Exam 18: Public Choice, Taxes, and the Distribution of Income

Exam 1: Economics: Foundations and Models234 Questions

Exam 2: Trade-Offs, Comparative Advantage, and the Market System258 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply242 Questions

Exam 4: Economic Efficiency, Government Price Setting, and Taxes208 Questions

Exam 5: Externalities, Environmental Policy, and Public Goods263 Questions

Exam 6: Elasticity: the Responsiveness of Demand and Supply295 Questions

Exam 7: The Economics of Health Care171 Questions

Exam 8: Firms, the Stock Market, and Corporate Governance264 Questions

Exam 9: Comparative Advantage and the Gains From International Trade188 Questions

Exam 10: Consumer Choice and Behavioral Economics300 Questions

Exam 11: Technology, Production, and Costs328 Questions

Exam 12: Firms in Perfectly Competitive Markets296 Questions

Exam 13: Monopolistic Competition: the Competitive Model in a More Realistic Setting274 Questions

Exam 14: Oligopoly: Firms in Less Competitive Markets259 Questions

Exam 15: Monopoly and Antitrust Policy279 Questions

Exam 16: Pricing Strategy261 Questions

Exam 17: The Markets for Labor and Other Factors of Production281 Questions

Exam 18: Public Choice, Taxes, and the Distribution of Income258 Questions

Select questions type

Horizontal equity is achieved when taxes are collected from those who benefit from the government expenditure of the tax revenue.

(True/False)

4.8/5  (40)

(40)

Congressman Gallstone seeks support from his colleagues for a bill he sponsors that will establish a new national park in his district.He offers to support Congresswoman Disrail's proposal to build a new library in her district in exchange for her vote for his national park bill.This is an example of

(Multiple Choice)

4.8/5  (41)

(41)

Consider the following methods of taxing a corporation's income:

A.A flat tax, as opposed to a progressive tax, is levied on corporate profits.

B.A system whereby a corporation calculates its annual profit and notifies each shareholder of her portion of the profits.The shareholder would then be required to include this amount as taxable income for her personal income tax.The corporation does not pay a tax.

C.A system where the federal government continues to tax corporate income through the corporate income tax but allows individual taxpayers to receive, tax free, corporate dividends and capital gains.

Which of the methods above would avoid double taxation?

(Multiple Choice)

4.8/5  (50)

(50)

The "ability-to-pay" principle of taxation is the normative idea that

(Multiple Choice)

5.0/5  (40)

(40)

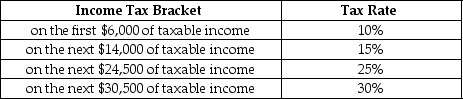

Table 18-10

Table 18-10 shows the income tax brackets and tax rates for single taxpayers in Bauxhall.

-Refer to Table 18-10.A tax exemption is granted for the first $10,000 earned per year.Suppose you earn $75,000.

a.What is the amount of taxes you will pay?

b.What is your average tax rate?

c.What is your marginal tax rate?

Table 18-10 shows the income tax brackets and tax rates for single taxpayers in Bauxhall.

-Refer to Table 18-10.A tax exemption is granted for the first $10,000 earned per year.Suppose you earn $75,000.

a.What is the amount of taxes you will pay?

b.What is your average tax rate?

c.What is your marginal tax rate?

(Essay)

4.9/5  (39)

(39)

One important difference between the political process and the market process is that

(Multiple Choice)

4.7/5  (28)

(28)

Which of the following tax systems would help reduce income inequality the most?

(Multiple Choice)

4.9/5  (37)

(37)

A Lorenz curve summarizes the information provided by a Gini coefficient.

(True/False)

4.8/5  (40)

(40)

If you pay $2,000 in taxes on an income of $20,000, and a tax of $2,700 on an income of $30,000, then over this range of income the tax is

(Multiple Choice)

4.8/5  (41)

(41)

When considering changes in tax policy, economists usually focus on

(Multiple Choice)

4.8/5  (44)

(44)

Since lower-income people spend a larger proportion of their incomes on groceries than do higher-income people, if grocery stores were required by law to charge a 10-cent fee for disposable bags, this fee could be considered a

(Multiple Choice)

4.9/5  (34)

(34)

In 2014, which type of tax raised the most revenue for the U.S.federal government? Which type of tax raised the most revenue for state and local governments?

(Essay)

4.9/5  (31)

(31)

The distribution of income typically refers to how income is distributed across the population ________.Income mobility looks at how a person or family's income changes ________.

(Multiple Choice)

4.8/5  (37)

(37)

A Gini coefficient of ________ means that an income distribution is perfectly equal and a Gini coefficient of ________ means the income distribution is perfectly unequal.

(Multiple Choice)

4.8/5  (35)

(35)

Rent-seeking behavior, unlike profit-maximizing behavior in competitive markets, wastes society's scarce resources.

(True/False)

4.9/5  (35)

(35)

If the marginal tax rate is greater than the average tax rate, the tax structure is described as regressive.

(True/False)

4.8/5  (47)

(47)

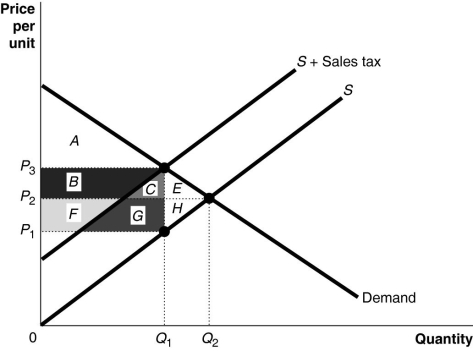

Figure 18-1

-Refer to Figure 18-1.Of the tax revenue collected by the government, the portion borne by consumers is represented by the area

-Refer to Figure 18-1.Of the tax revenue collected by the government, the portion borne by consumers is represented by the area

(Multiple Choice)

4.9/5  (36)

(36)

An income tax system is ________ if marginal tax rates increase as income increases.

(Multiple Choice)

4.9/5  (37)

(37)

Showing 141 - 160 of 258

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)