Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

Super Shoes Company manufactures sneakers. The Athletic Division sells its socks for $18 a pair to outsiders. Sneakers have manufacturing costs of $6.00 each for variable and $6.00 for fixed. The division's total fixed manufacturing costs are $315,000 at the normal volume of 70,000 units.

The European Division has offered to buy 15,000 Sneakers at the full cost of $12. The Athletic Division has excess capacity and the 15,000 units can be produced without interfering with the current outside sales of 70,000. The 85,000 volume is within the division's relevant operating range.

Explain whether the Athletic Division should accept the offer.

(Essay)

4.9/5  (41)

(41)

When an industry has excess capacity, market prices may drop well below their historical average. If this drop is temporary, it is called ________.

(Multiple Choice)

4.8/5  (34)

(34)

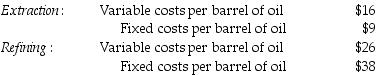

Axelia Corporation has two divisions, Refining and Extraction. The company's primary product is Luboil Oil. Each division's costs are provided below:

The Refining Division has been operating at a capacity of 40,900 barrels a day and usually purchases 25,600 barrels of oil from the Extraction Division and 15,400 barrels from other suppliers at $64 per barrel.

Assume 260 barrels are transferred from the Extraction Division to the Refining Division for a transfer price of $26 per barrel. The Refining Division sells the 260 barrels at a price of $220 each to customers. What is the operating income of both divisions together?

The Refining Division has been operating at a capacity of 40,900 barrels a day and usually purchases 25,600 barrels of oil from the Extraction Division and 15,400 barrels from other suppliers at $64 per barrel.

Assume 260 barrels are transferred from the Extraction Division to the Refining Division for a transfer price of $26 per barrel. The Refining Division sells the 260 barrels at a price of $220 each to customers. What is the operating income of both divisions together?

(Multiple Choice)

4.9/5  (36)

(36)

Negotiated transfer prices are often employed when ________.

(Multiple Choice)

5.0/5  (36)

(36)

The labels profit center and cost center are dependent on the degree of centralization or decentralization in a company.

(True/False)

4.8/5  (37)

(37)

TrueValue Company makes all types of office desks. The General Desk Division is currently producing 10,000 desks per year with a capacity of 15,000. The variable costs assigned to each desk are $300 and annual fixed costs of the division are $900,000. The General desk sells for $400.

The Executive Division wants to buy 5,000 desks at $250 for its custom office design business. The General Desk manager refused the order because the price is below variable cost. The executive manager argues that the order should be accepted because it will lower the fixed cost per desk from $90 to $60 and will take the division to its capacity, thereby causing operations to be at their most efficient level.

Required:

a.Should the order from the Executive Division be accepted by the General Desk Division? Why?

b.From the perspective of the General Desk Division and the company, should the order be accepted if the Executive Division plans on selling the desks in the outside market for $420 after incurring additional costs of $100 per desk?

c.What action should the company president take?

(Essay)

4.9/5  (27)

(27)

If a computer manufacturer used its common stock price as a Balanced Scorecard control measure, it would be utilizing which of the following?

(Multiple Choice)

4.8/5  (40)

(40)

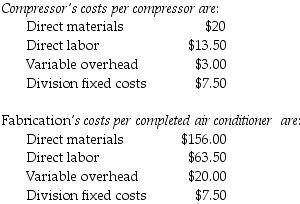

Plish Company manufactures only one type of washing machine and has two divisions, the Compressor Division, and the Fabrication Division. The Compressor Division manufactures compressors for the Fabrication Division, which completes the washing machine and sells it to retailers. The Compressor Division "sells" compressors to the Fabrication Division. The market price for the Fabrication Division to purchase a compressor is $56.00. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 11,000-16,000 units. The fixed costs for the Fabrication Division are assumed to be $8.50 per unit at 16,000 units.

What is the transfer price per compressor from the Compressor Division to the Fabrication Division if the method used to place a value on each compressor is 115% of variable costs?

What is the transfer price per compressor from the Compressor Division to the Fabrication Division if the method used to place a value on each compressor is 115% of variable costs?

(Multiple Choice)

4.9/5  (29)

(29)

Global Giant, a multinational corporation, has a producing subsidiary in a low tax rate country and a marketing subsidiary in a high tax country. If Global Giant wants to minimize its worldwide tax liability, we would expect Global Giant to ________.

(Multiple Choice)

4.8/5  (39)

(39)

The range over which two divisions will negotiate a transfer price is ________.

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following transfer-pricing methods always achieves goal congruence?

(Multiple Choice)

4.8/5  (35)

(35)

A transfer price based on the full cost plus a markup may lead to suboptimal decisions because ________.

(Multiple Choice)

5.0/5  (36)

(36)

Briefly explain each of the three methods used to determine a transfer price.

(Essay)

4.8/5  (38)

(38)

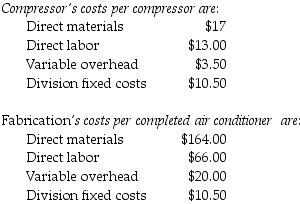

Plish Company manufactures only one type of washing machine and has two divisions, the Compressor Division, and the Fabrication Division. The Compressor Division manufactures compressors for the Fabrication Division, which completes the washing machine and sells it to retailers. The Compressor Division "sells" compressors to the Fabrication Division. The market price for the Fabrication Division to purchase a compressor is $60.00. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 13,000-18,000 units. The fixed costs for the Fabrication Division are assumed to be $7.50 per unit at 18,000 units.

What is the market-based transfer price per compressor from the Compressor Division to the Fabrication Division?

What is the market-based transfer price per compressor from the Compressor Division to the Fabrication Division?

(Multiple Choice)

4.8/5  (36)

(36)

"Management control systems consist of formal and informal control systems." Briefly explain the formal and informal management systems and enlist their components.

(Essay)

4.8/5  (36)

(36)

The product or service transferred between subunits of an organization is called an intermediate product.

(True/False)

4.8/5  (30)

(30)

Minimum transfer price can be arrived at by adding incremental cost per unit incurred up to the point of transfer with the markup required.

(True/False)

4.8/5  (38)

(38)

The president of Silicon Company has just returned from a week of professional development courses and is very excited that she will not have to change the organization from a centralized structure to a decentralized structure just to have responsibility centers. However, she is somewhat confused about how responsibility centers relate to centralized organizations where a few managers have most of the authority.

Required:

Explain how a centralized organization might allow for responsibility centers.

(Essay)

4.8/5  (27)

(27)

Showing 121 - 140 of 151

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)