Exam 21: Product and Geographic Expansion

Exam 1: Why Are Financial Institutions Special90 Questions

Exam 2: Deposit-Taking Institutions43 Questions

Exam 3: Finance Companies71 Questions

Exam 4: Securities, Brokerage, and Investment Banking91 Questions

Exam 5: Mutual Funds, Hedge Funds, and Pension Funds61 Questions

Exam 6: Insurance Companies80 Questions

Exam 7: Risks of Financial Institutions110 Questions

Exam 8: Interest Rate Risk I110 Questions

Exam 9: Interest Rate Risk II116 Questions

Exam 10: Credit Risk: Individual Loans112 Questions

Exam 11: Credit Risk: Loan Portfolio and Concentration Risk51 Questions

Exam 12: Liquidity Risk85 Questions

Exam 13: Foreign Exchange Risk87 Questions

Exam 14: Sovereign Risk89 Questions

Exam 15: Market Risk95 Questions

Exam 16: Off-Balance-Sheet Risk101 Questions

Exam 17: Technology and Other Operational Risks107 Questions

Exam 18: Liability and Liquidity Management38 Questions

Exam 19: Deposit Insurance and Other Liability Guarantees54 Questions

Exam 20: Capital Adequacy102 Questions

Exam 21: Product and Geographic Expansion114 Questions

Exam 22: Futures and Forwards234 Questions

Exam 23: Options, Caps, Floors, and Collars113 Questions

Exam 24: Swaps95 Questions

Exam 25: Loan Sales83 Questions

Exam 26: Securitization Index98 Questions

Select questions type

An underwriter is quoting the following rates for the issue of new securities on behalf of a firm on a firm commitment basis: $64.00-64.25. 2,000,000 shares are being offered.

(Multiple Choice)

4.8/5  (39)

(39)

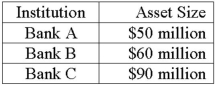

The following three FIs dominate a local market and their total assets are given below.  If Bank C splits into two separate institutions at ½ its original size each, what is the new Herfindahl (HHI) Index?

If Bank C splits into two separate institutions at ½ its original size each, what is the new Herfindahl (HHI) Index?

(Multiple Choice)

4.9/5  (29)

(29)

Which of the following is a factor deterring Canadian bank expansions abroad?

(Multiple Choice)

4.8/5  (33)

(33)

Concern about bank solvency has been used to justify product segmentation on the grounds of

(Multiple Choice)

4.8/5  (33)

(33)

International expansion often produces revenue-risk diversification benefits for Canadian banks.

(True/False)

5.0/5  (34)

(34)

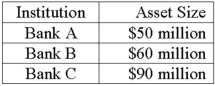

The following three FIs dominate a local market and their total assets are given below.  What are the market shares of banks A, B and C, respectively?

What are the market shares of banks A, B and C, respectively?

(Multiple Choice)

4.8/5  (35)

(35)

A bank holding company has a banking affiliate and a securities affiliate. If the securities affiliate fails, it could cause the bank to also fail because

(Multiple Choice)

4.8/5  (42)

(42)

The banking industry in Canada has faced increased competition

(Multiple Choice)

4.8/5  (43)

(43)

The approval of cheap loans to an investor under the implicit condition that the loan proceeds are to be used to purchase securities underwritten by a securities affiliate.

(Short Answer)

4.8/5  (31)

(31)

Success in a merger from revenue enhancement is more likely if the markets into which expansion occurs are less than fully competitive.

(True/False)

4.9/5  (32)

(32)

If the firm commitment price is $15 and one million shares are sold in the primary market for $15.50 and then resold in the secondary market for $15.75, what is the underwriter's profit/loss?

(Multiple Choice)

4.8/5  (38)

(38)

The effect of the International Banking Act of 1978 was to accelerate the expansion of foreign bank activities in the U.S. primarily because of their access to the Federal Reserve's discount window, Fedwire, and FDIC insurance.

(True/False)

4.9/5  (40)

(40)

Banks typically have faced few restrictions in expanding their businesses, while securities firms and insurance companies have faced complex rules regarding expansion.

(True/False)

4.8/5  (34)

(34)

Chinese walls are barriers within organizations that limit the flow of confidential information between departments of business areas.

(True/False)

4.8/5  (28)

(28)

Canadian financial institutions have expanded abroad in recent years, although their foreign counterparts have been prohibited from expanding into Canada.

(True/False)

4.9/5  (37)

(37)

A value below 1,000 of the Herfindahl-Hirschman Index (HHI) is considered to reflect

(Multiple Choice)

4.9/5  (31)

(31)

Identify the action taken by OCC and the U.S. Federal Reserve in 1997, to expand the permitted activities of bank holding companies.

(Multiple Choice)

4.9/5  (35)

(35)

The use of inside information about customers or rivals that can be useful in setting securities prices or distributing securities offerings.

(Short Answer)

4.9/5  (35)

(35)

Showing 61 - 80 of 114

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)