Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

When using transfer prices based on costs rather than market prices, management can better determine profitability of the investment made in the intermediate producing division.

(True/False)

4.8/5  (32)

(32)

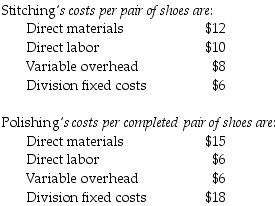

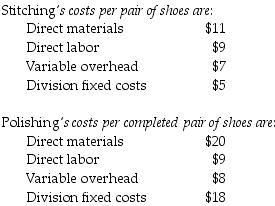

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoes and sells them to retailers. The Stitching Division "sells" shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $46. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-101,000 units. The fixed costs for the Polishing Division are assumed to be $14 per pair at 101,000 units.

What is the transfer price per pair of shoes from the Stitching Division to the Polishing Division if the transfer price per pair of shoes is 125% of full costs?

What is the transfer price per pair of shoes from the Stitching Division to the Polishing Division if the transfer price per pair of shoes is 125% of full costs?

(Multiple Choice)

4.8/5  (35)

(35)

Transferring products internally at a market price leads to optimal decisions when all of the following conditions are prevalent except ________.

(Multiple Choice)

4.9/5  (33)

(33)

The formal management control system includes shared values, loyalties, and mutual commitments among members of the company, company culture, and norms about acceptable behavior for managers and other employees.

(True/False)

4.9/5  (41)

(41)

Dual pricing uses two separate transfer-pricing methods to price each transfer from one subunit to another.

(True/False)

4.9/5  (45)

(45)

To reduce the excessive focus of subunit managers on their own subunits, many companies compensate subunit managers on the basis of ________.

(Multiple Choice)

4.8/5  (42)

(42)

Sandra's Sheet Metal Company has two divisions. The Raw Material Division prepares sheet metal at its warehouse facility. The Finishing Division prepares the cut sheet metal into finished products for the air conditioning industry. No inventories exist in either division at the beginning of 20X8. During the year, the Raw Material Division prepared 450,000 square feet of sheet metal at a cost of $1,800,000. All the sheet metal was transferred to the Finishing Division, where additional operating costs of $1.50 per square foot were incurred. The 450,000 square feet of finished fabricated sheet metal products were sold for $3,875,000.

Required:

a.Determine the operating income for each division if the transfer price from Raw Material to Finishing is at a cost of $4 per square foot.

b.Determine the operating income for each division if the transfer price is $6 per square foot.

c.Since the Raw Materials Division sells all of its sheet metal internally to the Finishing Division, does the Raw Materials manager care what price is selected? Why? Should the Raw Materials Division be a cost center or a profit center under the circumstances?

(Essay)

4.7/5  (39)

(39)

The transfer-pricing method that reduces the goal-congruence problems associated with a pure cost-plus-based transfer-pricing method is the ________.

(Multiple Choice)

4.8/5  (28)

(28)

When cost-based transfer pricing is used between subunits of a large organization, describe how to avoid making suboptimal decisions.

(Essay)

4.9/5  (33)

(33)

If the selling subunit is operating at capacity, the opportunity cost of transferring a unit internally rather than selling it externally is equal to the market price minus the variable cost.

(True/False)

5.0/5  (30)

(30)

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoes and sells them to retailers. The Stitching Division "sells" shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $48. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-101,000 units. The fixed costs for the Polishing Division are assumed to be $17 per pair at 101,000 units.

What is the market-based transfer price per pair of shoes from the Stitching Division to the Polishing Division?

What is the market-based transfer price per pair of shoes from the Stitching Division to the Polishing Division?

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following is a drawback of decentralizing a multinational company?

(Multiple Choice)

4.8/5  (41)

(41)

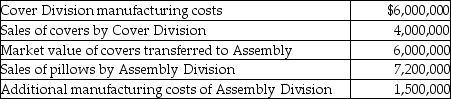

Bedtime Bedding Company manufactures pillows. The Cover Division makes covers and the Assembly Division makes the finished products. The covers can be sold separately for $5.00. The pillows sell for $6.00. The information related to manufacturing for the most recent year is as follows:

Required:

Compute the operating income for each division and the company as a whole. Use market value as the transfer price. Are all managers happy with this concept? Explain.

Required:

Compute the operating income for each division and the company as a whole. Use market value as the transfer price. Are all managers happy with this concept? Explain.

(Essay)

4.8/5  (31)

(31)

Line managers supervising individual refineries are concerned with ________.

(Multiple Choice)

4.8/5  (38)

(38)

The additional cost of producing and transferring the product or service is called variable manufacturing cost.

(True/False)

4.8/5  (37)

(37)

Which of the following statements is true of decentralization?

(Multiple Choice)

4.8/5  (34)

(34)

Showing 61 - 80 of 151

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)