Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

Cornerstone Company has two divisions. The Bottle Division produces products that have variable costs of $3 per unit. Its 20X5 sales were 140,000 to outsiders at $5 per unit and 40,000 units to the Mixing Division at 140% of variable costs. Under a dual transfer-pricing system, the Mixing Division pays only the variable cost per unit. The fixed costs of the Bottle Division are $125,000 per year.

Mixing sells its finished products to outside customers for $11.50 per unit. Mixing has variable costs of $2.50 per unit in addition to the costs from the Bottle Division. The annual fixed costs of Mixing were $85,000. There were no beginning or ending inventories during the year.

Required:

What are the operating incomes of the two divisions and the company as a whole for the year? Explain why the company's operating income is less than the sum of the two divisions' total income.

(Essay)

4.9/5  (37)

(37)

Division A sells ground veal internally to Division B, which in turn, produces veal burgers that sell for $12 per pound. Division A incurs costs of $5.25 per pound while Division B incurs additional costs of $11.50 per pound.

What is Division A's operating income per burger, assuming the transfer price of the ground veal is set at $7.00 per burger?

(Multiple Choice)

4.8/5  (44)

(44)

Aerated Water Company makes internal transfers at 175% of full cost. The Soda Refining Division purchases 30,500 containers of carbonated water per day, on average, from a local supplier, who delivers the water for $31 per container via an external shipper. To reduce costs, the company located an independent supplier in Missouri who is willing to sell 30,500 containers at $28 each, delivered to Aerated Water Company's Shipping Division in Missouri. The company's Shipping Division in Missouri has excess capacity and can ship the 30,500 containers at a variable cost of $8.00 per container. What is the total cost to Aerated Water Company if the carbonated water is purchased from the local supplier?

(Multiple Choice)

4.8/5  (45)

(45)

Which of the following is an advantage of decentralization?

(Multiple Choice)

4.9/5  (28)

(28)

Which of the following is an advantage of decentralization?

(Multiple Choice)

4.7/5  (28)

(28)

An advantage of a negotiated transfer price of a product to be transferred between divisions is the ________.

(Multiple Choice)

4.8/5  (34)

(34)

Hybrid transfer prices take into account both cost and market information.

(True/False)

4.8/5  (38)

(38)

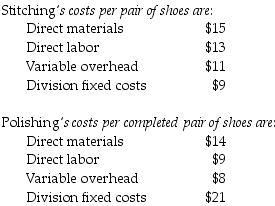

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoes and sells them to retailers. The Stitching Division "sells" shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $51. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-110,000 units. The fixed costs for the Polishing Division are assumed to be $20 per pair at 110,000 units.

Assume the transfer price for a pair of shoes is 185% of total costs of the Stitching Division and 40,000 of shoes are produced and transferred to the Polishing Division. The Stitching Division's operating income is ________.

Assume the transfer price for a pair of shoes is 185% of total costs of the Stitching Division and 40,000 of shoes are produced and transferred to the Polishing Division. The Stitching Division's operating income is ________.

(Multiple Choice)

4.8/5  (36)

(36)

For each of the following statements regarding the satisfaction of transfer pricing criteria, identify whether you would expect the transfer pricing method to meet the criteria. Provide a yes, no, or sometimes for each situation.

________a.Market-Based transfer pricing achieves goal congruence.

________b.Cost-Based transfer pricing achieves goal congruence.

________c.Negotiated transfer pricing achieves goal congruence.

________d.Market-Based transfer pricing motivates management effort.

________e.Cost-Based transfer pricing motivates management effort.

________f.Negotiated transfer pricing motivates management effort.

________g.Market-Based transfer pricing is useful for evaluating subunit performance.

________h.Cost-Based transfer pricing is useful for evaluating subunit performance.

________i.Negotiated transfer pricing is useful for evaluating subunit performance.

________j.Market-Based transfer pricing preserves subunit autonomy.

________k.Cost-Based transfer pricing preserves subunit autonomy.

________l.Negotiated transfer pricing preserves subunit autonomy.

(Essay)

4.8/5  (30)

(30)

Which of the following would be considered an example of an element of an informal control system?

(Multiple Choice)

4.8/5  (26)

(26)

Showing 141 - 151 of 151

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)