Exam 9: Interest Rate Risk II

Exam 1: Why Are Financial Institutions Special90 Questions

Exam 2: Deposit-Taking Institutions43 Questions

Exam 3: Finance Companies71 Questions

Exam 4: Securities, Brokerage, and Investment Banking91 Questions

Exam 5: Mutual Funds, Hedge Funds, and Pension Funds61 Questions

Exam 6: Insurance Companies80 Questions

Exam 7: Risks of Financial Institutions110 Questions

Exam 8: Interest Rate Risk I110 Questions

Exam 9: Interest Rate Risk II116 Questions

Exam 10: Credit Risk: Individual Loans112 Questions

Exam 11: Credit Risk: Loan Portfolio and Concentration Risk51 Questions

Exam 12: Liquidity Risk85 Questions

Exam 13: Foreign Exchange Risk87 Questions

Exam 14: Sovereign Risk89 Questions

Exam 15: Market Risk95 Questions

Exam 16: Off-Balance-Sheet Risk101 Questions

Exam 17: Technology and Other Operational Risks107 Questions

Exam 18: Liability and Liquidity Management38 Questions

Exam 19: Deposit Insurance and Other Liability Guarantees54 Questions

Exam 20: Capital Adequacy102 Questions

Exam 21: Product and Geographic Expansion114 Questions

Exam 22: Futures and Forwards234 Questions

Exam 23: Options, Caps, Floors, and Collars113 Questions

Exam 24: Swaps95 Questions

Exam 25: Loan Sales83 Questions

Exam 26: Securitization Index98 Questions

Select questions type

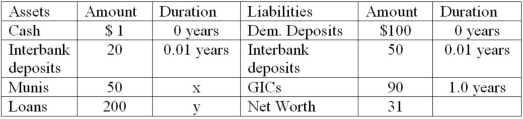

The following is an FI's balance sheet ($millions).  Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

What is this bank's interest rate risk exposure, if any?

Notes to Balance Sheet: Munis are 2-year 6 percent annual coupon municipal notes selling at par. Loans are floating rates, repriced quarterly. Spot discount yields for 91-day Treasury bills are 3.75 percent. GICs are 1-year pure discount certificates of deposit paying 4.75 percent.

What is this bank's interest rate risk exposure, if any?

Free

(Multiple Choice)

4.9/5  (34)

(34)

Correct Answer:

C

Duration of a fixed-rate coupon bond will always be greater than one-half of the maturity.

Free

(True/False)

4.7/5  (32)

(32)

Correct Answer:

False

An FI purchases at par value a $100,000 Treasury bond paying 10 percent interest with a 7.5 year duration. If interest rates rise by 4 percent, calculate the bond's new value. Recall that Treasury bonds pay interest semiannually. Use the duration valuation equation.

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

E

Buying a fixed-rate asset whose duration is exactly equal to the desired investment horizon immunizes against interest rate risk.

(True/False)

4.8/5  (38)

(38)

Matching the maturities of assets and liabilities is not a perfect method of immunizing the balance sheet because the timing of the cash flows is likely to differ between the assets and liabilities.

(True/False)

4.8/5  (44)

(44)

All fixed-income assets exhibit convexity in their price-yield relationships.

(True/False)

4.8/5  (32)

(32)

The value for duration describes the percentage increase in the price of an asset for a given increase in the required yield or interest rate.

(True/False)

4.8/5  (36)

(36)

Convexity is a desirable effect to a portfolio manager because it is easy to measure and price.

(True/False)

4.9/5  (40)

(40)

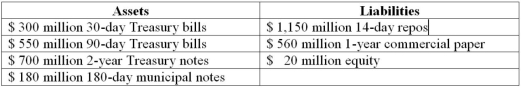

Third Duration Investments has the following assets and liabilities on its balance sheet. The two-year Treasury notes are zero coupon assets. Interest payments on all other assets and liabilities occur at maturity. Assume 360 days in a year.  What is the leverage-adjusted duration gap?

What is the leverage-adjusted duration gap?

(Multiple Choice)

4.9/5  (45)

(45)

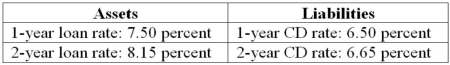

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs). All interest rates are fixed and paid annually.  What is the interest rate risk exposure of the optimal transaction in the previous question over the next 2 years?

What is the interest rate risk exposure of the optimal transaction in the previous question over the next 2 years?

(Multiple Choice)

4.8/5  (33)

(33)

The cost in terms of both time and money to restructure the balance sheet of large and complex FIs has decreased over time.

(True/False)

4.8/5  (37)

(37)

The leverage adjusted duration of a typical depository institution is positive.

(True/False)

4.7/5  (32)

(32)

Consider a six-year maturity, $100,000 face value bond that pays a 5 percent fixed coupon annually. What is the percentage price change for the bond if interest rates decline 50 basis points from the original 5 percent?

(Multiple Choice)

4.8/5  (34)

(34)

A $1,000 six-year Eurobond has an 8 percent coupon, is selling at par, and contracts to make annual payments of interest. The duration of this bond is 4.99 years. What will be the new price using the duration model if interest rates increase to 8.5 percent?

(Multiple Choice)

4.8/5  (35)

(35)

Investing in a zero-coupon asset with a maturity equal to the desired investment horizon removes interest rate risk from the investment management process.

(True/False)

4.8/5  (33)

(33)

For a given change in required yields, short-duration securities suffer a smaller capital loss or receive a smaller capital gain than do long-duration securities.

(True/False)

4.8/5  (48)

(48)

Immunizing net worth from interest rate risk using duration matching requires that the duration match must be realigned periodically as the maturity horizon approaches.

(True/False)

4.7/5  (36)

(36)

The duration of a portfolio of assets can be found by calculating the book value weighted average of the durations of the individual assets.

(True/False)

4.9/5  (39)

(39)

Showing 1 - 20 of 116

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)