Exam 18: Public Choice, Taxes, and the Distribution of Income

Exam 1: Economics: Foundations and Models234 Questions

Exam 2: Trade-Offs, Comparative Advantage, and the Market System258 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply242 Questions

Exam 4: Economic Efficiency, Government Price Setting, and Taxes208 Questions

Exam 5: Externalities, Environmental Policy, and Public Goods263 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply295 Questions

Exam 7: The Economics of Health Care171 Questions

Exam 8: Firms, the Stock Market, and Corporate Governance264 Questions

Exam 9: Comparative Advantage and the Gains From International Trade188 Questions

Exam 10: Consumer Choice and Behavioral Economics300 Questions

Exam 11: Technology, Production, and Costs328 Questions

Exam 12: Firms in Perfectly Competitive Markets296 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a More Realistic Setting274 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets259 Questions

Exam 15: Monopoly and Antitrust Policy279 Questions

Exam 16: Pricing Strategy261 Questions

Exam 17: The Markets for Labor and Other Factors of Production281 Questions

Exam 18: Public Choice, Taxes, and the Distribution of Income258 Questions

Select questions type

The proposition that the outcome of a majority vote is likely to represent the preferences of the voter who is in the political middle is called

(Multiple Choice)

4.7/5  (32)

(32)

Article Summary

Monthly marijuana sales in Colorado topped $100 million for the first time in August, 2015, with $59.2 million in recreational sales and $41.4 million in medical sales. Colorado has levied three types of state taxes on recreational-use marijuana: a 2.9% standard sales tax, a 10% special marijuana sales tax, and a 15% excise tax on wholesale marijuana transfers. The 15% excise tax is earmarked for school construction projects. In August, recreational-use taxes and fees totaled $11.2 million and medical taxes and fees were $2 million, bringing total revenue-to-date for the year to over $86 million.

Source: Elizabeth Hernandez, "Colorado monthly marijuana sales eclipse $100 million mark," Denver Post, October 9, 2015.

-Refer to the Article Summary above.Suppose the sale of marijuana is legalized in Florida, and the state decides to charge a tax of $50 per ounce on each sale, with the state claiming that retailers will bear the entire burden of this tax.Draw a graph illustrating the situation where retail outlets would bear the entire tax burden of $50 per ounce of marijuana.Explain what would need to be true about the demand for marijuana for retailers to bear the entire burden of this tax, and if this would likely occur if marijuana sales were legalized.

(Essay)

4.9/5  (47)

(47)

"For a given supply curve, the excess burden of a tax will be greater when the demand for a product is less elastic than when the demand is more elastic." This statement is

(Multiple Choice)

4.8/5  (41)

(41)

Horizontal equity means that two people in identical economic situations should pay the same amount of taxes.

(True/False)

4.9/5  (35)

(35)

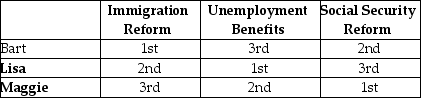

Table 18-3

-Refer to Table 18-3.The table above outlines the rankings of three members of the U.S.Senate on three spending alternatives.Assume that Congress can spend additional revenue on only one of the three spending alternatives and that Bart, Lisa, and Maggie, all members of the Senate, participate in a series of votes in which they are to determine which of the spending alternatives should receive funding.Three votes will be taken: (1)Immigration Reform and Unemployment Benefits (2)Immigration Reform and Social Security Reform and (3)Unemployment Benefits and Social Security Reform.

Show the results of each vote and determine whether the voting paradox will occur as a result of these votes.

-Refer to Table 18-3.The table above outlines the rankings of three members of the U.S.Senate on three spending alternatives.Assume that Congress can spend additional revenue on only one of the three spending alternatives and that Bart, Lisa, and Maggie, all members of the Senate, participate in a series of votes in which they are to determine which of the spending alternatives should receive funding.Three votes will be taken: (1)Immigration Reform and Unemployment Benefits (2)Immigration Reform and Social Security Reform and (3)Unemployment Benefits and Social Security Reform.

Show the results of each vote and determine whether the voting paradox will occur as a result of these votes.

(Essay)

4.9/5  (36)

(36)

"Sin taxes," such as taxes on alcoholic beverages, are intended to

(Multiple Choice)

4.9/5  (43)

(43)

Economists argue that the corporate income tax is an example of a tax with a high deadweight loss because

(Multiple Choice)

4.7/5  (32)

(32)

A proportional tax is a tax for which people with lower incomes

(Multiple Choice)

4.8/5  (36)

(36)

Public schools in the United States get most of their operating funds from

(Multiple Choice)

4.8/5  (40)

(40)

Describe the main factors economists believe cause inequality of income.

(Essay)

4.9/5  (36)

(36)

For the top 1 percent of income distribution, the share of federal individual income taxes paid by households in this group in 2015 was ________ percent.

(Multiple Choice)

4.8/5  (42)

(42)

Economists caution that conventional statistics used to estimate the extent of poverty in the United States fail to account for benefits people receive that, if considered, would reduce the amount of poverty.Which of the following is an example of these benefits?

(Multiple Choice)

4.9/5  (34)

(34)

A common belief among political analysts is that someone running for his or her party's nomination for president of the United States must choose a different strategy once the nomination is secured.To be nominated, the candidate must appeal to voters from one party - Democrat or Republican - but in a general election a party's nominee must appeal to voters from both parties as well as independent voters.Which of the following offers the best explanation for this change in strategy?

(Multiple Choice)

4.8/5  (42)

(42)

Showing 81 - 100 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)