective decisions are made by governments (state, local, and federal)and the manner in which individual choices are made in markets.Which of the following descriptions is consistent with the difference between collective decision-making and decision-making in markets?

(Multiple Choice)

4.8/5  (40)

(40)

What is the difference between a marginal tax rate and an average tax rate? Which is more important in determining the impact of the tax system on economic behavior?

(Essay)

4.8/5  (41)

(41)

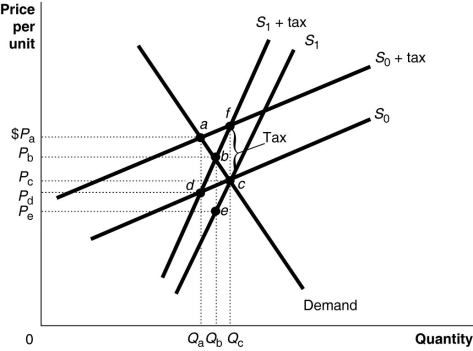

Figure 18-2

Figure 18-2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold, the producer's burden of the tax

Figure 18-2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold, the producer's burden of the tax

(Multiple Choice)

5.0/5  (37)

(37)

Most economists agree that some of the burden of the corporate income tax

(Multiple Choice)

4.9/5  (41)

(41)

Congressman Flack votes for a program that will benefit the constituents of Congressman Walpole.Which of the following explanations for Flack's vote is most consistent with the public choice model?

(Multiple Choice)

4.9/5  (35)

(35)

Article Summary

Monthly marijuana sales in Colorado topped $100 million for the first time in August, 2015, with $59.2 million in recreational sales and $41.4 million in medical sales. Colorado has levied three types of state taxes on recreational-use marijuana: a 2.9% standard sales tax, a 10% special marijuana sales tax, and a 15% excise tax on wholesale marijuana transfers. The 15% excise tax is earmarked for school construction projects. In August, recreational-use taxes and fees totaled $11.2 million and medical taxes and fees were $2 million, bringing total revenue-to-date for the year to over $86 million.

Source: Elizabeth Hernandez, "Colorado monthly marijuana sales eclipse $100 million mark," Denver Post, October 9, 2015.

-Refer to the Article Summary above.Colorado taxes marijuana with a 12.9% sales tax on buyers and a 15% wholesale excise tax on producers, or a total tax of 27.9% Suppose the actual burden of the tax falls 80 percent on consumers and 20 percent on producers.In this case, consumers will actually bear the tax burden of about ________ percent of the selling price and producers will actually bear the tax burden of ________ percent of the selling price.

(Multiple Choice)

4.7/5  (47)

(47)

In the United States, over the past 40 years federal revenues as a share of gross domestic product have

(Multiple Choice)

4.9/5  (34)

(34)

A situation where a member of Congress votes to approve a bill in exchange for favorable votes from other members on other bills is called

(Multiple Choice)

4.8/5  (35)

(35)

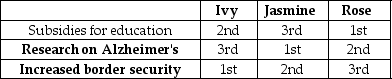

Table 18-1

Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: 1)Subsidies for education, 2)Research on Alzheimer's or 3)Increased border security.Table 18-1 shows three voters' rankings of the alternatives.

-Refer to Table 18-1.Suppose a series of votes are taken in which each pair of alternatives is considered in turn.If the vote is between allocating funds to education subsidies and increased border security

Suppose $1 billion is available in the budget and Congress is considering allocating the funds to one of the following three alternatives: 1)Subsidies for education, 2)Research on Alzheimer's or 3)Increased border security.Table 18-1 shows three voters' rankings of the alternatives.

-Refer to Table 18-1.Suppose a series of votes are taken in which each pair of alternatives is considered in turn.If the vote is between allocating funds to education subsidies and increased border security

(Multiple Choice)

4.8/5  (47)

(47)

Income inequality increases as the Gini coefficient approaches 1.

(True/False)

4.9/5  (40)

(40)

The complexity of the U.S.federal income tax system results in significant annual deadweight losses.The opportunity cost of the hours taxpayers spend on record keeping and completing their tax returns amounts to billions of dollars.

a.If the tax system was simplified, how would this benefit the economy?

b.Why hasn't the tax system been simplified?

(Essay)

4.8/5  (42)

(42)

When members of Congress vote to pass new legislation, they will

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following statements about rent seeking is false?

(Multiple Choice)

4.8/5  (31)

(31)

Showing 41 - 60 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)